The wet wipes market is expected to grow from USD 22.3 billion in 2022 to USD 33.0 billion by 2032, at a CAGR of 4.0% during the forecast period 2023-2032.

In the case of dispensers, a wet wipe is a moistened piece of plastic or cloth that is folded and individually wrapped for convenience, or as a continuous roll with individual wipes that may be peeled off. Wet wipes can be used for a variety of cleaning tasks, including hand washing, oil removal from the face, and intimate hygiene. Furthermore, wet wipes can be used to clean objects or surfaces, among other things. The rise in the global newborn population is one of the primary causes driving the rising use of wet wipes. The ever-increasing newborn population drives the demand for wet wipes. The skin of newborns is extremely sensitive and should be handled with caution. As a result, parents are increasingly using wet wipes to keep their children's cleanliness in check. Furthermore, more women are entering the workforce around the world, increasing their purchasing power and raising their awareness of personal hygiene, all of which contribute to the expansion of items designed to provide people with cleanliness and sanitation. As a result of the varied applications of hygiene and cleanliness products, new products such as intimate wipes, feminine wipes, flushable wipes, and scented wipes have been introduced to the market, which aids in cleaning and eliminating bacteria on the skin while also reducing the risk of infection and skin irritation.

The rising usage of wet wipes for hygiene purposes, particularly when clean water is scarce, is driving the market. Furthermore, the advantages of wet wipes for infection control, as well as their disposable nature, are enticing customers to buy more wet wipes. The market is being influenced by an increasing newborn population, urbanization, and rising consumer expenditure on personal hygiene goods. Cost, hygiene, convenience, performance, ease of use, time savings, and consumer-centric aesthetics are the primary product qualities influencing growth. In times of economic distress, consumers have become more careful of their spending habits, preferring low-cost and inexpensive products over high-priced speciality ones. These variables have had a favourable impact on growth because the product is in high demand. Furthermore, the global increase in the newborn population, rising urbanisation, high disposable income of female customers, and a surge in hygiene concerns among them all have a beneficial impact on market growth. Many women are entering the labour sector around the world, increasing their purchasing power and raising their awareness of personal hygiene, which is eventually propelling growth.

This study delivers a comprehensive analysis of the product, distribution channel, material, and region. The product segment includes facial & cosmetics, intimate, baby, hand & body, and others. The baby segment holds the largest market share in 2022. Millennial parents are concerned about their child's sensitive skin, particularly around the nappy area. As a result, parents prefer utilising baby wipes to avoid rashes because of the related benefits, such as improved absorbent fabrics that aid in cleansing and eliminating bacteria on the baby's skin, as well as a lower chance of infection and skin irritation. According to the National Retail Federation, U.S., 69% of parents make more than the national median income of USD 59,000 per year, and 80% of millennials with children are in their 30s and prefer to spend on excellent baby supplies. The distribution channel segment includes supermarkets & hypermarkets, pharmacies, convenience stores, and e-commerce. The supermarkets & hypermarkets segment held the largest market share in 2022. Due to the significant customer preference for purchasing toiletries from supermarkets and hypermarkets, which offer a broader selection of products and brands, the segment is expected to maintain its lead during the forecast period. Supermarkets in places such as North America and Europe have bought a considerable number of grocery stores, increasing their clout with suppliers. Supermarkets are a perfect platform for all types of customers since they provide substantial benefits to consumers such as freedom of option, lower pricing, and strong visibility of international brands. This is due to the rising adoption of solutions and software by these businesses. Furthermore, most businesses are expected to use cloud-based gamification technology to create collaborative user experiences. The material segment includes non-woven and oven. The non-woven segment holds the largest market share in 2022. Nonwoven wet wipes, which are impregnated with a solution, have recently acquired appeal due to their absorption and softness. Non-woven fabrics, the primary raw material used in manufacturing, are created by weaving and pressing a single sheet of fibre material from a mass of different fibres such as cotton and rayon. Non-woven materials, which are one of the most important components in the production of wipes, are likely to benefit from investments and manufacturing plant expansions.

The market has been divided into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. North America holds the largest market share, The changing lifestyles of people, an increase in the number of working women, developing internet retailing tendencies, and increased disposable income are the primary factors propelling this region. Furthermore, increased female awareness of baby care is boosting demand for baby wet wipes across North America. In addition, women's increased disposable income allows them to spend more on premium personal care and hygiene items, such as wet wipes.

