Global Perfluoropolyether Market size was estimated at USD 610 million in 2020 and is expected to reach 987.02 million at a CAGR of 6.2% between 2021 and 2028.

Perfluoropolyether (PFPE) belongs to the family of fluorinated synthetic fluids. Perfluoropolyether is non-toxic, non-flammable, and chemically resistant low-molecular-weight, partly fluorinated oxetane oligomeric polyols. They are employed in temperatures ranging from 80° C to 200° C. Perfluoropolyethers are polymeric species composed of perfluorinated methyl-, ethyl-, or isopropyl ether units are repeated. Some molecules are fluids composed of pendant molecules that serve as lubricants in industrial applications such as the automotive sector.The oil has a 25 to 510 CST viscosity range at 400°C and a service temperature range of -54 to 2500°C for use in slides, gears, and bearings. They offer several end groups that are tailored to specific applications. Because of its excellent lubricating characteristics, demand is increasing rapidly all over the world. It can also be found in practically every industry, from the chemical industry to modern machinery. Because of its direct use as lubricants in ball bearings, joints, and various pivots used in automotive components, the increasing growth of commercial and personal cars has increased the market value. Many countries around the world today rely on nuclear power for energy. Perfluoropolyether is the only lubricant that can withstand the hazardous radiation emitted during this industry's reaction, making it helpful in extending the life of the gear.

Significant factors such as rapid growth in the automotive sector, incorporation of high-quality lubricants, the long-lasting property of perfluoropolyether, increasing commercial aerospace production, and the need for efficient aircraft design to improve overall performance are expected to fuel the market growth during the forecast period of 2021-2028. Government regulations are increasing in response to the carbon footprint, which should boost corporate growth. One of the primary drivers of the global perfluoropolyether (PFPE) market growth is the low cost and high strength of perfluoropolyether, which protects under severe load circumstances. The increased demand for and acceptance of smart wearables, smartphones, and other handheld technology will promote Perfluoropolyether usage in the consumer electronics sector. Ongoing technical advancements in the electronics industry will undoubtedly provide a promising future for PFPE makers.However, problems such as a lack of literature and R&D, a declining market for CD drives, and the release of fumes from perfluoropolyether fluid when exposed to high temperatures are anticipated to impede the demand for perfluoropolyether.The increased manufacture of fuel-efficient and lightweight carriers will create good opportunities for Perfluoropolyether suppliers, resulting from increased air passengers. The gap would be filled by supplying companies with material on the environmental concerns of Perfluoropolyether fluids.

This study delivers a comprehensive analysis of the product, and end-user, and region. The product segment includes PFPE-K, PFPE-M, PFPE-Z, PFPE-Y, PFPE-D. PFPE-Y held the largest market share in 2020 due to its cost-effectiveness when compared to its competitors. These fluids are used in various applications, including gears, slides, and bearings, where high-temperature elastomer compatibility is required and where the performance of machine components is affected by heat, corrosion, solvents, toxicity, and flammability. They can also be used as grease in various end-use industries, including chemical, electronics, automotive, and data processing.They have outstanding properties such as thermal, chemical, electrical, and solvent resistance and being non-reactive with elastomers, metal, plastic, and rubber, which will eventually drive product demand in the market during the projected period of 2021-2028.The End- User segment includes Automotive, Aerospace, Chemical & Petrochemical, Food Processing, Metal Processing, Medical Industry Equipment, Power Generation, Pulp & Paper. In 2020, the Aerospace sector held the largest share in the perfluoropolyether market, owing to their high efficiency and little environmental effect are invaluable. These devices also improve efficiency by eliminating part loss, an essential factor in the aircraft sector under challenging circumstances. The oil and grease used in aircraft extend the life of the components and have a high resistance to vapor losses at high altitudes. There is a constant upsurge in the aerospace industry, increasing passenger demand and increasing military spending.

