Description

Scope of the Report:

The global Index-based Agricultural Insurance market is valued at xx million USD in 2018 and is expected to reach xx million USD by the end of 2024, growing at a CAGR of xx% between 2019 and 2024.

The Asia-Pacific will occupy for more market share in following years, especially in China, also fast growing India and Southeast Asia regions.

North America, especially The United States, will still play an important role which cannot be ignored. Any changes from United States might affect the development trend of Index-based Agricultural Insurance.

Europe also play important roles in global market, with market size of xx million USD in 2019 and will be xx million USD in 2024, with a CAGR of xx%.

This report studies the Index-based Agricultural Insurance market status and outlook of Global and major regions, from angles of players, countries, product types and end industries; this report analyzes the top players in global market, and splits the Index-based Agricultural Insurance market by product type and applications/end industries.

Market Segment by Companies, this report covers

PICC

XL Catlin

QBE

Zurich (RCIS)

Prudential

Chubb

Endurance Specialty

American Financial Group

China United Property Insurance

Everest Re Group

Farmers Mutual Hail

ICICI Lombard

CUNA Mutual

Archer Daniels Midland

CGB Diversified Services

Agriculture Insurance Company of India

New India Assurance

Tokio Marine

Market Segment by Regions, regional analysis covers

North America (United States, Canada and Mexico)

Europe (Germany, France, UK, Russia and Italy)

Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

South America (Brazil, Argentina, Colombia)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Market Segment by Type, covers

Weather Index

Yield Index

Others

Market Segment by Applications, can be divided into

Corn

Soybeans

Wheat

Cotton

Others

Table of Contents

1 Index-based Agricultural Insurance Market Overview

1.1 Product Overview and Scope of Index-based Agricultural Insurance

1.2 Classification of Index-based Agricultural Insurance by Types

1.2.1 Global Index-based Agricultural Insurance Revenue Comparison by Types (2019-2024)

1.2.2 Global Index-based Agricultural Insurance Revenue Market Share by Types in 2018

1.2.3 Weather Index

1.2.4 Yield Index

1.2.5 Others

1.3 Global Index-based Agricultural Insurance Market by Application

1.3.1 Global Index-based Agricultural Insurance Market Size and Market Share Comparison by Applications (2014-2024)

1.3.2 Corn

1.3.3 Soybeans

1.3.4 Wheat

1.3.5 Cotton

1.3.6 Others

1.4 Global Index-based Agricultural Insurance Market by Regions

1.4.1 Global Index-based Agricultural Insurance Market Size (Million USD) Comparison by Regions (2014-2024)

1.4.1 North America (USA, Canada and Mexico) Index-based Agricultural Insurance Status and Prospect (2014-2024)

1.4.2 Europe (Germany, France, UK, Russia and Italy) Index-based Agricultural Insurance Status and Prospect (2014-2024)

1.4.3 Asia-Pacific (China, Japan, Korea, India and Southeast Asia) Index-based Agricultural Insurance Status and Prospect (2014-2024)

1.4.4 South America (Brazil, Argentina, Colombia) Index-based Agricultural Insurance Status and Prospect (2014-2024)

1.4.5 Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa) Index-based Agricultural Insurance Status and Prospect (2014-2024)

