The Global Ignition System for Natural Gas Engines Market is expected to grow from USD 13.34 Billion in 2019 to USD 23.77 Billion by 2027, at a CAGR of 7.49% during the forecast period 2020-2027.

An ignition system makes a spark or heats an electrode to a high temperature to ignite a fuel-air blend in spark ignition internal combustion engines, oil-fired and gas-fired boilers, rocket engines, etc. The extensive application for spark ignition internal combustion engines is in petrol (gasoline) road vehicles: cars and motorcycles.

Compression ignition Diesel engines ignite the fuel-air blend by the heat of compression and do not require a spark. They generally have glow plugs that preheat the combustion chamber to let starting in cold weather. Other engines may utilize a flame, or a heated tube, for ignition. Whereas this was common for very initial engines before it is now rare. Some of the protruding trends that the market is observing include growing demand from developing countries and rising ample number of vehicles.

Natural gas fuel, as an alternate energy source of transportation, has been used extensively since it has an advantage of low emission levels. Though, new technologies are essential in order to meet the reinforced emission regulations. For this reason, study into the growth of hydrogen-compressed natural gas (HCNG) blend engine was happening to evaluate its feasibility and emission characteristics.

The market has been segmented on the basic of ignition type, engine, ignition system, application, end user and region. The ignition type segment includes spark plug ignition, inductive ignition, and capacitive ignition. The spark plug ignition segment is dominating the market with largest market share of 51.31% and valued at USD 6.84 Billion in 2019. Engine segment includes CNG engines, LPG engines, and ethanol engines. The CNG engines segment is dominating the market with largest market share of 73.31% and valued at USD 9.78 Billion in 2019. Ignition system segment covers coil-on-plug ignition system, compression ignition system, and simultaneous ignition system. Coil-On-Plug Ignition System segment is dominating the market with largest market share of 59.11% and valued at USD 7.88 Billion in 2019.

The application segment includes engine unit and battery. Engine unit segment held the largest market share of 61.48% and valued at USD 8.20 Billion in 2019. End-user segment includes aircraft, automotive, generator, gas turbine, marine industries, and manufacturing & processing machinery. The automotive segment held the largest market share of 60.06% and valued at USD 8.55 Billion in 2019.

The market has been divided into North America, Europe, South America, MEA and APAC. APAC has the largest market share with China held the largest market share of 28.22% and valued at USD 3.76 million in 2019.

The major companies for global ignition system for natural gas engines market includes Robert Bosch GmbH, Delphi, BorgWarner Inc., Hitachi, NGK Spark Plug Co., Ltd, Mitsubishi Corporation, and among Others. Of these key players, Robert Bosch GmbH held the largest market share of 19.04% in 2019.

This study forecasts revenue growth at global, regional, and country levels from 2013 to 2027. Fior Markets has segmented the on the basis of below mentioned segments:

