The Industrial Electrification market is expected to grow from USD 90.26 billion in 2022 to USD 265.20 billion by 2032, at a CAGR of 11.38% during the forecast period 2023-2032.

Electrification is a crucial step in energy decarbonisation, which recycles waste energy into usable energy, which can be used in various applications. Energy transition defines the shift in movements away from traditional energy sources (fossil fuels) and towards clean energy sources, such as sustainable ones. The industrial electricity market includes services based on electricity supply, maintenance and generation systems. A notable example of how vehicles can rely on electricity derived from renewable sources is vehicle electrification.

The growing requirement for green energy, increasing efforts to lower toxic gas emissions, and increasing investments by major players are driving the growth of the industrial electrification market. On the other side, increasing issues with battery backup, rising maintenance costs and the rising incidence of electric vehicle power shortages hamper the market's growth. However, the increasing demand for renewable energy sources and rising R&D of battery storage for intermittent grids are expected to create significant opportunities over the forecast period. Besides, increasing risks associated with the electrification technologies, such as high battery cost, overheating, the thermal runaway of batteries, fewer charging facilities, and others, will challenge the market's growth during the forecast period.

This study comprehensively analyses the product, hybridization, and region. The product segment includes actuators, electric air conditioner, electric power steering (EPS), compressor, electric oil pump, liquid heater PTC, electric vacuum pump, integrated starter generator (ISG), electric water pump, starter motor & alternator, and start/stop system. The electric power steering (EPS) segment held the highest market share in 2022. Electric power steering is vastly preferred across different end-user industries due to its multiple advantages, including energy savings, reduced mechanical complexity, and more. In addition, electric power steering-based systems are less dependent on hydraulics and more energy efficient than HPS systems. The hybridization segment is divided into battery electric vehicle, internal combustion engine, hybrid electric vehicle, micro-hybrid vehicle and plug-in hybrid electric vehicle. The internal combustion engine segment registered the largest market share in 2022 due to the growing requirement for battery electric vehicles and continuous technological advancement. In addition, the growing popularity and adoption of gasoline vehicles and rising shale gas production fuel the growth of the increased internal combustion engine segment.

The market has been divided into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. The Asia-Pacific region held the highest market revenue in 2022 due to the growing population, increasing disposable income, and increasing government initiatives & subsidiaries to encourage the use of electric vehicles.

Some of the notable players in the market are Aisin Seiki Co. Ltd., Continental Ag, Borgwarner Inc., Wabco Holdings Inc., Delphi Automotive Plc, Hitachi Automotive Systems Ltd., Denso Corporation, Johnson Controls Inc., Jtekt Corporation, Johnson Electric, Magna International Inc., Robert Bosch Gmbh, Mitsubishi Electric Corporation, Valeo Sa and Zf Friedrichshafen AG among others.

Report Description:

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

1.5. Key Target Audience

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces Analysis

4.2. Value Chain Analysis

4.3. Top Investment Pockets

4.3.1. Market Attractiveness Analysis By Product

4.3.2. Market Attractiveness Analysis By Hybridization

4.3.3. Market Attractiveness Analysis By Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.2.1. Increasing demand for green energy

