The global intelligent shelves market size is expected to grow from an estimated value of USD 2.41 billion in 2020 to USD 6.23 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 26.1% from 2021 to 2028.

Smart shelves have been transistorized and have a radio frequency identification reader (RFID) sensor installed within, above, or behind the shelves. Smart shelves are becoming popular in hypermarkets as they aid in optimization and sales growth. Consumers prefer to shop in hypermarkets with smart shelves because the smart shelves provide discounts or offer as the consumer selects a product. The market share of smart shelves has steadily increased due to the increasing use of smart shelves, which bring benefits to both customers and hypermarkets and offer various advantages over traditional shelves. Smart shelves provide evolutionary advantages over traditional shelves, such as automatic low-end stock alerts, better operations management, tracking consumer preferences, and detecting theft. Furthermore, standard shelves do not provide these characteristics, resulting in lower hypermarket staff efficiency and low sales figures. On the other hand, smart shelves are integrated solutions that improve hypermarket goods' control and connectivity. When an item is lifted, weight sensors on the smart shelves send a notification to the back end system. Furthermore, when these shelves detect a product that does not belong in that section, they transmit information to the rear-end system as misplaced products. Smart shelves provide shops with a variety of data that they may utilize to improve customer experience. By digitizing stores and hypermarkets, the retail sector is expected to be more responsive to consumer demands and provide a better shopping experience.

The increasing need for workflow simplification in physical retail stores and easy data analysis is expected to drive the smart shelves market during the forecast period. Furthermore, the increased demand for improved surveillance and monitoring at physical retail outlets is expected to drive the market during the projected period of 2021-2028. The increased demand for real-time stock information and inventory management is a crucial driver that will propel the smart shelves market in the coming years. Increased demand in retail for inventory accuracy and supply chain management is expected to drive rising demand for smart shelves. However, privacy worries about embedded data tags are expected to hinder the market, resulting in low adoption of smart shelves by small and medium-sized stores. Incompatibility concerns with infrastructure and an absence of experienced labor are expected to hamper the smart shelves market throughout the forecast period of 2021-2028. The desire for merchants to establish stronger relationships with customers at the front of the store will provide market growth potential. The integration of IoT and AI in the construction of smart shelves will aid in the resolution of warehouse issues and the tracking of products along the supply chain. Smart shelving is one of the most used technologies in the retail and fulfillment industries. Furthermore, expanding the RFID technology market will increase and create new prospects for the smart shelves market. In addition to RFID, the smart label industry will positively impact the smart shelf market.

This study delivers a comprehensive analysis of components, applications, and regions. The component segment includes RFID Tags and Readers, ESL, IoT Sensors, Cameras, and Software and Solutions. The software and solutions segment held the largest market share. Software and solutions are critical tools and platforms used to link shelf components to cloud servers and gateways. Some of the most common applications of smart shelf software and solutions are in-store execution, category analysis and planning, price and promotion compliance, inventory optimization, store monitoring and intelligence, and planogram monitoring. The application segment includes Inventory Management, Pricing Management, Content Management, and Planogram Management. The pricing management segment holds the largest market share, owing to the rise of hyper-connected customers and intense competition. Consumers are always looking for a product's fair pricing and are connected to multiple distribution channels simultaneously. As a result, retailers have implemented a consistent pricing strategy across channels, as consumers frequently compare prices. The growing demand for commodities has resulted in the emergence of always-on media that can provide the need while minimizing opportunity loss. The retail industry's fierce competition has had a substantial impact on retailers' margins, and as new options for consumers have emerged, these margins have shrunk even further.

The market has been divided into Europe, North America, South America, Asia Pacific, the Middle East, and Africa. Europe holds the largest market share. Significant players such as SES Imagotag, Pricer, Cicor, and Opticon Sensors drive growth in this region. High ESL penetration in the regional retail business, particularly in France, Italy, Belgium, Germany, and other European countries, is predicted to give the industry the most significant market share. Europe will be the second-and third-largest market for smart shelves, followed by the Asia Pacific and North America. Various elements, such as the need for modern and fast retail procedures and a highly interactive retail environment in Europe, contribute to the region's electronic market's growth.