Chapter 1 Introduction

1.1 Research Methodology

1.2 FMR desk research

1.2.1 FMR data synthesis

1.2.2 Data validation and market feedback

1.2.3 FMR data sources

Chapter 2 Global Ignition System for Natural Gas Engines Market Overview

2.1 Definition and Specifications of Ignition System for Natural Gas Engines

2.2 Global Ignition System for Natural Gas Engines Segment by Ignition Types

2.2.1 Global Ignition System for Natural Gas Engines Output and Growth Rate Comparison by Ignition Type (2013-2027)

2.2.2 Global Ignition System for Natural Gas Engines Production Market Share by Ignition Type in 2017

2.2.3 Spark Plug Ignition System for Natural Gas Engines

2.2.4 Inductive Ignition System for Natural Gas Engines

2.2.5 Capacitive Ignition System for Natural Gas Engines

2.3 Global Ignition System for Natural Gas Engines Segment by Engine

2.3.1 Global Ignition System for Natural Gas Engines Output Comparison by Engine (2013-2027)

2.3.2 CNG Engines

2.3.3 LPG Engines

2.3.4 Ethanol Engines

2.3.5 Others

2.4 Global Ignition System for Natural Gas Engines Segment by Ignition System

2.4.1 Global Ignition System for Natural Gas Engines Output Comparison by Ignition System (2013-2027)

2.4.2 Coil-On-Plug Ignition System

2.4.3 Compression Ignition System

2.4.4 Simultaneous Ignition System

2.5 Global Ignition System for Natural Gas Engines Segment by Application

2.5.1 Global Ignition System for Natural Gas Engines Consumption Comparison by Application (2013-2027)

2.5.2 Engine Unit

2.5.3 Battery

2.6 Global Ignition System for Natural Gas Engines Segment by Type

2.6.1 Gasoline

2.6.2 Ignition

2.6.3 Direct Fire

2.7 Global Ignition System for Natural Gas Engines Segment by End User

2.7.1 Global Ignition System for Natural Gas Engines Consumption Comparison by End User (2013-2027)

2.7.2 Aircraft

2.7.3 Automotive

2.7.4 Generator

2.7.5 Gas turbine

2.7.6 Marine Industries

2.7.7 Manufacturing & Processing Machinery

2.8 Key development in Ignition Market

2.9 Market Analysis by Regions

2.9.1 Global Ignition System for Natural Gas Engines Market Size and Growth Rate Comparison by Regions (2013-2027)

2.9.2 North America Ignition System for Natural Gas Engines Status and Prospect (2013-2027)

2.9.3 China Ignition System for Natural Gas Engines Status and Prospect (2013-2027)

2.9.4 Europe Ignition System for Natural Gas Engines Status and Prospect (2013-2027)

2.9.5 Japan Ignition System for Natural Gas Engines Status and Prospect (2013-2027)

2.9.6 India Ignition System for Natural Gas Engines Status and Prospect (2013-2027)

2.9.7 Korea Ignition System for Natural Gas Engines Status and Prospect (2013-2027)

2.10 Global Ignition System for Natural Gas Engines Market Size (2013-2027)

2.10.1 Global Ignition System for Natural Gas Engines Revenue Status and Outlook (2013-2027)

2.10.2 Global Ignition System for Natural Gas Engines Capacity, Output and Outlook (2013-2027)

Chapter 3 Manufacturing Cost Structure Analysis of Ignition System for Natural Gas Engines

3.1 Raw Material and Suppliers

3.2 Manufacturing Cost Structure Analysis of Ignition System for Natural Gas Engines

3.2.1 Proportion of Manufacturing Cost Structure

3.2.2 Labor Cost

3.2.2.1 USA Labor Cost Analysis

3.3 Working Process Analysis of Ignition System for Natural Gas Engines

3.4 Industry Chain Structure of Ignition System for Natural Gas Engines

Chapter 4 Analysis of Major Ignition System for Natural Gas Engines Manufacturers

4.1 Robert Bosch GmbH

4.1.1 Company Profile

4.1.2 Ignition System for Natural Gas Engines Product Category, End Uses and Specification of Robert Bosch GmbH

4.1.3 Robert Bosch GmbH Ignition System for Natural Gas Engines Sales, Revenue, Price, Gross Margin and Market Share (2013-2019)

4.2 DENSO Corporation

4.2.1 Company Profile

4.2.2 Ignition System for Natural Gas Engines Product Category, End Uses and Specification of DENSO Corporation

4.3 Delphi

4.3.1 Company Profile

4.3.2 Ignition System for Natural Gas Engines Product Category, End Uses and Specification of Delphi

4.3.3 Delphi Ignition System for Natural Gas Engines Sales, Revenue, Price, Gross Margin and Market Share (2013-2019)

4.4 BorgWarner Inc.

4.4.1 Company Profile

4.4.2 Ignition System for Natural Gas Engines Product Category, End Uses and Specification of BorgWarner Inc.

4.4.3 BorgWarner Inc. Ignition System for Natural Gas Engines Sales, Revenue, Price, Gross Margin and Market Share (2013-2019)