1.5 Global Market Size of Index-based Agricultural Insurance (2014-2024)

2 Company Profiles

2.1 PICC

2.1.1 Business Overview

2.1.2 Index-based Agricultural Insurance Type and Applications

2.1.2.1 Product A

2.1.2.2 Product B

2.1.3 PICC Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

2.2 XL Catlin

2.2.1 Business Overview

2.2.2 Index-based Agricultural Insurance Type and Applications

2.2.2.1 Product A

2.2.2.2 Product B

2.2.3 XL Catlin Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

2.3 QBE

2.3.1 Business Overview

2.3.2 Index-based Agricultural Insurance Type and Applications

2.3.2.1 Product A

2.3.2.2 Product B

2.3.3 QBE Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

2.4 Zurich (RCIS)

2.4.1 Business Overview

2.4.2 Index-based Agricultural Insurance Type and Applications

2.4.2.1 Product A

2.4.2.2 Product B

2.4.3 Zurich (RCIS) Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

2.5 Prudential

2.5.1 Business Overview

2.5.2 Index-based Agricultural Insurance Type and Applications

2.5.2.1 Product A

2.5.2.2 Product B

2.5.3 Prudential Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

2.6 Chubb

2.6.1 Business Overview

2.6.2 Index-based Agricultural Insurance Type and Applications

2.6.2.1 Product A

2.6.2.2 Product B

2.6.3 Chubb Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

2.7 Endurance Specialty

2.7.1 Business Overview

2.7.2 Index-based Agricultural Insurance Type and Applications

2.7.2.1 Product A

2.7.2.2 Product B

2.7.3 Endurance Specialty Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

2.8 American Financial Group

2.8.1 Business Overview

2.8.2 Index-based Agricultural Insurance Type and Applications

2.8.2.1 Product A

2.8.2.2 Product B

2.8.3 American Financial Group Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

2.9 China United Property Insurance

2.9.1 Business Overview

2.9.2 Index-based Agricultural Insurance Type and Applications

2.9.2.1 Product A

2.9.2.2 Product B

2.9.3 China United Property Insurance Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

2.10 Everest Re Group

2.10.1 Business Overview

2.10.2 Index-based Agricultural Insurance Type and Applications

2.10.2.1 Product A

2.10.2.2 Product B

2.10.3 Everest Re Group Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

2.11 Farmers Mutual Hail

2.11.1 Business Overview

2.11.2 Index-based Agricultural Insurance Type and Applications

2.11.2.1 Product A

2.11.2.2 Product B

2.11.3 Farmers Mutual Hail Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

2.12 ICICI Lombard

2.12.1 Business Overview

2.12.2 Index-based Agricultural Insurance Type and Applications

2.12.2.1 Product A

2.12.2.2 Product B

2.12.3 ICICI Lombard Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

2.13 CUNA Mutual

2.13.1 Business Overview

2.13.2 Index-based Agricultural Insurance Type and Applications

2.13.2.1 Product A

2.13.2.2 Product B

2.13.3 CUNA Mutual Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

2.14 Archer Daniels Midland

2.14.1 Business Overview

2.14.2 Index-based Agricultural Insurance Type and Applications

2.14.2.1 Product A

2.14.2.2 Product B

2.14.3 Archer Daniels Midland Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

2.15 CGB Diversified Services

2.15.1 Business Overview

2.15.2 Index-based Agricultural Insurance Type and Applications

2.15.2.1 Product A

2.15.2.2 Product B

2.15.3 CGB Diversified Services Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

2.16 Agriculture Insurance Company of India

2.16.1 Business Overview

2.16.2 Index-based Agricultural Insurance Type and Applications

2.16.2.1 Product A

2.16.2.2 Product B

2.16.3 Agriculture Insurance Company of India Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

2.17 New India Assurance

2.17.1 Business Overview

2.17.2 Index-based Agricultural Insurance Type and Applications

2.17.2.1 Product A

2.17.2.2 Product B

2.17.3 New India Assurance Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

2.18 Tokio Marine

2.18.1 Business Overview

2.18.2 Index-based Agricultural Insurance Type and Applications

2.18.2.1 Product A

2.18.2.2 Product B

2.18.3 Tokio Marine Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

3 Global Index-based Agricultural Insurance Market Competition, by Players

3.1 Global Index-based Agricultural Insurance Revenue and Share by Players (2014-2019)

3.2 Market Concentration Rate

3.2.1 Top 5 Index-based Agricultural Insurance Players Market Share

3.2.2 Top 10 Index-based Agricultural Insurance Players Market Share

3.3 Market Competition Trend

4 Global Index-based Agricultural Insurance Market Size by Regions

4.1 Global Index-based Agricultural Insurance Revenue and Market Share by Regions

4.2 North America Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

4.3 Europe Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

4.4 Asia-Pacific Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

4.5 South America Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

4.6 Middle East and Africa Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

5 North America Index-based Agricultural Insurance Revenue by Countries

5.1 North America Index-based Agricultural Insurance Revenue by Countries (2014-2019)

5.2 USA Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

5.3 Canada Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

5.4 Mexico Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

6 Europe Index-based Agricultural Insurance Revenue by Countries

6.1 Europe Index-based Agricultural Insurance Revenue by Countries (2014-2019)

6.2 Germany Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

6.3 UK Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

6.4 France Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

6.5 Russia Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

6.6 Italy Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

7 Asia-Pacific Index-based Agricultural Insurance Revenue by Countries

7.1 Asia-Pacific Index-based Agricultural Insurance Revenue by Countries (2014-2019)

7.2 China Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

7.3 Japan Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

7.4 Korea Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

7.5 India Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

7.6 Southeast Asia Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

8 South America Index-based Agricultural Insurance Revenue by Countries

8.1 South America Index-based Agricultural Insurance Revenue by Countries (2014-2019)

8.2 Brazil Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

8.3 Argentina Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