5.2.2. Increasing consumer demand and investments from major players

5.3. Restraints

5.3.1. The problems associated with battery backup and power shortages of electric vehicles

5.4. Opportunities

5.4.1. Development of battery storage for intermittent grids provides

5.5. Challenges

5.5.1. The multiple risks associated with the electrification technologies

6. Global Industrial Electrification Market Analysis and Forecast, By Product

6.1. Segment Overview

6.2. Actuators

6.3. Electric Oil Pump

6.4. Electric Power Steering (EPS)

6.5. Electric Air Conditioner Compressor

6.6. Liquid Heater PTC

6.7. Electric Water Pump

6.8. Electric Vacuum Pump

6.9. Integrated Starter Generator (ISG)

6.10. Starter Motor & Alternator

6.11. Start/Stop System

7. Global Industrial Electrification Market Analysis and Forecast, By Hybridization

7.1. Segment Overview

7.2. Battery Electric Vehicle

7.3. Hybrid Electric Vehicle

7.4. Internal Combustion Engine

7.5. Micro-Hybrid Vehicle

7.6. Plug-In Hybrid Electric Vehicle

8. Global Industrial Electrification Market Analysis and Forecast, By Regional Analysis

8.1. Segment Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.2.3. Mexico

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.4. Asia-Pacific

8.4.1. Japan

8.4.2. China

8.4.3. India

8.5. South America

8.5.1. Brazil

8.6. Middle East and Africa

8.6.1. UAE

8.6.2. South Africa

9. Global Industrial Electrification Market-Competitive Landscape

9.1. Overview

9.2. Market Share of Key Players in Global Industrial Electrification Market

9.2.1. Global Company Market Share

9.2.2. North America Company Market Share

9.2.3. Europe Company Market Share

9.2.4. APAC Company Market Share

9.3. Competitive Situations and Trends

9.3.1. Product Launches and Developments

9.3.2. Partnerships, Collaborations, and Agreements

9.3.3. Mergers & Acquisitions

9.3.4. Expansions

10. Company Profiles

10.1. Aisin Seiki Co. Ltd.

10.1.1. Business Overview

10.1.2. Company Snapshot

10.1.3. Company Market Share Analysis

10.1.4. Company Product Portfolio

10.1.5. Recent Developments

10.1.6. SWOT Analysis

10.2. Continental Ag

10.2.1. Business Overview

10.2.2. Company Snapshot

10.2.3. Company Market Share Analysis

10.2.4. Company Product Portfolio

10.2.5. Recent Developments

10.2.6. SWOT Analysis

10.3. Borgwarner Inc.

10.3.1. Business Overview

10.3.2. Company Snapshot

10.3.3. Company Market Share Analysis

10.3.4. Company Product Portfolio

10.3.5. Recent Developments

10.3.6. SWOT Analysis

10.4. Wabco Holdings Inc.

10.4.1. Business Overview

10.4.2. Company Snapshot

10.4.3. Company Market Share Analysis

10.4.4. Company Product Portfolio

10.4.5. Recent Developments

10.4.6. SWOT Analysis

10.5. Delphi Automotive Plc

10.5.1. Business Overview

10.5.2. Company Snapshot

10.5.3. Company Market Share Analysis

10.5.4. Company Product Portfolio

10.5.5. Recent Developments

10.5.6. SWOT Analysis

10.6. Hitachi Automotive Systems Ltd.

10.6.1. Business Overview

10.6.2. Company Snapshot

10.6.3. Company Market Share Analysis

10.6.4. Company Product Portfolio

10.6.5. Recent Developments

10.6.6. SWOT Analysis

10.7. Denso Corporation

10.7.1. Business Overview

10.7.2. Company Snapshot

10.7.3. Company Market Share Analysis

10.7.4. Company Product Portfolio

10.7.5. Recent Developments

10.7.6. SWOT Analysis

10.8. Johnson Controls Inc.

10.8.1. Business Overview

10.8.2. Company Snapshot

10.8.3. Company Market Share Analysis

10.8.4. Company Product Portfolio

10.8.5. Recent Developments

10.8.6. SWOT Analysis

10.9. Jtekt Corporation

10.9.1. Business Overview

10.9.2. Company Snapshot

10.9.3. Company Market Share Analysis