Major vendors in the global Smart Shelves market include Happiest minds, Intel, PCCW Solutions, Avery Dennison, Honeywell, Huawei Technologies Co. Ltd, NXP Semiconductor, E-Ink Holdings, Samsung Electronics. Pricer stated in July 2020 that the Canadian Tire Dealer Association (CTDA), a dealer network with about 500 locations across Canada, has signed a Master Framework Agreement with Pricer as its exclusive supplier for Electronic Shelves Label (ESL) systems. Pricer Plaza, a new and improved architecture for innovative retail in-store services and business models, was unveiled in February 2020. Pricer's retail automation offerings would become more sophisticated as a result of this product launch.

Smart Shelves Market Analysis and Forecast, Component

Smart Shelves Market Analysis and Forecast, Application

Smart Shelves Market Analysis and Forecast, Region

Report Description:

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

1.5. Key Target Audience

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces Analysis

4.2. Value Chain Analysis

4.3. Top Investment Pockets

4.3.1. Market Attractiveness Analysis By Component

4.3.2. Market Attractiveness Analysis By Application

4.3.3. Market Attractiveness Analysis By Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.2.1. Increase in demand for workflow simplification in physical retail stores

5.2.2. More accessible data analysis

5.2.3. Increase in demand for greater surveillance and monitoring at physical retail outlets

5.2.4. Rise in demand for real-time stock information and inventory management

5.2.5. Increase in retail demand for inventory accuracy and supply chain management

5.3. Restraints

5.3.1. Worries about embedded data tags resulting in low adoption of smart shelves by small and medium-sized stores

5.3.2. Incompatibility concerns with infrastructure

5.3.3. Absence of experienced labor

5.4. Opportunities

5.4.1. Desire of merchants to create closer interactions with clients at the front of the store

6. Global Smart Shelves Market Analysis and Forecast, By Component

6.1. Segment Overview

6.2. RFID Tags and Readers

6.3. ESL

6.4. IoT Sensors

6.5. Cameras

6.6. Software and Solutions

7. Global Smart Shelves Market Analysis and Forecast, By Application

7.1. Segment Overview

7.2. Inventory Management

7.3. Pricing Management

7.4. Content Management

7.5. Planogram Management

8. Global Smart Shelves Market Analysis and Forecast, By Regional Analysis

8.1. Segment Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.2.3. Mexico

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.4. Asia-Pacific

8.4.1. Japan

8.4.2. China

8.4.3. India

8.5. South America

8.5.1. Brazil

8.6. Middle East and Africa

8.6.1. UAE

8.6.2. South Africa

9. Global Smart Shelves Treatment Market-Competitive Landscape

9.1. Overview

9.2. Market Share of Key Players in Global Smart Shelves Market

9.2.1. Global Company Market Share

9.2.2. North America Company Market Share

9.2.3. Europe Company Market Share

9.2.4. APAC Company Market Share

9.3. Competitive Situations and Trends

9.3.1. Product Launches and Developments

9.3.2. Partnerships, Collaborations, and Agreements

9.3.3. Mergers & Acquisitions

9.3.4. Expansions

10. Company Profiles

10.1. Happiest Minds