The market has been divided into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. The Asia Pacific holds the largest market share, followed by Europe and North America. The expansion in the number of low-cost carriers in the Asia Pacific region has increased the number of air passengers. The rising aircraft sector would result in the utilization of Perfluoropolyether oil due to the demand for these products in high-temperature applications. The Asia Pacific aerospace industry's continued growth has created a need for lubricants suitable for low atmospheric radiation, pressure, and faulty maintenance components. The adoption of high-temperature components ensured outstanding performance and long-term durability.The ongoing expansion of Asia Pacific's manufacturing, transportation, and construction industries has resulted in high demand for vehicles, trucks, power tools, and industrial machinery. The temperature range of perfluoropolyether items is vast, which helps the lubrication given by the machines. These items are specifically developed for extreme temperature ranges and dynamic circumstances.

Some of the key players operating in the Global Perfluoropolyether market are Daikin, Dow Corning, Kluber Lubrication, DuPont, Chemours Company, Solvay Solexis, ICAN, M&I Materials Limited, and Halocarbon Product Corporation. Chemours Company is a significant producer of fluoro products. It has entered the Perfluoropolyether industry with its product KrytoxTM, a high-performance synthetic lubricant that is non-flammable, chemically inert, and capable of maintaining viscosity at high temperatures. In February 2021, Solvay will collaborate with vertical aerospace to develop composites for passenger air taxis. Vertical Aerospace is a British aerospace manufacturer with headquarters in Bristol, United Kingdom. These firms will also collaborate on developing light weight and sophisticated material portfolios, which should benefit the perfluoropolyether market growth.

Perfluoropolyether Market Analysis and Forecast, Product

Perfluoropolyether Market Analysis and Forecast, End-User

Perfluoropolyether Market Analysis and Forecast, Region

Report Description:

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

1.5. Key Target Audience

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces Analysis

4.2. Value Chain Analysis

4.3. Top Investment Pockets

4.3.1. Market Attractiveness Analysis By Product

4.3.2. Market Attractiveness Analysis By End- User

4.3.3. Market Attractiveness Analysis By Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.2.1. Increase in the automotive sector