4.5 Federal-Mogul

4.5.1 Company Profile

4.5.2 Ignition System for Natural Gas Engines Product Category, End Uses and Specification of Federal-Mogul

4.6 Hitachi

4.6.1 Company Profile

4.6.2 Ignition System for Natural Gas Engines Product Category, End Uses and Specification of Hitachi

4.6.3 Hitachi Ignition System for Natural Gas Engines Sales, Revenue, Price, Gross Margin and Market Share (2013-2019)

4.7 NGK Spark Plug Co., Ltd

4.7.1 Company Profile

4.7.2 Ignition System for Natural Gas Engines Product Category, End Uses and Specification of NGK Spark Plug Co., Ltd

4.7.3 NGK Spark Plug Co., Ltd Ignition System for Natural Gas Engines Sales, Revenue, Price, Gross Margin and Market Share (2013-2019)

4.8 Yura Tech. Co., Ltd

4.8.1 Company Profile

4.8.2 Ignition System for Natural Gas Engines Product Category, End Uses and Specification of Yura Tech. Co., Ltd

4.9 Mitsubishi Corporation

4.9.1 Company Profile

4.9.2 Ignition System for Natural Gas Engines Product Category, End Uses and Specification of Mitsubishi Corporation

4.9.3 Mitsubishi Corporation Ignition System for Natural Gas Engines Sales, Revenue, Price, Gross Margin and Market Share (2013-2019)

4.10 Sparktronic Co., Ltd

4.10.1 Company Profile

4.10.2 Ignition System for Natural Gas Engines Product Category, End Uses and Specification of Sparktronic Co., Ltd

4.11 Sogreat Electronics

4.11.1 Company Profile

4.11.2 Ignition System for Natural Gas Engines Product Category, End Uses and Specification of Sogreat Electronics

4.12 Zunyi Changzheng Auto Parts Co., Ltd.

4.12.1 Company Profile

4.12.2 Ignition System for Natural Gas Engines Product Category, End Uses and Specification of Zunyi Changzheng Auto Parts Co., Ltd.

Chapter 5 Global Ignition System for Natural Gas Engines Overall Market

5.1 Global 2013-2019E Overall Market Analysis

5.2 Revenue Analysis

5.2.1 2013-2019E Global Ignition System for Natural Gas Engines Revenue and Growth Rate Analysis

5.2.2 2017 Ignition System for Natural Gas Engines Revenue Analysis (Company Segment)

5.3 Output Analysis

5.3.1 2013-2019E Global Ignition System for Natural Gas Engines Output and Growth Rate Analysis

5.3.2 2017 Ignition System for Natural Gas Engines Output Analysis (Company Segment)

5.4 Price Analysis

5.4.1 2013-2019E Global Ignition System for Natural Gas Engines Price

Chapter 6 Ignition System for Natural Gas Engines Regional Market Analysis

6.1 North America Ignition System for Natural Gas Engines Market Analysis

6.1.1 North America Ignition System for Natural Gas Engines Market Overview

6.1.2 North America 2013-2019E Ignition System for Natural Gas Engines Local Supply, Import, Export, Local Consumption Analysis

