The global track inspection vehicles market is expected to grow from USD 713.23 million in 2019 to USD 1002.1 million by 2027, at a CAGR of 4.79% during the forecast period from 2020-2027. The rapid expansion of high-speed rails and mass transit systems across the globe, driving the growth of the market.

In addition to this, exponential expansion of the rail tracks in countries such as China, Japan, and India has led to the increase in demand for overhead lines for rail application which has increased the growth of the track inspection vehicles market. However, the presence of various standards and regulations in the railway industry and lack of required infrastructure is hindering the growth of the market.

The market has been segmented on the basis of type, vehicle type, application, and region. The type segment includes eddy current testing and ultrasonic testing. The ultrasonic testing segment held the largest market share of 47.33% and valued at USD 335.65 million in 2019. However, another testing segment is expected to grow with the highest CAGR of 5.80% during the forecast period. Ultrasonic testing is the most popular non-destructive testing methods applied to problems such as the inspection of rail track, subway, or engineering track. The vehicle type segment includes portable track inspection vehicle and ordinary track inspection vehicle.

The portable track inspection Vehicle held the largest market share of 87.89% in 2019. These vehicles are often the most efficient tool for mainline rail flaw detection needs, some applications, including the testing of yards, switches, crossings, replacement rail and verification behind regular test vehicles benefit from the efficiency of pedestrian or manually operated testing equipment.

The application segment includes engineering track, subway, railway, and other. The railway segment is expected to grow with highest CAGR of 5.02% during the forecast period. Rail inspection vehicle are installed with rail head profile inspection & analysis system to facilitate advance digital inspection of rails for selection of an optimum rail grinding program. These vehicles shall be possible to haul in both directions at the same speed and are likely to cover long distances on their own power.

The market has been divided into North America, Europe, Asia Pacific, Middle East & Africa, and South America. Europe region held the largest market share of 25.28% in 2019.

Key players in the track inspection vehicles market are Amberg Technologies AG, ENSCO, Inc, Trimble Railway Asset Solutions Group, MER MEC S.p.A., Harsco Corporation, Nordco, Inc., Loram Maintenance of Way, Inc., and Fugro N.V. among others. Developing and developed countries are offering greater opportunities and major players are continuously focused on new developments, strategic partnerships, acquisitions and venture capital investments to obtain high growth in the market.

In September 2019, ENSCO Rail announced the launch of autonomous track inspection vehicle to estimate risk of track buckling based on the predicted rail temperatures and user input estimates of rail neutral temperature and lateral track strength.

This study forecasts revenue growth at global, regional, and country levels from 2014 to 2027. Fior Markets has segmented the on the basis of below mentioned segments:

Chapter 1 Introduction 16

1.1 Research Methodology 16

1.2 FMR desk research 17

1.2.1 FMR data synthesis 18

1.2.2 Data validation and market feedback 18

1.2.3 FMR data sources 19

Chapter 2 Global Track Inspection Vehicle Market Overview 21

2.1 Product Overview and Scope of Track Inspection Vehicle 21

2.2 Track Inspection Vehicle Market Scope and Market Size Estimation 23

2.3 Global Track Inspection Vehicle Value and Growth Rate from 2014-2027 24

2.4 Market Segmentation 25

2.4.1 Types of Track Inspection Vehicle 25

2.4.1.1 Eddy Current Testing Overview 28

2.4.1.2 Ultrasonic Testing Overview 30

2.4.1.3 Other Overview 32

2.4.2 Vehicle Type of Track Inspection Vehicle 33

2.4.2.1 Portable Track Inspection Vehicle 35

2.4.2.2 Ordinary Track Inspection Vehicle 36

2.4.3 Application of Track Inspection Vehicle 37

2.4.3.1 Engineering Track of Track Inspection Vehicles 40

2.4.3.2 Subway of Track Inspection Vehicles 40

2.4.3.3 Railway of Track Inspection Vehicles 40

2.4.3.4 Other of Track Inspection Vehicles 41

2.5 Research Regions 42

2.5.1.1 North America Track Inspection Vehicle Production Value and Growth Rate (2014-2019E) 44

2.5.1.2 Europe Track Inspection Vehicle Production Value and Growth Rate (2014-2019E) 45

2.5.1.3 Asia Pacific Track Inspection Vehicle Production Value and Growth Rate (2014-2019E) 46

2.5.1.5 Middle East & Africa Track Inspection Vehicle Production Value and Growth Rate (2014-2019E) 48

2.5.1.7 South America Track Inspection Vehicle Production Value and Growth Rate (2014-2019E) 50

2.6 Market Dynamics 51

2.6.1 Drivers 51

2.6.2 Limitations 51

2.6.3 Opportunities 51

2.7 Industry News and Policies by Regions 52

2.7.1 Industry News 52

Chapter 3 Industry Chain Analysis 54

3.1.1 Industry Chain of Track Inspection Vehicle 54

3.2 Upstream Market and Representative Suppliers Analysis 55

3.3 Major Players of Track Inspection Vehicle 57

3.3.1 Major Players Manufacturing Base and Market Share of Track Inspection Vehicle in 2017 57

3.3.2 Major Players Product Types 59

3.3.3 Upstream Suppliers Analysis 61

3.4 Proportion of Manufacturing Cost Structure 62

3.4.1 Labor Cost Analysis 63

3.4.1.1 USA Labor Cost Analysis 64

Chapter 4 Marketing Status Analysis of Track Inspection Vehicle 68

4.1 Marketing Channel 68

4.1.1 Direct Marketing 70

4.1.2 Indirect Marketing 71

4.2 Market Positioning 73

4.2.1 Marketing Channel Future Trend 73

4.2.2 Pricing Strategy 74

4.2.3 Brand Strategy 77

4.3 Distributors/Traders List 79

4.4 Major Downstream Buyers of Track Inspection Vehicles Analysis 80

Chapter 5 Global Track Inspection Vehicle Market, by Type 81

5.1 Global Track Inspection Vehicle Value and Market Share by Type (2014-2019E) 81

5.2 Global Track Inspection Vehicle Value and Growth Rate by Type (2014-2019E) 83

5.2.1 Global Track Inspection Vehicle Value and Growth Rate of Eddy Current 83

5.2.2 Global Track Inspection Vehicle Value and Growth Rate of Ultra-Sonic 84

5.2.3 Global Track Inspection Vehicle Value and Growth Rate of Others 85

5.3 Global Track Inspection Vehicle Value and Market Share Type Analysis by Application (2014-2019E) 86

5.3.1 Eddy Current Analysis by Application 86

5.3.2 Ultra-Sonic Analysis by Application 86

5.3.3 Others Type Analysis by Application 87

Chapter 6 Global Track Inspection Vehicle Market, by Vehicle Type 88

6.1 Global Track Inspection Vehicle Value and Market Share by Vehicle Type (2014-2019E) 88

6.2 Global Track Inspection Vehicle Value and Growth Rate by Vehicle Type (2014-2019E) 90

6.2.1 Global Track Inspection Vehicle Value and Growth Rate of Portable Track Inspection Vehicle 90

6.2.2 Global Track Inspection Vehicle Value and Growth Rate of Ordinary Track Inspection Vehicle 91

Chapter 7 Global Track Inspection Vehicle Market, by Application 92

7.1 Global Track Inspection Vehicle Value and Market Share by Application (2014-2019E) 92

7.2 Global Track Inspection Vehicle Value and Growth Rate by Application (2014-2019E) 94

7.2.1 Global Track Inspection Vehicle Value and Growth Rate of Engineering Track 94

7.2.2 Global Track Inspection Vehicle Value and Growth Rate of Subway 95

7.2.3 Global Track Inspection Vehicle Value and Growth Rate of Railway 96

7.2.4 Global Track Inspection Vehicle Value and Growth Rate of Others 97

Chapter 8 Global Track Inspection Vehicle Value (USD) by Region (2014-2019E) 98

8.1 Global Track Inspection Vehicle Value and Market Share by Region (2014-2019E) 98

Chapter 9 Global Track Inspection Vehicles Market Status and SWOT Analysis by Regions 101