10.9.4. Company Product Portfolio

10.9.5. Recent Developments

10.9.6. SWOT Analysis

10.10. Johnson Electric

10.10.1. Business Overview

10.10.2. Company Snapshot

10.10.3. Company Market Share Analysis

10.10.4. Company Product Portfolio

10.10.5. Recent Developments

10.10.6. SWOT Analysis

10.11. Magna International Inc.

10.11.1. Business Overview

10.11.2. Company Snapshot

10.11.3. Company Market Share Analysis

10.11.4. Company Product Portfolio

10.11.5. Recent Developments

10.11.6. SWOT Analysis

10.12. Robert Bosch Gmbh

10.12.1. Business Overview

10.12.2. Company Snapshot

10.12.3. Company Market Share Analysis

10.12.4. Company Product Portfolio

10.12.5. Recent Developments

10.12.6. SWOT Analysis

10.13. Mitsubishi Electric Corporation

10.13.1. Business Overview

10.13.2. Company Snapshot

10.13.3. Company Market Share Analysis

10.13.4. Company Product Portfolio

10.13.5. Recent Developments

10.13.6. SWOT Analysis

10.14. Valeo Sa

10.14.1. Business Overview

10.14.2. Company Snapshot

10.14.3. Company Market Share Analysis

10.14.4. Company Product Portfolio

10.14.5. Recent Developments

10.14.6. SWOT Analysis

10.15. Zf Friedrichshafen Ag

10.15.1. Business Overview

10.15.2. Company Snapshot

10.15.3. Company Market Share Analysis

10.15.4. Company Product Portfolio

10.15.5. Recent Developments

10.15.6. SWOT Analysis

List of Table

1. Global Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

2. Global Actuators, Industrial Electrification Market, By Region, 2019-2032 (USD Billion)

3. Global Electric Oil Pump, Industrial Electrification Market, By Region, 2019-2032 (USD Billion)

4. Global Electric Power Steering (EPS), Industrial Electrification Market, By Region, 2019-2032 (USD Billion)

5. Global Electric Air Conditioner Compressor, Industrial Electrification Market, By Region, 2019-2032 (USD Billion)

6. Global Liquid Heater PTC, Industrial Electrification Market, By Region, 2019-2032 (USD Billion)

7. Global Electric Water Pump, Industrial Electrification Market, By Region, 2019-2032 (USD Billion)

8. Global Electric Vacuum Pump, Industrial Electrification Market, By Region, 2019-2032 (USD Billion)

9. Global Integrated Starter Generator (ISG), Industrial Electrification Market, By Region, 2019-2032 (USD Billion)

10. Global Starter Motor & Alternator, Industrial Electrification Market, By Region, 2019-2032 (USD Billion)

11. Global Start/Stop System, Industrial Electrification Market, By Region, 2019-2032 (USD Billion)

12. Global Industrial Electrification Market, By Hybridization, 2019-2032 (USD Billion)

13. Global Battery Electric Vehicle, Industrial Electrification Market, By Region, 2019-2032 (USD Billion)

14. Global Hybrid Electric Vehicle, Industrial Electrification Market, By Region, 2019-2032 (USD Billion)

15. Global Internal Combustion Engine, Industrial Electrification Market, By Region, 2019-2032 (USD Billion)

16. Global Micro-Hybrid Vehicle, Industrial Electrification Market, By Region, 2019-2032 (USD Billion)

17. Global Plug-In Hybrid Electric Vehicle, Industrial Electrification Market, By Region, 2019-2032 (USD Billion)

18. Global Industrial Electrification Market, By Region, 2019-2032 (USD Billion)

19. North America Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

20. North America Industrial Electrification Market, By Hybridization, 2019-2032 (USD Billion)

21. U.S. Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

22. U.S. Industrial Electrification Market, By Hybridization, 2019-2032 (USD Billion)

23. Canada Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

24. Canada Industrial Electrification Market, By Hybridization, 2019-2032 (USD Billion)