6.1.3 North America 2013-2019E Ignition System for Natural Gas Engines Sales Price Analysis

6.1.4 North America 2017 Ignition System for Natural Gas Engines Market Share Analysis

6.2 China Ignition System for Natural Gas Engines Market Analysis

6.2.1 China Ignition System for Natural Gas Engines Market Overview

6.2.2 China 2013-2019E Ignition System for Natural Gas Engines Local Supply, Import, Export, Local Consumption Analysis

6.2.3 China 2013-2019E Ignition System for Natural Gas Engines Sales Price Analysis

6.2.4 China 2017 Ignition System for Natural Gas Engines Market Share Analysis

6.3 Europe Ignition System for Natural Gas Engines Market Analysis

6.3.1 Europe Ignition System for Natural Gas Engines Market Overview

6.3.2 Europe 2013-2019E Ignition System for Natural Gas Engines Local Supply, Import, Export, Local Consumption Analysis

6.3.3 Europe 2013-2019E Ignition System for Natural Gas Engines Sales Price Analysis

6.3.4 Europe 2017 Ignition System for Natural Gas Engines Market Share Analysis

6.4 Japan Ignition System for Natural Gas Engines Market Analysis

6.4.1 Japan Ignition System for Natural Gas Engines Market Overview

6.4.2 Japan 2013-2019E Ignition System for Natural Gas Engines Local Supply, Import, Export, Local Consumption Analysis

6.4.3 Japan 2013-2019E Ignition System for Natural Gas Engines Sales Price Analysis

6.4.4 Japan 2017 Ignition System for Natural Gas Engines Market Share Analysis

6.5 Korea Ignition System for Natural Gas Engines Market Analysis

6.5.1 Korea Ignition System for Natural Gas Engines Market Overview

6.5.2 Korea 2013-2019E Ignition System for Natural Gas Engines Local Supply, Import, Export, Local Consumption Analysis

6.5.3 Korea 2013-2019E Ignition System for Natural Gas Engines Sales Price Analysis

6.5.4 Korea 2017 Ignition System for Natural Gas Engines Market Share Analysis

6.6 India Ignition System for Natural Gas Engines Market Analysis

6.6.1 India Ignition System for Natural Gas Engines Market Overview

6.6.2 India 2013-2019E Ignition System for Natural Gas Engines Local Supply, Import, Export, Local Consumption Analysis

6.6.3 India 2013-2019E Ignition System for Natural Gas Engines Sales Price Analysis

6.6.4 India 2017 Ignition System for Natural Gas Engines Market Share Analysis

Chapter 7 Global Ignition System for Natural Gas Engines Segment Market Analysis 2013-2019E (by Ignition Type)

7.1 Global Ignition System for Natural Gas Engines Sales by Ignition Type (2013-2019)

7.2 Different Types Ignition System for Natural Gas Engines Product Driving Factors Analysis

Chapter 8 Global Ignition System for Natural Gas Engines Segment Market Analysis 2013-2019E (by Engine)

8.1 Global Ignition System for Natural Gas Engines Sales by Engine (2013-2019)

8.2 Different Types Ignition System for Natural Gas Engines Product Driving Factors Analysis

Chapter 9 Global Ignition System for Natural Gas Engines Segment Market Analysis 2013-2019E (by Ignition System)

9.1 Global Ignition System for Natural Gas Engines Sales by Ignition System (2013-2019)

9.2 Different Types Ignition System for Natural Gas Engines Product Driving Factors Analysis

Chapter 10 Global Ignition System for Natural Gas Engines Segment Market Analysis 2013-2019E (by Application)

10.1 Global Ignition System for Natural Gas Engines Sales by Application (2013-2019)

10.2 Different Application for Natural Gas Engines Product Driving Factors Analysis

Chapter 11 Global Ignition System for Natural Gas Engines Segment Market Analysis 2013-2019E (by End User)

11.1 Global Ignition System for Natural Gas Engines Sales by Ignition Type (2013-2019)

11.2 Different End User for Natural Gas Engines Product Driving Factors Analysis

Chapter 12 Global Ignition System for Natural Gas Engines Marketing Channel Analysis

12.1 Ignition System for Natural Gas Engines Regional Marketing Channel Analysis

12.1.1 Marketing Channel

12.1.2 Direct Marketing

12.1.3 Indirect Marketing

12.1.4 Market Positioning

12.1.5 Marketing Channel Future Trend

12.1.6 Pricing Strategy

12.1.7 Brand Strategy

12.2 Traders or Distributors with Contact Information of Ignition System for Natural Gas Engines by Regions

Chapter 13 Development Trend of Analysis of Ignition System for Natural Gas Engines Market