10.1.1. Business Overview

10.1.2. Company Snapshot

10.1.3. Company Market Share Analysis

10.1.4. Company Product Portfolio

10.1.5. Recent Developments

10.1.6. SWOT Analysis

10.2. Intel

10.2.1. Business Overview

10.2.2. Company Snapshot

10.2.3. Company Market Share Analysis

10.2.4. Company Product Portfolio

10.2.5. Recent Developments

10.2.6. SWOT Analysis

10.3. PCCW Solutions

10.3.1. Business Overview

10.3.2. Company Snapshot

10.3.3. Company Market Share Analysis

10.3.4. Company Product Portfolio

10.3.5. Recent Developments

10.3.6. SWOT Analysis

10.4. Avery Dennison

10.4.1. Business Overview

10.4.2. Company Snapshot

10.4.3. Company Market Share Analysis

10.4.4. Company Product Portfolio

10.4.5. Recent Developments

10.4.6. SWOT Analysis

10.5. Honeywell

10.5.1. Business Overview

10.5.2. Company Snapshot

10.5.3. Company Market Share Analysis

10.5.4. Company Product Portfolio

10.5.5. Recent Developments

10.5.6. SWOT Analysis

10.6. Huawei Technologies Co. Ltd

10.6.1. Business Overview

10.6.2. Company Snapshot

10.6.3. Company Market Share Analysis

10.6.4. Company Product Portfolio

10.6.5. Recent Developments

10.6.6. SWOT Analysis

10.7. NXP Semiconductor

10.7.1. Business Overview

10.7.2. Company Snapshot

10.7.3. Company Market Share Analysis

10.7.4. Company Product Portfolio

10.7.5. Recent Developments

10.7.6. SWOT Analysis

10.8. E-Ink Holdings

10.8.1. Business Overview

10.8.2. Company Snapshot

10.8.3. Company Market Share Analysis

10.8.4. Company Product Portfolio

10.8.5. Recent Developments

10.8.6. SWOT Analysis

10.9. Samsung Electronics

10.9.1. Business Overview

10.9.2. Company Snapshot

10.9.3. Company Market Share Analysis

10.9.4. Company Product Portfolio

10.9.5. Recent Developments

10.9.6. SWOT Analysis

List of Table

1. Global Smart Shelves Market, By Component, 2018-2028 (USD Billion)

2. Global RFID Tags and Readers, Smart Shelves Market, By Region, 2018-2028 (USD Billion)

3. Global ESL, Smart Shelves Market, By Region, 2018-2028 (USD Billion)

4. Global IoT Sensors, Smart Shelves Market, By Region, 2018-2028 (USD Billion)

5. Global Cameras, Smart Shelves Market, By Region, 2018-2028 (USD Billion)

6. Global Software and Solutions, Smart Shelves Market, By Region, 2018-2028 (USD Billion)

7. Global Smart Shelves Market, By Application, 2018-2028 (USD Billion)

8. Global Inventory Management, Smart Shelves Market, By Region, 2018-2028 (USD Billion)

9. Global Pricing Management, Smart Shelves Market, By Region, 2018-2028 (USD Billion)

10. Global Content Management, Smart Shelves Market, By Region, 2018-2028 (USD Billion)

11. Global Planogram Management, Smart Shelves Market, By Region, 2018-2028 (USD Billion)

12. North America Smart Shelves Market, By Component, 2018-2028 (USD Billion)

13. North America Smart Shelves Market, By Application, 2018-2028 (USD Billion)

14. U.S. Smart Shelves Market, By Component, 2018-2028 (USD Billion)

15. U.S. Smart Shelves Market, By Application, 2018-2028 (USD Billion)

16. Canada Smart Shelves Market, By Component, 2018-2028 (USD Billion)

17. Canada Smart Shelves Market, By Application, 2018-2028 (USD Billion)

18. Mexico Smart Shelves Market, By Component, 2018-2028 (USD Billion)

19. Mexico Smart Shelves Market, By Application, 2018-2028 (USD Billion)

