The global railway air conditioner units market is expected to grow from USD 1.08 billion in 2019 to USD 1.29 billion by 2027, at a CAGR of 3.76% during the forecast period from 2020-2027. Changing climate and increasing global warming which also affect passengers in trains is one of the primary factor propelling the growth of the global railway air conditioner units market. In addition to this, providing comfort to the passenger while traveling also propelling the growth of the market. However, high maintenance costs and mechanical failure, are some of the key factors hindering the growth of the market.

The market is classified into type, application, and region. The type segment includes AC power railway air conditioner units and DC power railway air conditioner units. AC power railway air conditioner units segment held the largest market share of 71.71% and valued at USD 766.11 million in 2019. Generators fitted below the coach generate power, which converted power to DC and stored in Batteries. This power is used to run lights, fans, ACs, load on electric sockets. The operating voltage of this system is 110V DC. When the train is at rest, power from the batteries is used to run equipment and the compressor unit of the AC goes off while the blowers can still work. That is because a compressor is a unit that consumes more power.

The application segment includes rapid transit vehicles, locomotives, and passenger coaches. The passenger coaches segment held the largest market share of 50.62% in 2019. A passenger car (known as a coach or carriage in the UK, and also known as a bogie in India is a piece of railway rolling stock that is designed to carry passengers. The term passenger car can also be associated with a sleeping car, baggage, dining, railway post office, and prisoner transport cars. The market has been divided into North America, Europe, Asia-Pacific, South America and the Middle East and Africa. Asia-Pacific held the largest market share of 33.55% in 2019.

Key players in the railway air conditioner units market are Liebherr, Faiveley, Knorr-Bremse, Shijiazhuang King, Thermo King, Hitachi, Guangzhou Zhongche, New United Group, Toshiba, Longertek, Lloyd, DC Airco and Autoclima among others. Developing and developed countries are offering greater opportunities and major players are continuously focused on new developments, strategic partnerships, acquisitions, and venture capital investments to obtain high growth in the market. In January 2020, Liebherr-Transportation Systems announced that it has received an order from Siemens Mobility Austria to supply air conditioning units for 21 Viaggio intercity passenger trains.

This study forecasts revenue growth at global, regional, and country levels from 2015 to 2027. Fior Markets has segmented on the basis of below-mentioned segments:

Chapter 1 Introduction 17

1.1 Research Methodology 17

1.2 FMR Desk Research 18

1.2.1 FMR Data Synthesis 19

1.2.2 Data Validation And Market Feedback 20

1.2.3 FMR Data Sources 21

Chapter 2 Industry Overview 23

2.1 Railway Air Conditioner Units Industry 23

2.1.1 Railway Air Conditioner Units Overview 23

2.1.2 Terminology Definition in the Report 25

2.1.2.1 Production 25

2.1.2.2 Demand 25

2.1.2.3 Revenue 25

2.1.2.4 Ex-factory Price & Sales Price 26

2.1.2.5 Cost 26

2.1.2.6 Gross Margin 26

2.2 Products & Services Scope 28

2.3 Industry Chain 28

2.4 Global Market Overview 29

Chapter 3 Upstream & Manufacturing 30

3.1 Raw Materials 30

3.2 Procurement Methods & Channels 31

3.2.1 Direct Marketing 32

3.2.2 Indirect Marketing 34

3.1 Market Positioning 35

3.1.1 Marketing Channel Future Trend 35

3.1.2 Pricing Strategy 37

3.1.3 Brand Strategy 39

3.2 Cost Structure & Manufacturing 41

3.2.1 Raw Material 41

3.2.2 Labor Cost Analysis 41

3.2.2.1 USA Labor Cost Analysis 42

3.3 Industry Capacity Overview 46

3.4 Production Distribution by Geography 47

3.4.1 Production in Major Regions / Countries 47

Chapter 4 Product Segment 48

4.1 Introduction 48

4.1.1 AC Power 48

4.1.2 DC Power 48

4.2 Market Status 50

Chapter 5 Application / End-Use Segment 51

5.1 Introduction 51

5.1.1 Rapid Transit Vehicles 51

5.1.2 Locomotives 52

5.1.3 Passenger Coaches 53

5.2 Market Status 54

Chapter 6 Regional Market 55

6.1 Market Overview 55

6.2 By Region 57

6.2.1 North America 57

6.2.1.1 United States Market Size and Growth (2015-2018) 58

6.2.1.2 Canada Market Size and Growth (2015-2018) 59

6.2.1.3 Mexico Market Size and Growth (2015-2018) 60

6.2.2 Europe 61

6.2.2.1 Germany Market Size and Growth (2015-2018) 62

6.2.2.2 UK Market Size and Growth (2015-2018) 63

6.2.2.3 France Market Size and Growth (2015-2018) 64

6.2.2.4 Italy Market Size and Growth (2015-2018) 65

6.2.2.5 Netherlands Market Size and Growth (2015-2018) 66

6.2.2.6 Poland Market Size and Growth (2015-2018) 67

6.2.2.7 Belgium Market Size and Growth (2015-2018) 68

6.2.2.8 Sweden Market Size and Growth (2015-2018) 69

6.2.2.9 Austria Market Size and Growth (2015-2018) 70

6.2.2.10 Denmark Market Size and Growth (2015-2018) 71

6.2.2.11 Switzerland Market Size and Growth (2015-2018) 72

6.2.2.12 Russia Market Size and Growth (2015-2018) 73

6.2.3 Asia-Pacific 74

6.2.3.1 China Market Size and Growth (2015-2018) 75

6.2.3.2 India Market Size and Growth (2015-2018) 76

6.2.3.3 Japan Market Size and Growth (2015-2018) 77

6.2.3.4 Korea Market Size and Growth (2015-2018) 78

6.2.3.5 Australia Market Size and Growth (2015-2018) 79

6.2.3.6 Indonesia Market Size and Growth (2015-2018) 80

6.2.3.7 Thailand Market Size and Growth (2015-2018) 81

6.2.3.8 Malaysia Market Size and Growth (2015-2018) 82

6.2.3.9 Singapore Market Size and Growth (2015-2018) 83

6.2.3.10 Philippines Market Size and Growth (2015-2018) 84

6.2.4 South America 85

6.2.4.1 Brazil Market Size and Growth (2015-2018) 86

6.2.4.2 Argentina Market Size and Growth (2015-2018) 87

6.2.4.3 Columbia Market Size and Growth (2015-2018) 88

6.2.4.4 Chile Market Size and Growth (2015-2018) 89

6.2.4.5 Peru Market Size and Growth (2015-2018) 90

6.2.4.6 Puerto Rico Market Size and Growth (2015-2018) 91

6.2.4.7 Ecuador Market Size and Growth (2015-2018) 92

6.2.5 Middle East and Africa 93

6.2.5.1 Saudi Arabia Market Size and Growth (2015-2018) 94

6.2.5.2 Iran Market Size and Growth (2015-2018) 95

6.2.5.3 UAE Market Size and Growth (2015-2018) 96

6.2.5.4 Oman Market Size and Growth (2015-2018) 97

6.2.5.5 Kuwait Market Size and Growth (2015-2018) 98

6.2.5.6 Iraq Market Size and Growth (2015-2018) 99

6.2.5.7 Turkey Market Size and Growth (2015-2018) 100

6.2.5.8 South Africa Market Size and Growth (2015-2018) 101

6.2.5.9 Egypt Market Size and Growth (2015-2018) 102

6.2.5.10 Nigeria Market Size and Growth (2015-2018) 103

6.2.5.11 Algeria Market Size and Growth (2015-2018) 104

6.2.5.12 Angola Market Size and Growth (2015-2018) 105