9.1 North America Track Inspection Vehicle Market SWOT Analysis 101

9.2 Europe Track Inspection Vehicle Market SWOT Analysis 102

9.3 Asia Pacific Track Inspection Vehicle Market SWOT Analysis 103

9.5 Middle East and Africa Track Inspection Vehicle Market SWOT Analysis 105

9.7 South America Track Inspection Vehicle Market SWOT Analysis 107

Chapter 10 Track Inspection Vehicle Market Competition Status by Major Manufacturers 108

10.1 Competitive Profile 108

10.2 Major Players Production Value (USD) Share (2014-2019E) 110

10.3 Amberg Technologies AG 111

10.3.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 111

10.3.2 Track Inspection Vehicles Product Category, End Uses and Specification of Amberg Technologies AG 113

10.3.3 Amberg Technologies AG Track Inspection Revenue (2014-2019E) 114

10.4 ENSCO, Inc 116

10.4.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 116

10.4.2 Track Inspection Vehicles Product Category, End Uses and Specification of ENSCO, Inc 118

10.4.3 ENSCO, Inc Track Inspection Vehicles Revenue (2014-2019E) 118

10.5 Trimble Railway Asset Solutions Group 120

10.5.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 120

10.5.2 Track Inspection Vehicles Product Category, End Uses and Specification of Trimble Railway Asset Solutions Group 121

10.5.3 Trimble Railway Asset Solutions Group Track Inspection Revenue (2014-2019E) 122

10.6 MER MEC S.p.A. 123

10.6.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 123

10.6.2 Track Inspection Vehicles Product Category, End Uses and Specification of MER MEC S.p.A. 125

10.6.3 MER MEC S.p.A. Track Inspection Vehicles Revenue (2014-2019E) 126

10.7 Harsco Corporation 128

10.7.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 128

10.7.2 Track Inspection Vehicles Product Category, End Uses and Specification of Harsco Corporation 130

10.7.3 Harsco Corporation Track Inspection Vehicles Revenue (2014-2019E) 131

10.8 Nordco, Inc. 132

10.8.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 132

10.8.2 Track Inspection Vehicles Product Category, End Uses and Specification of Nordco, Inc. 134

10.9 Loram Maintenance of Way, Inc. 136

10.9.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 136

10.9.2 Track Inspection Vehicles Product Category, End Uses and Specification of Loram Maintenance of Way, Inc. 137

10.10 Fugro N.V. 138

10.10.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 138

10.10.2 Track Inspection Vehicles Product Category, End Uses and Specification of Fugro N.V. 140

10.10.3 Fugro N.V. Track Inspection Vehicles Revenue (2014-2019E) 140

10.11 MRX Technologies 142

10.11.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 142

10.11.2 Track Inspection Vehicles Product Category, End Uses and Specification of MRX Technologies 143

10.12 Holland LP 145

10.12.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 145

10.12.2 Track Inspection Vehicles Product Category, End Uses and Specification of Holland LP 147

10.13 Eurailscout Inspection & Analysis B.V. 148

10.13.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 148

10.13.2 Track Inspection Vehicles Product Category, End Uses and Specification of Eurailscout Inspection & Analysis B.V. 149

Chapter 11 Global Track Inspection Vehicles Market Analysis and Forecast by Type, Vehicle Type, and Application 150