5.2.2. Incorporation of high-quality lubricants

5.2.3. Rising commercial aerospace production

5.2.4. Increase in government regulations for the carbon footprint

5.2.5. The low cost and high strength of perfluoropolyether

5.2.6. Increase in demand for smart wearables, smartphones, and other handheld technology

5.2.7. Technical advancements in the electronics industry

5.3. Restraints

5.3.1. Lack of literature and R&D

5.3.2. Declining need for CD drives

5.3.3. Release of fumes from perfluoropolyether fluid when exposed to high temperatures

5.4. Opportunities

5.4.1. Increase in the manufacture of fuel-efficient and lightweight carriers

6. Global Perfluoropolyether Market Analysis and Forecast, By Product

6.1. Segment Overview

6.2. PFPE-K

6.3. PFPE-M

6.4. PFPE-Z

6.5. PFPE-Y

6.6. PFPE-D

7. Global Perfluoropolyether Market Analysis and Forecast, By End- User

7.1. Segment Overview

7.2. Automotive

7.3. Aerospace

7.4. Chemical & Petrochemical

7.5. Food Processing

7.6. Metal Processing

7.7. Medical Industry Equipment

7.8. Power Generation

7.9. Pulp & Paper

8. Global Perfluoropolyether Treatment Market Analysis and Forecast, By Regional Analysis

8.1. Segment Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.2.3. Mexico

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.4. Asia-Pacific

8.4.1. Japan

8.4.2. China

8.4.3. India

8.5. South America

8.5.1. Brazil

8.6. Middle East and Africa

8.6.1. UAE

8.6.2. South Africa

9. Global Perfluoropolyether Market-Competitive Landscape

9.1. Overview

9.2. Market Share of Key Players in Global Perfluoropolyether Market

9.2.1. Global Company Market Share

9.2.2. North America Company Market Share

9.2.3. Europe Company Market Share

9.2.4. APAC Company Market Share

9.3. Competitive Situations and Trends

9.3.1. Product Launches and Developments

9.3.2. Partnerships, Collaborations, and Agreements

9.3.3. Mergers & Acquisitions

9.3.4. Expansions

10. Company Profiles

10.1. Daikin

10.1.1. Business Overview

10.1.2. Company Snapshot

10.1.3. Company Market Share Analysis

10.1.4. Company Product Portfolio

10.1.5. Recent Developments

10.1.6. SWOT Analysis

10.2. Dow Corning

10.2.1. Business Overview

10.2.2. Company Snapshot

10.2.3. Company Market Share Analysis

10.2.4. Company Product Portfolio

10.2.5. Recent Developments

10.2.6. SWOT Analysis

10.3. Kluber Lubrication

10.3.1. Business Overview

10.3.2. Company Snapshot

10.3.3. Company Market Share Analysis

10.3.4. Company Product Portfolio

10.3.5. Recent Developments

10.3.6. SWOT Analysis

10.4. DuPont

10.4.1. Business Overview

10.4.2. Company Snapshot

10.4.3. Company Market Share Analysis

10.4.4. Company Product Portfolio

10.4.5. Recent Developments

10.4.6. SWOT Analysis

10.5. Chemours Company

10.5.1. Business Overview

10.5.2. Company Snapshot

10.5.3. Company Market Share Analysis

10.5.4. Company Product Portfolio

10.5.5. Recent Developments

10.5.6. SWOT Analysis

10.6. Solvay Solexis

10.6.1. Business Overview

10.6.2. Company Snapshot

10.6.3. Company Market Share Analysis

10.6.4. Company Product Portfolio

10.6.5. Recent Developments

10.6.6. SWOT Analysis

10.7. ICAN

10.7.1. Business Overview

10.7.2. Company Snapshot

10.7.3. Company Market Share Analysis

10.7.4. Company Product Portfolio

10.7.5. Recent Developments

10.7.6. SWOT Analysis

10.8. M&I Materials Limited

10.8.1. Business Overview

10.8.2. Company Snapshot

10.8.3. Company Market Share Analysis

10.8.4. Company Product Portfolio

10.8.5. Recent Developments

10.8.6. SWOT Analysis

10.9. Halocarbon Product Corporation

10.9.1. Business Overview

10.9.2. Company Snapshot

10.9.3. Company Market Share Analysis

10.9.4. Company Product Portfolio

10.9.5. Recent Developments

10.9.6. SWOT Analysis

List of Table

1. Global Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

2. Global PFPE-K, Perfluoropolyether Market, By Region, 2021-2028 (USD Million)

3. Global PFPE-M, Perfluoropolyether Market, By Region, 2021-2028 (USD Million)

4. Global PFPE-Z, Perfluoropolyether Market, By Region, 2021-2028 (USD Million)

5. Global PFPE-Y, Perfluoropolyether Market, By Region, 2021-2028 (USD Million)

6. Global PFPE-D, Perfluoropolyether Market, By Region, 2021-2028 (USD Million)

7. Global Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