20. Europe Smart Shelves Market, By Component, 2018-2028 (USD Billion)

21. Europe Smart Shelves Market, By Application, 2018-2028 (USD Billion)

22. Germany Smart Shelves Market, By Component, 2018-2028 (USD Billion)

23. Germany Smart Shelves Market, By Application, 2018-2028 (USD Billion)

24. France Smart Shelves Market, By Component, 2018-2028 (USD Billion)

25. France Smart Shelves Market, By Application, 2018-2028 (USD Billion)

26. U.K. Smart Shelves Market, By Component, 2018-2028 (USD Billion)

27. U.K. Smart Shelves Market, By Application, 2018-2028 (USD Billion)

28. Italy Smart Shelves Market, By Component, 2018-2028 (USD Billion)

29. Italy Smart Shelves Market, By Application, 2018-2028 (USD Billion)

30. Spain Smart Shelves Market, By Component, 2018-2028 (USD Billion)

31. Spain Smart Shelves Market, By Application, 2018-2028 (USD Billion)

32. Asia Pacific Smart Shelves Market, By Component, 2018-2028 (USD Billion)

33. Asia Pacific Smart Shelves Market, By Application, 2018-2028 (USD Billion)

34. Japan Smart Shelves Market, By Component, 2018-2028 (USD Billion)

35. Japan Smart Shelves Market, By Application, 2018-2028 (USD Billion)

36. China Smart Shelves Market, By Component, 2018-2028 (USD Billion)

37. China Smart Shelves Market, By Application, 2018-2028 (USD Billion)

38. India Smart Shelves Market, By Component, 2018-2028 (USD Billion)

39. India Smart Shelves Market, By Application, 2018-2028 (USD Billion)

40. South America Smart Shelves Market, By Component, 2018-2028 (USD Billion)

41. South America Smart Shelves Market, By Application, 2018-2028 (USD Billion)

42. Brazil Smart Shelves Market, By Component, 2018-2028 (USD Billion)

43. Brazil Smart Shelves Market, By Application, 2018-2028 (USD Billion)

44. Middle East and Africa Smart Shelves Market, By Component, 2018-2028 (USD Billion)

45. Middle East and Africa Smart Shelves Market, By Application, 2018-2028 (USD Billion)

46. UAE Smart Shelves Market, By Component, 2018-2028 (USD Billion)

47. UAE Smart Shelves Market, By Application, 2018-2028 (USD Billion)

48. South Africa Smart Shelves Market, By Component, 2018-2028 (USD Billion)

49. South Africa Smart Shelves Market, By Application, 2018-2028 (USD Billion)

List of Figures

1. Global Smart Shelves Market Segmentation

2. Global Smart Shelves Market: Research Methodology

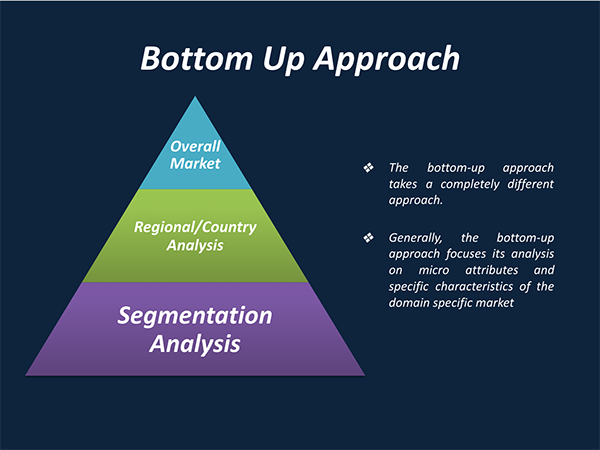

3. Market Size Estimation Methodology: Bottom-Up Approach

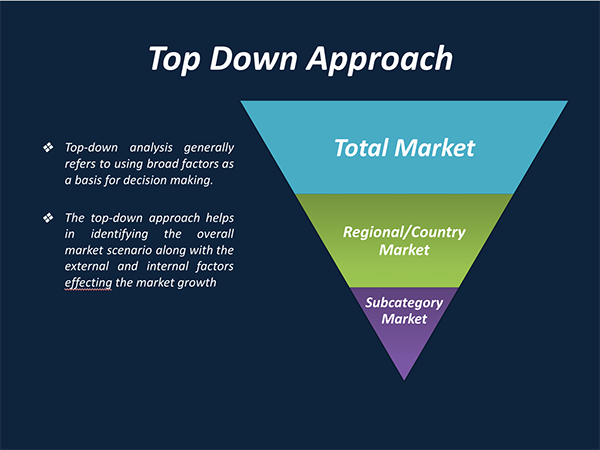

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Smart Shelves Market Attractiveness Analysis By Component

9. Global Smart Shelves Market Attractiveness Analysis By Application

10. Global Smart Shelves Market Attractiveness Analysis By Region

11. Global Smart Shelves Market: Dynamics

12. Global Smart Shelves Market Share By Component(2021 & 2028)

13. Global Smart Shelves Market Share By Application (2021 & 2028)

14. Global Smart Shelves Market Share by Regions (2021 & 2028)

15. Global Smart Shelves Market Share by Company (2020)

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

Our market research process involves with the four specific stages.

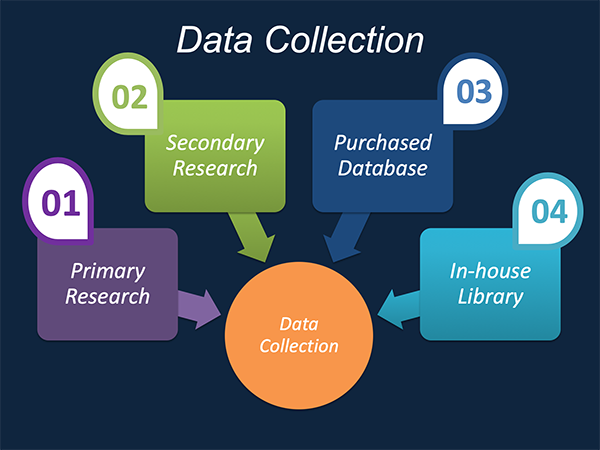

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.