Some of the notable players in the market are Nice-Pak Products, Inc., The Clorox Company, Kimberly-Clark Corporation, WipesPlus, PDI Healthcare, Inc., Reckitt Benckiser Group PLC, Essity Aktiebolag (publ), The Procter and Gamble Company, The Honest Company, Inc. and others.

Report Description:

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

1.5. Key Target Audience

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces

4.2. Value Chain

4.3. Top Investment Pockets

4.3.1. Market Attractiveness

by Product

4.3.2. Market Attractiveness

by Distribution Channel

4.3.3. Market Attractiveness

by Material

4.3.4. Market Attractiveness

by Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.2.1. Rising healthcare concern

5.3. Restraints

5.3.1. High cost

5.4. Opportunities

5.4.1. Rising number of working women’s

5.5. Challenges

5.5.1. Infection

6. Global Wet Wipes Market

and Forecast, By Product

6.1. Segment Overview

6.2. Facial & Cosmetics

6.3. Intimate

6.4. Baby

6.5. Hand & Body

6.6. Others

7. Global Wet Wipes Market

and Forecast, By Distribution Channel

7.1. Segment Overview

7.2. Supermarkets & Hypermarkets

7.3. Pharmacy

7.4. Convenience Stores

7.5. E-commerce

8. Global Wet Wipes Market

and Forecast, By Material

8.1. Segment Overview

8.2. Non-woven

8.3. Oven

9. Global Wet Wipes Market

and Forecast, By Regional

9.1. Segment Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.2.3. Mexico

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Italy

9.3.5. Spain

9.4. Asia-Pacific

9.4.1. Japan

9.4.2. China

9.4.3. India

9.5. South America

9.5.1. Brazil

9.6. Middle East and Africa

9.6.1. UAE

9.6.2. South Africa

10. Global Wet Wipes Market-Competitive Landscape

10.1. Overview

10.2. Market Share of Key Players in Global Wet Wipes Market

10.2.1. Global Company Market Share

10.2.2. North America Company Market Share

10.2.3. Europe Company Market Share

10.2.4. APAC Company Market Share

10.3. Competitive Situations and Trends

10.3.1. Product Launches and Developments

10.3.2. Partnerships, Collaborations, and Agreements

10.3.3. Mergers & Acquisitions

10.3.4. Expansions

11. Company Profiles

11.1. Nice-Pak Products, Inc.

11.1.1. Business Overview

11.1.2. Company Snapshot

11.1.3. Company Market Share

11.1.4. Company Product Portfolio

11.1.5. Recent Developments

11.1.6. SWOT

11.2. The Clorox Company

11.2.1. Business Overview

11.2.2. Company Snapshot

11.2.3. Company Market Share

11.2.4. Company Product Portfolio

11.2.5. Recent Developments

11.2.6. SWOT

11.3. Kimberly-Clark Corporation

11.3.1. Business Overview

11.3.2. Company Snapshot

11.3.3. Company Market Share

11.3.4. Company Product Portfolio

11.3.5. Recent Developments

11.3.6. SWOT

11.4. WipesPlus

11.4.1. Business Overview

11.4.2. Company Snapshot

11.4.3. Company Market Share

11.4.4. Company Product Portfolio

11.4.5. Recent Developments

11.4.6. SWOT

11.5. PDI Healthcare, Inc.

11.5.1. Business Overview

11.5.2. Company Snapshot

11.5.3. Company Market Share

11.5.4. Company Product Portfolio

11.5.5. Recent Developments

11.5.6. SWOT

11.6. Reckitt Benckiser Group PLC

11.6.1. Business Overview

11.6.2. Company Snapshot

11.6.3. Company Market Share

11.6.4. Company Product Portfolio

11.6.5. Recent Developments

11.6.6. SWOT