8. Global Automotive, Perfluoropolyether Market, By Region, 2021-2028 (USD Million)

9. Global Aerospace, Perfluoropolyether Market, By Region, 2021-2028 (USD Million)

10. Global Chemical & Petrochemical, Perfluoropolyether Market, By Region, 2021-2028 (USD Million)

11. Global Food Processing, Perfluoropolyether Market, By Region, 2021-2028 (USD Million)

12. Global Metal Processing, Perfluoropolyether Market, By Region, 2021-2028 (USD Million)

13. Global Medical Industry Equipment, Perfluoropolyether Market, By Region, 2021-2028 (USD Million)

14. Global Power Generation, Perfluoropolyether Market, By Region, 2021-2028 (USD Million)

15. Global Pulp & Paper, Perfluoropolyether Market, By Region, 2021-2028 (USD Million)

16. North America Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

17. North America Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

18. U.S. Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

19. U.S. Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

20. Canada Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

21. Canada Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

22. Mexico Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

23. Mexico Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

24. Europe Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

25. Europe Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

26. Germany Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

27. Germany Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

28. France Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

29. France Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

30. U.K. Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

31. U.K. Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

32. Italy Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

33. Italy Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

34. Spain Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

35. Spain Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

36. Asia Pacific Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

37. Asia Pacific Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

38. Japan Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

39. Japan Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

40. China Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

41. China Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

42. India Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

43. India Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

44. South America Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

45. South America Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

46. Brazil Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

47. Brazil Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

48. Middle East and Africa Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

49. Middle East and Africa Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

50. UAE Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

51. UAE Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

52. South Africa Perfluoropolyether Market, By Product, 2021-2028 (USD Million)

53. South Africa Perfluoropolyether Market, By End- User, 2021-2028 (USD Million)

List of Figures

1. Global Perfluoropolyethe Market Segmentation

2. Global Perfluoropolyethe Market: Research Methodology

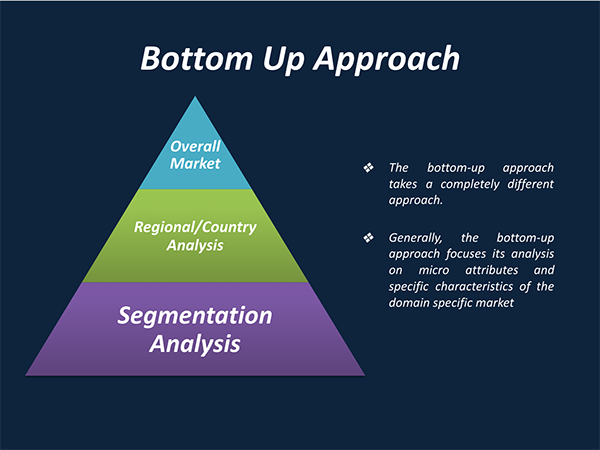

3. Market Size Estimation Methodology: Bottom-Up Approach

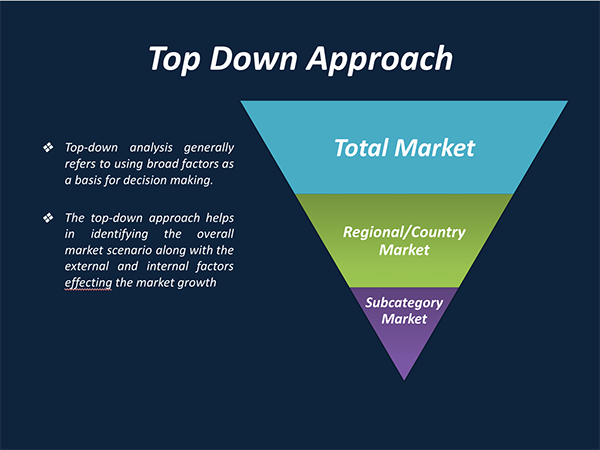

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Perfluoropolyethe Market Attractiveness Analysis By Product

9. Global Perfluoropolyethe Market Attractiveness Analysis By End- User

10. Global Perfluoropolyethe Market Attractiveness Analysis By Region

11. Global Perfluoropolyethe Market: Dynamics

12. Global Perfluoropolyethe Market Share by Product(2021 & 2028)

13. Global Perfluoropolyethe Market Share by End- User (2021 & 2028)

14. Global Perfluoropolyethe Market Share by Regions (2021 & 2028)

15. Global Perfluoropolyethe Market Share by Company (2020)

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

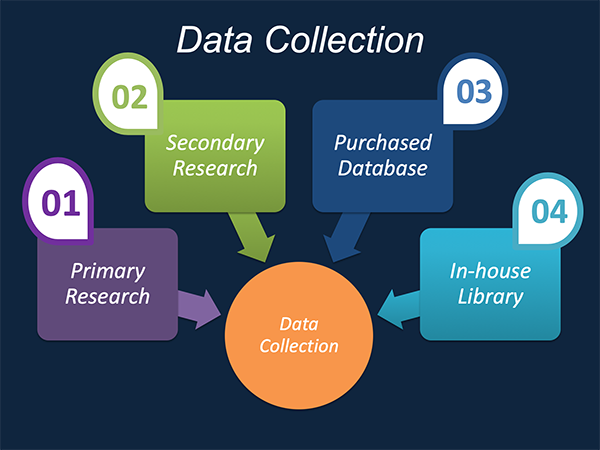

Our market research process involves with the four specific stages.

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.