11.1 Global Track Inspection Vehicles Market Value & Volume Forecast, by Type (2019-2027) 150

11.1.1 Eddy Current Testing Market Value and Volume Forecast (2019-2027) 151

11.1.2 Ultrasonic Testing Market Value and Volume Forecast (2019-2027) 152

11.2 Global Eddy Current by Application 153

11.3 Global Ultra-Sonic by Application 154

11.4 Global Other by Application 155

11.5 Global Track Inspection Vehicles Market Value & Volume Forecast, by Vehicle Type (2019-2027) 156

11.5.1 Portable Track Inspection Vehicle Market Value and Volume Forecast (2019-2027) 157

11.5.2 Ordinary Track Inspection Vehicle Inspection Vehicle Market Value and Volume Forecast (2019-2027) 158

11.6 Global Track Inspection Vehicles Market Value & Volume Forecast, by Application (2019-2027) 159

11.6.1 Engineering Track Market Value and Volume Forecast (2019-2027) 160

11.6.2 Subway Market Value and Volume Forecast (2019-2027) 161

11.6.3 Railway Market Value and Volume Forecast (2019-2027) 162

Chapter 12 Track Inspection Vehicles Market Analysis and Forecast by Region 163

12.1 North America Market Value Forecast (2019-2027) 163

12.2 Europe Market Value Forecast (2019-2027) 164

12.3 Asia Pacific Market Value Forecast (2019-2027) 165

12.5 Middle East and Africa Market Value Forecast (2019-2027) 167

12.7 South America Market Value Forecast (2019-2027) 169

Chapter 13 Research Findings and Conclusion 170

List of Figures

FIG. 1 Representative Commercial Product Picture of Track Inspection Vehicle 22

FIG. 2 Representative Commercial Product Picture of Track Inspection Vehicle 23

FIG. 3 Global Track Inspection Vehicle Value (USD) and Growth Rate from 2014-2027 24

FIG. 4 Global Track Inspection Vehicle Value (USD) Segment by Type from 2014-2019E 26

FIG. 5 Global Track Inspection Vehicle Market Share by Types in 2017 27

FIG. 6 Representative Commercial Product Picture of Eddy Current Testing 29

FIG. 7 Representative Commercial Product Picture of Ultrasonic Testing 31

FIG. 8 Global Track Inspection Vehicle Value (USD) Segment by Vehicle Type from 2014-2019E 33

FIG. 9 Global Track Inspection Vehicle Market Share by Vehicle Type in 2017 34

FIG. 10 Representative Commercial Product Picture of Portable Track Inspection Vehicle 35

FIG. 11 Representative Commercial Product Picture of Ordinary Track Inspection Vehicle 36

FIG. 12 Global Track Inspection Vehicle Value (USD) Segment by Application from 2014-2019E 38

FIG. 13 Global Track Inspection Vehicle Market Share by Applications in 2017 39

FIG. 14 Global Track Inspection Vehicle Market Share by Regions in 2017 43

FIG. 15 North America Track Inspection Vehicle Production Value (USD) and Growth Rate (2014-2019E) 44

FIG. 16 Europe Track Inspection Vehicle Production Value (USD) and Growth Rate (2014-2019E) 45

FIG. 17 Asia Pacific Track Inspection Vehicle Production Value (USD) and Growth Rate (2014-2019E) 46

FIG. 19 Middle East & Africa Track Inspection Vehicle Production Value (USD) and Growth Rate (2014-2019E) 48

FIG. 21 South America Track Inspection Vehicle Production Value (USD) and Growth Rate (2014-2019E) 50

FIG. 22 Industry Chain of Track Inspection Vehicle 54

FIG. 23 Major Players Production Value Market Share of Track Inspection Vehicle in 2017 58

FIG. 24 Manufacturing Cost Structure 62

FIG. 25 USA Overview of Average Hourly Wages 2015-2016 (USD/Hour) 64

FIG. 27 Europe CPI (2014-2018) 67

FIG. 28 Marketing Channels 68

FIG. 29 Direct Marketing 71

FIG. 30 Indirect Marketing 72

FIG. 31 Marketing Channel 74

FIG. 32 Pricing Strategy 76

FIG. 33 Brand Strategy 78

FIG. 34 Global Track Inspection Vehicle Value Share by Type (2014-2019E) 82

FIG. 35 Global Track Inspection Vehicle Value (USD) and Growth Rate of Eddy Current 83

FIG. 36 Global Track Inspection Vehicle Value (USD) and Growth Rate of Ultra-Sonic 84