11.7. Essity Aktiebolag (publ)

11.7.1. Business Overview

11.7.2. Company Snapshot

11.7.3. Company Market Share

11.7.4. Company Product Portfolio

11.7.5. Recent Developments

11.7.6. SWOT

11.8. The Procter and Gamble Company

11.8.1. Business Overview

11.8.2. Company Snapshot

11.8.3. Company Market Share

11.8.4. Company Product Portfolio

11.8.5. Recent Developments

11.8.6. SWOT

11.9. The Honest Company, Inc.

11.9.1. Business Overview

11.9.2. Company Snapshot

11.9.3. Company Market Share

11.9.4. Company Product Portfolio

11.9.5. Recent Developments

11.9.6. SWOT

List of Table

1. Global Wet Wipes Market, By Product, 2019-2032 (USD Billion)

2. Global Facial & Cosmetics, Wet Wipes Market, By Region, 2019-2032 (USD Billion)

3. Global Intimate, Wet Wipes Market, By Region, 2019-2032 (USD Billion)

4. Global Baby, Wet Wipes Market, By Region, 2019-2032 (USD Billion)

5. Global Hand & Body, Wet Wipes Market, By Region, 2019-2032 (USD Billion)

6. Global Others, Wet Wipes Market, By Region, 2019-2032 (USD Billion)

7. Global Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

8. Global Supermarkets & Hypermarkets, Wet Wipes Market, By Region, 2019-2032 (USD Billion)

9. Global Pharmacy, Wet Wipes Market, By Region, 2019-2032 (USD Billion)

10. Global Convenience Stores, Wet Wipes Market, By Region, 2019-2032 (USD Billion)

11. Global E-commerce, Wet Wipes Market, By Region, 2019-2032 (USD Billion)

12. Global Wet Wipes Market, By Material, 2019-2032 (USD Billion)

13. Global Non-woven, Wet Wipes Market, By Region, 2019-2032 (USD Billion)

14. Global Oven, Wet Wipes Market, By Region, 2019-2032 (USD Billion)

15. North America Wet Wipes Market, By Product, 2019-2032 (USD Billion)

16. North America Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

17. North America Wet Wipes Market, By Material, 2019-2032 (USD Billion)

18. U.S. Wet Wipes Market, By Product, 2019-2032 (USD Billion)

19. U.S. Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

20. U.S. Wet Wipes Market, By Material, 2019-2032 (USD Billion)

21. Canada Wet Wipes Market, By Product, 2019-2032 (USD Billion)

22. Canada Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

23. Canada Wet Wipes Market, By Material, 2019-2032 (USD Billion)

24. Mexico Wet Wipes Market, By Product, 2019-2032 (USD Billion)

25. Mexico Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

26. Mexico Wet Wipes Market, By Material, 2019-2032 (USD Billion)

27. Europe Wet Wipes Market, By Product, 2019-2032 (USD Billion)

28. Europe Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

29. Europe Wet Wipes Market, By Material, 2019-2032 (USD Billion)

30. Germany Wet Wipes Market, By Product, 2019-2032 (USD Billion)

31. Germany Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

32. Germany Wet Wipes Market, By Material, 2019-2032 (USD Billion)

33. France Wet Wipes Market, By Product, 2019-2032 (USD Billion)

34. France Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

35. France Wet Wipes Market, By Material, 2019-2032 (USD Billion)

36. U.K. Wet Wipes Market, By Product, 2019-2032 (USD Billion)

37. U.K. Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

38. U.K. Wet Wipes Market, By Material, 2019-2032 (USD Billion)

39. Italy Wet Wipes Market, By Product, 2019-2032 (USD Billion)