6.2.5.13 Morocco Market Size and Growth (2015-2018) 106

6.2.5.14 Sudan Market Size and Growth (2015-2018) 107

Chapter 7 Market Subdivision 108

7.1 Regional Production 108

7.1.1 By Type 108

7.1.1.1 AC Power Production 108

7.1.1.2 DC Power Production 109

7.1.2 By Application / End-Use 110

7.1.2.1 Rapid Transit Vehicles Production 110

7.1.2.2 Locomotive Production 111

7.1.2.3 Passenger Coaches Production 112

7.2 Regional Revenue 113

7.2.1 By Type 113

7.2.1.1 AC Power Revenue 113

7.2.1.2 DC Power Revenue 114

7.2.2 By Application / End-Use 115

7.2.2.1 Rapid Transit Vehicles Revenue 115

7.2.2.2 Locomotive Revenue 116

7.2.2.3 Passenger Coaches Revenue 117

Chapter 8 Market Forecast 118

8.1 Global Forecast 118

8.2 Forecast by Type 120

8.3 Forecast by Application 120

8.4 Forecast by Region 121

Chapter 9 Railway Air Conditioner Units Companies List 122

9.1 Liebherr-International AG 122

9.1.1 Company Profile 122

9.1.2 Representative Railway Air Conditioner Units Industry Product 123

9.1.3 Business Overview 124

9.2 Faiveley Transport S.A. (subsidiary of Faiveley Transport S.A.) 126

9.2.1 Company Profile 126

9.2.2 Representative Railway Air Conditioner Units Industry Product 127

9.2.3 Business Overview 127

9.3 Knorr-Bremse Aktiengesellschaft (subsidiary of KB Holding GmbH.) 128

9.3.1 Company Profile 128

9.3.2 Representative Railway Air Conditioner Units Industry Product 129

9.3.3 Business Overview 129

9.4 Shijiazhuang King Transportation Equipment Co. Ltd 131

9.4.1 Company Profile 131

9.4.2 Representative Railway Air Conditioner Units Industry Product 132

9.4.3 Business Overview 133

9.5 Thermo King Corporation. (Subsidiary of Ingersoll-Rand Plc.) 134

9.5.1 Company Profile 134

9.5.2 Representative Railway Air Conditioner Units Industry Product 135

9.5.3 Business Overview 136

9.6 Hitachi 138

9.6.1 Company Profile 138

9.6.2 Representative Railway Air Conditioner Units Industry Product 139

9.6.3 Business Overview 140

9.7 Guangzhou Zhongche (subsidiary of Beijing Dinghan Technology Co., Ltd.) 142

9.7.1 Company Profile 142

9.7.2 Representative Railway Air Conditioner Units Industry Product 143

9.7.3 Business Overview 144

9.8 New United Rail Transit Technology Co., Ltd. 145

9.8.1 Company Profile 145

9.8.2 Representative Railway Air Conditioner Units Industry Product 146

9.8.3 Business Overview 147

9.9 Toshiba Corporation 148

9.9.1 Company Profile 148

9.9.2 Representative Railway Air Conditioner Units Industry Product 149

9.9.3 Business Overview 150

9.10 Shandong Longertek Technology Co 151

9.10.1 Company Profile 151

9.10.2 Representative Railway Air Conditioner Units Industry Product 152

9.10.3 Business Overview 153

9.11 Lloyd 154

9.11.1 Company Profile 154

9.11.2 Representative Railway Air Conditioner Units Industry Product 155

9.11.3 Business Overview 156

9.12 DC Airco 158

9.12.1 Company Profile 158

9.12.2 Representative Railway Air Conditioner Units Industry Product 159

9.12.3 Business Overview 160

9.13 Autoclima Spa a socio unico 161

9.13.1 Company Profile 161

9.13.2 Representative Railway Air Conditioner Units Industry Product 162

9.13.3 Business Overview 163

9.14 Ingersoll-Rand plc 164

9.14.1 Company Profile 164

9.14.2 Representative Railway Air Conditioner Units Industry Product 165

9.14.3 Business Overview 166

Chapter 10 Company Competition 168

10.1 Market by Company 168

10.2 Gross Margin 170

10.3 Competitive Environment for New Entrants 171

10.3.1 Michael Porter's Five Forces Model 171

10.3.2 SWOT 172

Chapter 11 Research Conclusion 173

1

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

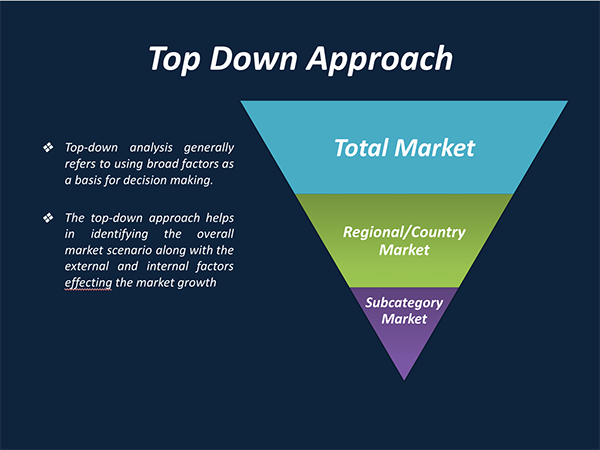

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

Our market research process involves with the four specific stages.

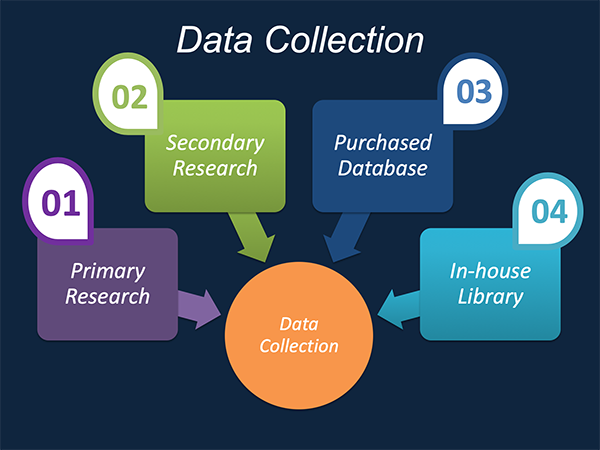

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

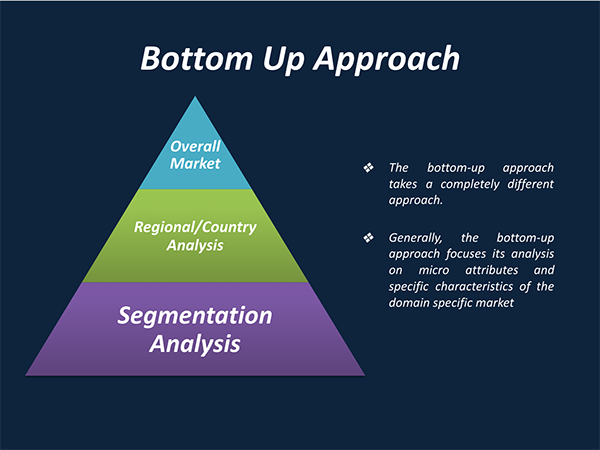

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.