FIG. 37 Global Track Inspection Vehicle Value (USD) and Growth Rate of Others 85

FIG. 38 Global Track Inspection Vehicle Value Share by Vehicle Type (2014-2019E) 89

FIG. 39 Global Track Inspection Vehicle Value (USD) and Growth Rate of Portable Track Inspection Vehicle 90

FIG. 40 Global Track Inspection Vehicle Value (USD) and Growth Rate of Ordinary Track Inspection Vehicle 91

FIG. 41 Global Track Inspection Vehicle Value Share by Application (2014-2019E) 93

FIG. 42 Global Track Inspection Vehicle Value (USD) and Growth Rate of Engineering Track 94

FIG. 43 Global Track Inspection Vehicle Value (USD) and Growth Rate of Subway 95

FIG. 44 Global Track Inspection Vehicle Value (USD) and Growth Rate of Railway 96

FIG. 45 Global Track Inspection Vehicle Value (USD) and Growth Rate of Others 97

FIG. 46 Global Track Inspection Vehicle Value Market Share by Region (2014-2019E) 100

FIG. 47 Top 3 Market Share of Track Inspection Vehicle Companies 108

FIG. 48 Major Player Market Share of Track Inspection Vehicle Companies 109

FIG. 49 Amberg Technologies AG Track Inspection Vehicles Revenue and Growth Rate (2014-2019E) 115

FIG. 50 ENSCO, Inc Track Inspection Vehicles Revenue and Growth Rate (2014-2019E) 119

FIG. 51 Trimble Railway Asset Solutions Group Track Inspection Vehicles Revenue and Growth Rate (2014-2019E) 122

FIG. 52 MER MEC S.p.A. Track Inspection Vehicles Revenue and Growth Rate (2014-2019E) 127

FIG. 53 Harsco Corporation Track Inspection Vehicles Revenue and Growth Rate (2014-2019E) 131

FIG. 54 Fugro N.V. Track Inspection Vehicles Revenue and Growth Rate (2014-2019E) 141

FIG. 55 Global Track Inspection Vehicles Market Value (USD Million) and Growth Rate Forecast of Eddy Current Testing (2019-2027) 151

FIG. 56 Global Track Inspection Vehicles Market Value (USD Million) and Growth Rate Forecast of Ultrasonic Testing (2019-2027) 152

FIG. 57 Global Track Inspection Vehicles Market Value (USD Million) and Growth Rate Forecast of Portable Track Inspection Vehicle (2019-2027) 157

FIG. 58 Global Track Inspection Vehicles Market Value (USD Million) and Growth Rate Forecast of Ordinary Track Inspection Vehicle (2019-2027) 158

FIG. 59 Global Track Inspection Vehicles Market Value (USD Million) and Growth Rate Forecast of Engineering Track (2019-2027) 160

FIG. 60 Global Track Inspection Vehicles Market Value (USD Million) and Growth Rate Forecast of Subway (2019-2027) 161

FIG. 61 Global Track Inspection Vehicles Market Value (USD Million) and Growth Rate Forecast of Railway (2019-2027) 162

FIG. 62 North America Market Value (USD Million) and Growth Rate Forecast (2019-2027) 163

FIG. 63 Europe Market Value (USD Million) and Growth Rate Forecast (2019-2027) 164

FIG. 64 Asia Pacific Market Value (USD Million) and Growth Rate Forecast (2019-2027) 165

FIG. 66 Middle East and Africa Market Value (USD Million) and Growth Rate Forecast (2019-2027) 167

FIG. 68 South America Market Value (USD Million) and Growth Rate Forecast (2019-2027) 169

List of Tables

TABLE 1 Research Regions of Track Inspection Vehicle 42

TABLE 2 Industry News 52

TABLE 3 Key Suppliers of Raw Materials 55

TABLE 4 Major Players Manufacturing Base and Market Share of Track Inspection Vehicle in 2017 57

TABLE 5 Major Players Manufacturing Base and Market Share of Track Inspection Vehicles 59

TABLE 6 Manufacturing Cost Structure 62

TABLE 7 Distributors/Traders List 79

TABLE 8 Major Downstream Buyers of Track Inspection Vehicles with Contact Information 80