40. Italy Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

41. Italy Wet Wipes Market, By Material, 2019-2032 (USD Billion)

42. Spain Wet Wipes Market, By Product, 2019-2032 (USD Billion)

43. Spain Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

44. Spain Wet Wipes Market, By Material, 2019-2032 (USD Billion)

45. Asia Pacific Wet Wipes Market, By Product, 2019-2032 (USD Billion)

46. Asia Pacific Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

47. Asia Pacific Wet Wipes Market, By Material, 2019-2032 (USD Billion)

48. Japan Wet Wipes Market, By Product, 2019-2032 (USD Billion)

49. Japan Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

50. Japan Wet Wipes Market, By Material, 2019-2032 (USD Billion)

51. China Wet Wipes Market, By Product, 2019-2032 (USD Billion)

52. China Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

53. China Wet Wipes Market, By Material, 2019-2032 (USD Billion)

54. India Wet Wipes Market, By Product, 2019-2032 (USD Billion)

55. India Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

56. India Wet Wipes Market, By Material, 2019-2032 (USD Billion)

57. South America Wet Wipes Market, By Product, 2019-2032 (USD Billion)

58. South America Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

59. South America Wet Wipes Market, By Material, 2019-2032 (USD Billion)

60. Brazil Wet Wipes Market, By Product, 2019-2032 (USD Billion)

61. Brazil Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

62. Brazil Wet Wipes Market, By Material, 2019-2032 (USD Billion)

63. Middle East and Africa Wet Wipes Market, By Product, 2019-2032 (USD Billion)

64. Middle East and Africa Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

65. Middle East and Africa Wet Wipes Market, By Material, 2019-2032 (USD Billion)

66. UAE Wet Wipes Market, By Product, 2019-2032 (USD Billion)

67. UAE Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

68. UAE Wet Wipes Market, By Material, 2019-2032 (USD Billion)

69. South Africa Wet Wipes Market, By Product, 2019-2032 (USD Billion)

70. South Africa Wet Wipes Market, By Distribution Channel, 2019-2032 (USD Billion)

71. South Africa Wet Wipes Market, By Material, 2019-2032 (USD Billion)

List of Figures

1. Global Wet Wipes Market Segmentation

2. Global Wet Wipes Market: Research Methodology

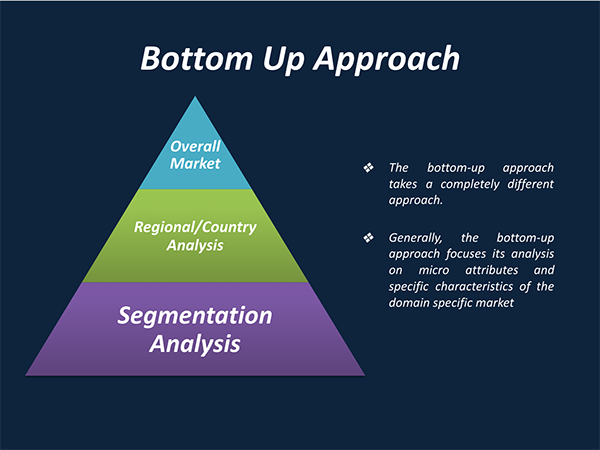

3. Market Size Estimation Methodology: Bottom-Up Approach

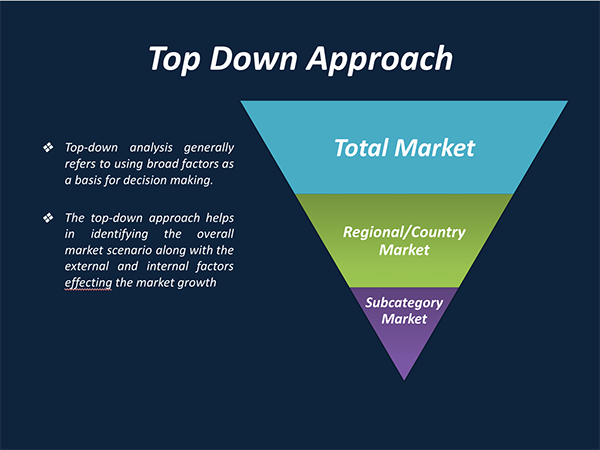

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Wet Wipes Market Attractiveness Analysis by Product

9. Global Wet Wipes Market Attractiveness Analysis by Distribution Channel

10. Global Wet Wipes Market Attractiveness Analysis by Material

11. Global Wet Wipes Market Attractiveness Analysis by Region

12. Global Wet Wipes Market: Dynamics

13. Global Wet Wipes Market Share by Product (2023 & 2032)

14. Global Wet Wipes Market Share by Distribution Channel (2023 & 2032)

15. Global Wet Wipes Market Share by Material (2023 & 2032)

16. Global Wet Wipes Market Share by Regions (2023 & 2032)

17. Global Wet Wipes Market Share by Company (2022)

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

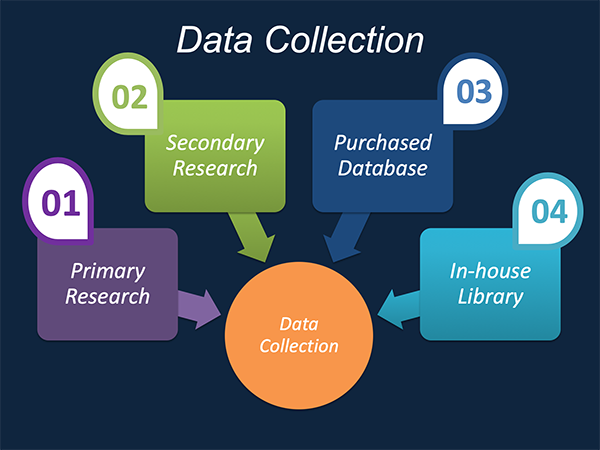

Our market research process involves with the four specific stages.

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.