25. Mexico Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

26. Mexico Industrial Electrification Market, By Hybridization, 2019-2032 (USD Billion)

27. Europe Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

28. Europe Industrial Electrification Market, By Hybridization, 2019-2032 (USD Billion)

29. Germany Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

30. Germany Industrial Electrification Market, By Hybridization, 2019-2032 (USD Billion)

31. France Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

32. France Industrial Electrification Market, By Hybridization 2019-2032 (USD Billion)

33. U.K. Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

34. U.K. Industrial Electrification Market, By Hybridization 2019-2032 (USD Billion)

35. Italy Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

36. Italy Industrial Electrification Market, By Hybridization 2019-2032 (USD Billion)

37. Spain Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

38. Spain Industrial Electrification Market, By Hybridization 2019-2032 (USD Billion)

39. Asia Pacific Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

40. Asia Pacific Industrial Electrification Market, By Hybridization 2019-2032 (USD Billion)

41. Japan Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

42. Japan Industrial Electrification Market, By Hybridization 2019-2032 (USD Billion)

43. China Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

44. China Industrial Electrification Market, By Hybridization 2019-2032 (USD Billion)

45. India Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

46. India Industrial Electrification Market, By Hybridization 2019-2032 (USD Billion)

47. South America Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

48. South America Industrial Electrification Market, By Hybridization 2019-2032 (USD Billion)

49. Brazil Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

50. Brazil Industrial Electrification Market, By Hybridization 2019-2032 (USD Billion)

51. Middle East and Africa Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

52. Middle East and Africa Industrial Electrification Market, By Hybridization 2019-2032 (USD Billion)

53. UAE Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

54. UAE Industrial Electrification Market, By Hybridization 2019-2032 (USD Billion)

55. South Africa Industrial Electrification Market, By Product, 2019-2032 (USD Billion)

56. South Africa Industrial Electrification Market, By Hybridization 2019-2032 (USD Billion)

List of Figures

1. Global Industrial Electrification Market Segmentation

2. Global Industrial Electrification Market: Research Methodology

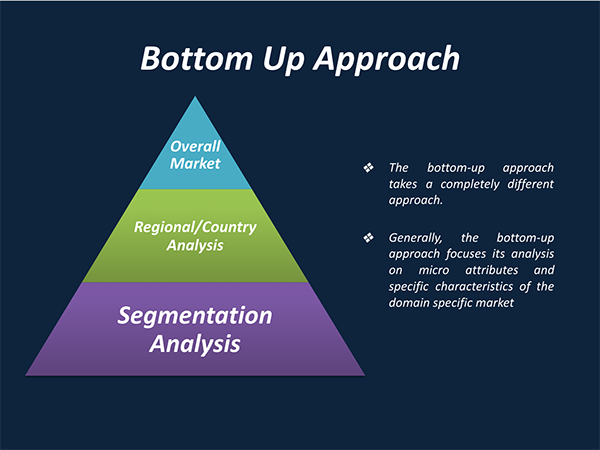

3. Market Size Estimation Methodology: Bottom-Up Approach

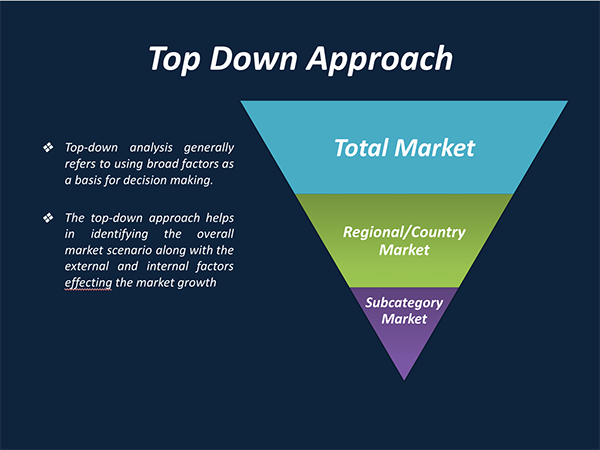

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Industrial Electrification Market Attractiveness Analysis By Product

9. Global Industrial Electrification Market Attractiveness Analysis By Hybridization

10. Global Industrial Electrification Market Attractiveness Analysis By Region

11. Global Industrial Electrification Market: Dynamics

12. Global Industrial Electrification Market Share By Product (2023 & 2032)

13. Global Industrial Electrification Market Share By Hybridization (2023 & 2032)

14. Global Industrial Electrification Market Share By Regions (2023 & 2032)

15. Global Industrial Electrification Market Share By Company (2022)

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

Our market research process involves with the four specific stages.

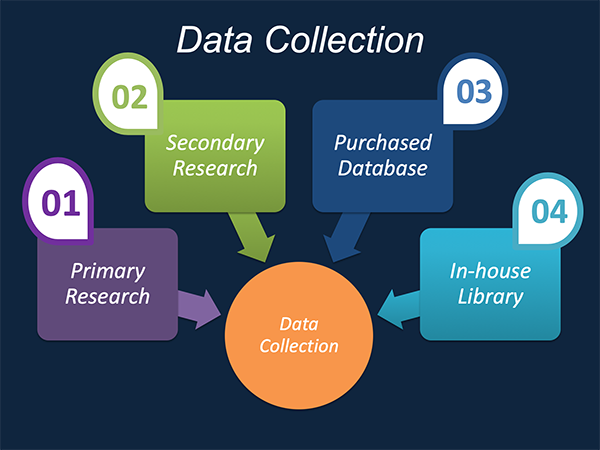

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.