TABLE 9 Global Track Inspection Vehicle Value (USD) by Type (2014-2019E) 81

TABLE 10 Global Track Inspection Vehicle Value Share by Type (2014-2019E) 81

TABLE 11 Eddy Current Analysis by Application (2014-2019E) 86

TABLE 12 Ultra-Sonic Analysis by Application (2014-2019E) 86

TABLE 13 Others Type Analysis by Application (2014-2019E) 87

TABLE 14 Global Track Inspection Vehicle Value (USD) by Vehicle Type (2014-2019E) 88

TABLE 15 Global Track Inspection Vehicle Value Share by Vehicle Type (2014-2019E) 88

TABLE 16 Global Track Inspection Vehicle Value (USD) by Application (2014-2019E) 92

TABLE 17 Global Track Inspection Vehicle Value Share by Application (2014-2019E) 92

TABLE 18 Global Track Inspection Vehicle Value (USD) by Region (2014-2019E) 98

TABLE 19 Global Track Inspection Vehicle Value Market Share by Region (2014-2019E) 99

TABLE 20 North America Track Inspection Vehicles SWOT Analysis 101

TABLE 21 Europe Track Inspection Vehicles SWOT Analysis 102

TABLE 22 Asia Pacific Track Inspection Vehicles SWOT Analysis 103

TABLE 24 Middle East and Africa Track Inspection Vehicles SWOT Analysis 105

TABLE 26 South America Track Inspection Vehicles SWOT Analysis 107

TABLE 27 Major Players Production Value (USD) Share (2014-2019E) 110

TABLE 28 Amberg Technologies AG Basic Information, Manufacturing Base, Sales Area and Its Competitors 111

TABLE 29 Representative Track Inspection Vehicles Product of Amberg Technologies AG 113

TABLE 30 Amberg Technologies AG Track Inspection Vehicles Revenue (2014-2018E) 114

TABLE 31 ENSCO, Inc Basic Information, Manufacturing Base, Sales Area and Its Competitors 116

TABLE 32 Representative Track Inspection Vehicles Product of ENSCO, Inc 118

TABLE 33 ENSCO, Inc Track Inspection Vehicles Revenue (Million USD) (2014-2018E) 118

TABLE 34 Trimble Railway Asset Solutions Group Basic Information, Manufacturing Base, Sales Area and Its Competitors 120

TABLE 35 Representative Track Inspection Vehicles Product of Trimble Railway Asset Solutions Group 121

TABLE 36 Trimble Railway Asset Solutions Group Track Inspection Revenue (Million USD) (2014-2019E) 122

TABLE 37 MER MEC S.p.A. Basic Information, Manufacturing Base, Sales Area and Its Competitors 123

TABLE 38 Representative Track Inspection Vehicles Product of MER MEC S.p.A. 125

TABLE 39 MER MEC S.p.A. Track Inspection Vehicles Revenue (Million USD) (2014-2019E) 126

TABLE 40 Harsco Corporation Basic Information, Manufacturing Base, Sales Area and Its Competitors 128

TABLE 41 Representative Track Inspection Vehicles Product of Harsco Corporation 130

TABLE 42 Harsco Corporation Track Inspection Vehicles Revenue (Million USD) (2014-2019E) 131

TABLE 43 Nordco, Inc. Basic Information, Manufacturing Base, Sales Area and Its Competitors 132

TABLE 44 Representative Track Inspection Vehicles Product of Nordco, Inc. 134

TABLE 45 Loram Maintenance of Way, Inc. Basic Information, Manufacturing Base, Sales Area and Its Competitors 136

TABLE 46 Representative Track Inspection Vehicles Product of Loram Maintenance of Way, Inc. 137

TABLE 47 Fugro N.V. Basic Information, Manufacturing Base, Sales Area and Its Competitors 138

TABLE 48 Representative Track Inspection Vehicles Product of Fugro N.V. 140

TABLE 49 Fugro N.V. Track Inspection Vehicles Revenue (Million USD) (2014-2019E) 140