13.1 Global Ignition System for Natural Gas Engines Market Trend Analysis

13.1.1 Global 2020-2027 Ignition System for Natural Gas Engines Market Size (Volume and Value) Forecast

13.1.2 Global 2020-2027 Ignition System for Natural Gas Engines Sales Price Forecast

13.2 Ignition System for Natural Gas Engines Regional Market Trend

13.2.1 North America 2020-2027 Ignition System for Natural Gas Engines Consumption Forecast

13.2.2 China 2020-2027 Ignition System for Natural Gas Engines Consumption Forecast

13.2.3 Europe 2020-2027 Ignition System for Natural Gas Engines Consumption Forecast

13.2.4 Korea 2020-2027 Ignition System for Natural Gas Engines Consumption Forecast

13.2.5 Japan 2020-2027 Ignition System for Natural Gas Engines Consumption Forecast

13.2.6 India 2020-2027 Ignition System for Natural Gas Engines Consumption Forecast

13.3 Ignition System for Natural Gas Engines Market Trend by Ignition

13.4 Ignition System for Natural Gas Engines Market Trend by Engine

13.5 Ignition System for Natural Gas Engines Market Trend by Ignition System

13.6 Ignition System for Natural Gas Engines Market Trend by Application

13.7 Ignition System for Natural Gas Engines Market Trend by End User

Chapter 14 Research Findings and Conclusion

1

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

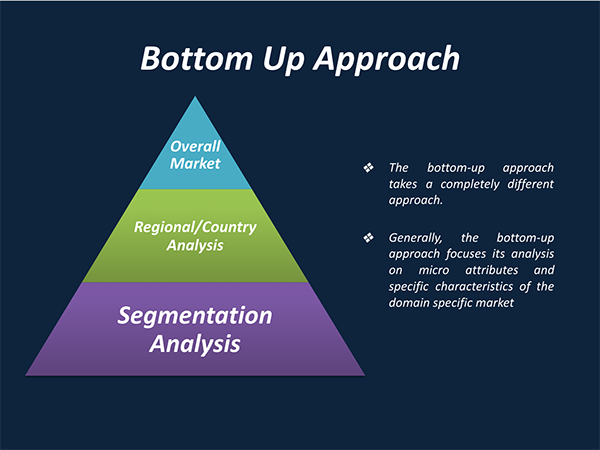

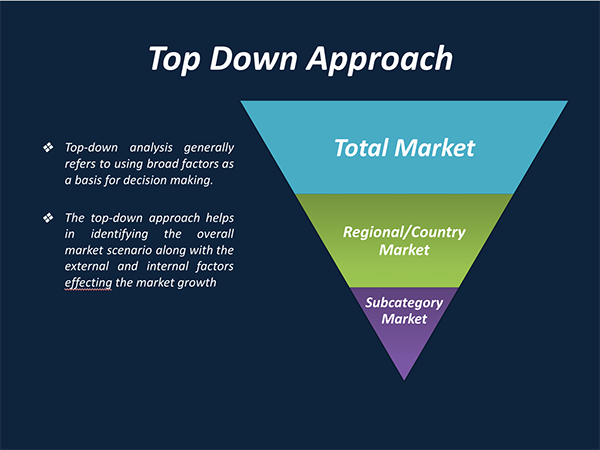

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

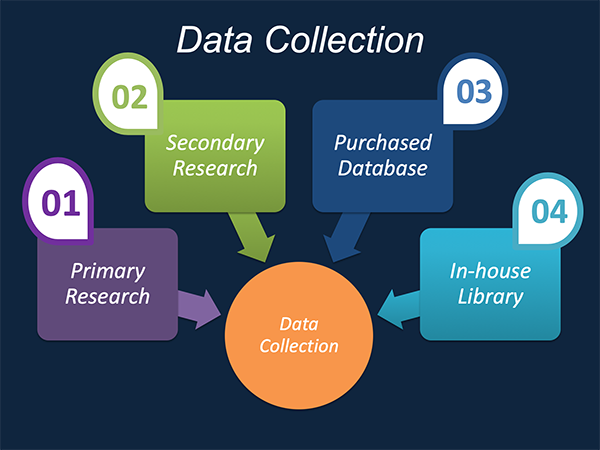

Our market research process involves with the four specific stages.

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.