TABLE 50 MRX Technologies Basic Information, Manufacturing Base, Sales Area and Its Competitors 142

TABLE 51 Representative Track Inspection Vehicles Product of MRX Technologies 143

TABLE 52 Holland LP Basic Information, Manufacturing Base, Sales Area and Its Competitors 145

TABLE 53 Representative Track Inspection Vehicles Product of Holland LP 147

TABLE 54 Eurailscout Inspection & Analysis B.V. Basic Information, Manufacturing Base, Sales Area and Its Competitors 148

TABLE 55 Representative Track Inspection Vehicles Product of Eurailscout Inspection & Analysis B.V. 149

TABLE 56 Global Track Inspection Vehicles Market Value (USD) Forecast, by Type 150

TABLE 57 Eddy Current by Application 153

TABLE 58 Ultra-Sonic by Application 154

TABLE 59 Other by Application 155

TABLE 60 Global Track Inspection Vehicles Market Value (USD) Forecast, by Vehicle Type 156

TABLE 61 Global Track Inspection Vehicles Market Value (USD) Forecast, by Type 159

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

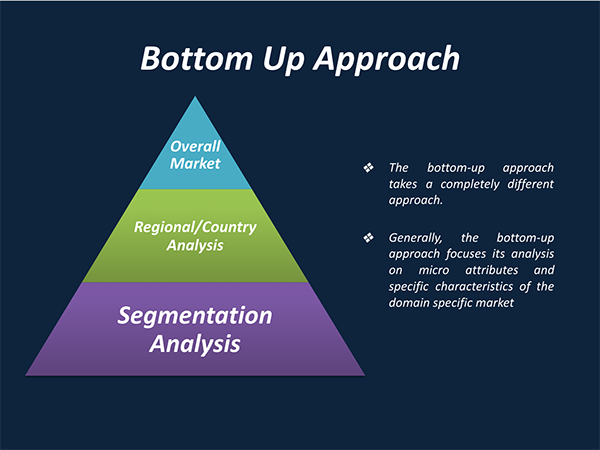

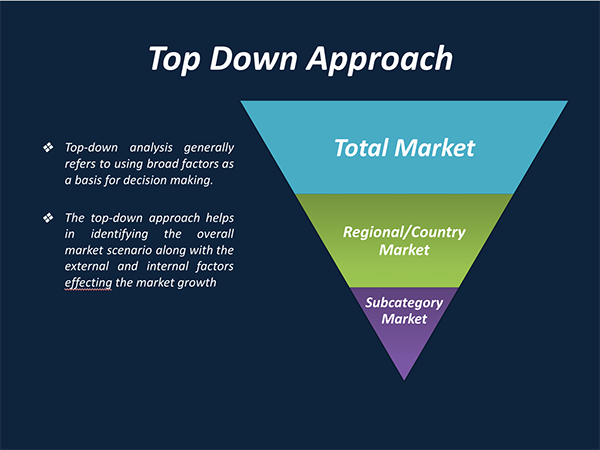

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

Our market research process involves with the four specific stages.

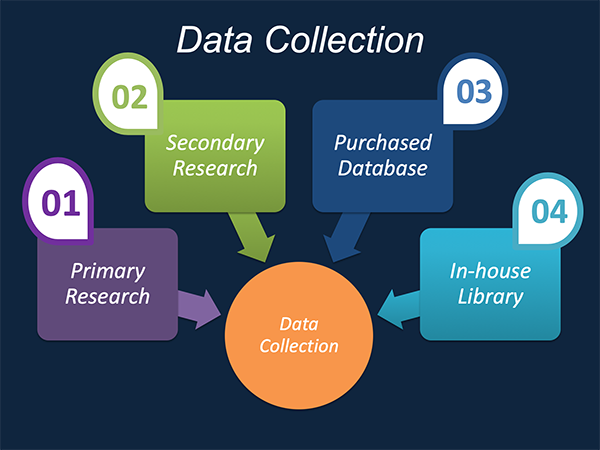

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.