8.4 Colombia Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

9 Middle East and Africa Revenue Index-based Agricultural Insurance by Countries

9.1 Middle East and Africa Index-based Agricultural Insurance Revenue by Countries (2014-2019)

9.2 Saudi Arabia Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

9.3 UAE Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

9.4 Egypt Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

9.5 Nigeria Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

9.6 South Africa Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

10 Global Index-based Agricultural Insurance Market Segment by Type

10.1 Global Index-based Agricultural Insurance Revenue and Market Share by Type (2014-2019)

10.2 Global Index-based Agricultural Insurance Market Forecast by Type (2019-2024)

10.3 Weather Index Revenue Growth Rate (2014-2024)

10.4 Yield Index Revenue Growth Rate (2014-2024)

10.5 Others Revenue Growth Rate (2014-2024)

11 Global Index-based Agricultural Insurance Market Segment by Application

11.1 Global Index-based Agricultural Insurance Revenue Market Share by Application (2014-2019)

11.2 Index-based Agricultural Insurance Market Forecast by Application (2019-2024)

11.3 Corn Revenue Growth (2014-2019)

11.4 Soybeans Revenue Growth (2014-2019)

11.5 Wheat Revenue Growth (2014-2019)

11.6 Cotton Revenue Growth (2014-2019)

11.7 Others Revenue Growth (2014-2019)

12 Global Index-based Agricultural Insurance Market Size Forecast (2019-2024)

12.1 Global Index-based Agricultural Insurance Market Size Forecast (2019-2024)

12.2 Global Index-based Agricultural Insurance Market Forecast by Regions (2019-2024)

12.3 North America Index-based Agricultural Insurance Revenue Market Forecast (2019-2024)

12.4 Europe Index-based Agricultural Insurance Revenue Market Forecast (2019-2024)

12.5 Asia-Pacific Index-based Agricultural Insurance Revenue Market Forecast (2019-2024)

12.6 South America Index-based Agricultural Insurance Revenue Market Forecast (2019-2024)

12.7 Middle East and Africa Index-based Agricultural Insurance Revenue Market Forecast (2019-2024)

13 Research Findings and Conclusion

14 Appendix

14.1 Methodology

14.2 Data Source

List of Tables and Figures

Figure Index-based Agricultural Insurance Picture

Table Product Specifications of Index-based Agricultural Insurance

Table Global Index-based Agricultural Insurance and Revenue (Million USD) Market Split by Product Type

Figure Global Index-based Agricultural Insurance Revenue Market Share by Types in 2018

Figure Weather Index Picture

Figure Yield Index Picture

Figure Others Picture

Table Global Index-based Agricultural Insurance Revenue (Million USD) by Application (2014-2024)

Figure Index-based Agricultural Insurance Revenue Market Share by Applications in 2018

Figure Corn Picture

Figure Soybeans Picture

Figure Wheat Picture

Figure Cotton Picture

Figure Others Picture

Table Global Market Index-based Agricultural Insurance Revenue (Million USD) Comparison by Regions 2014-2024

Figure North America Index-based Agricultural Insurance Revenue (Million USD) and Growth Rate (2014-2024)

Figure Europe Index-based Agricultural Insurance Revenue (Million USD) and Growth Rate (2014-2024)

Figure Asia-Pacific Index-based Agricultural Insurance Revenue (Million USD) and Growth Rate (2014-2024)

Figure South America Index-based Agricultural Insurance Revenue (Million USD) and Growth Rate (2014-2024)

Figure Middle East and Africa Index-based Agricultural Insurance Revenue (Million USD) and Growth Rate (2014-2024)

Figure Global Index-based Agricultural Insurance Revenue (Million USD) and Growth Rate (2014-2024)

Table PICC Basic Information, Manufacturing Base and Competitors

Table PICC Index-based Agricultural Insurance Type and Applications

Table PICC Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table XL Catlin Basic Information, Manufacturing Base and Competitors

Table XL Catlin Index-based Agricultural Insurance Type and Applications

Table XL Catlin Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table QBE Basic Information, Manufacturing Base and Competitors

Table QBE Index-based Agricultural Insurance Type and Applications

Table QBE Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table Zurich (RCIS) Basic Information, Manufacturing Base and Competitors

Table Zurich (RCIS) Index-based Agricultural Insurance Type and Applications

Table Zurich (RCIS) Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table Prudential Basic Information, Manufacturing Base and Competitors

Table Prudential Index-based Agricultural Insurance Type and Applications

Table Prudential Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table Chubb Basic Information, Manufacturing Base and Competitors

Table Chubb Index-based Agricultural Insurance Type and Applications

Table Chubb Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table Endurance Specialty Basic Information, Manufacturing Base and Competitors

Table Endurance Specialty Index-based Agricultural Insurance Type and Applications

Table Endurance Specialty Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table American Financial Group Basic Information, Manufacturing Base and Competitors

Table American Financial Group Index-based Agricultural Insurance Type and Applications

Table American Financial Group Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table China United Property Insurance Basic Information, Manufacturing Base and Competitors

Table China United Property Insurance Index-based Agricultural Insurance Type and Applications

Table China United Property Insurance Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table Everest Re Group Basic Information, Manufacturing Base and Competitors

Table Everest Re Group Index-based Agricultural Insurance Type and Applications

Table Everest Re Group Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table Farmers Mutual Hail Basic Information, Manufacturing Base and Competitors

Table Farmers Mutual Hail Index-based Agricultural Insurance Type and Applications

Table Farmers Mutual Hail Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table ICICI Lombard Basic Information, Manufacturing Base and Competitors

Table ICICI Lombard Index-based Agricultural Insurance Type and Applications

Table ICICI Lombard Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table CUNA Mutual Basic Information, Manufacturing Base and Competitors

Table CUNA Mutual Index-based Agricultural Insurance Type and Applications

Table CUNA Mutual Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table Archer Daniels Midland Basic Information, Manufacturing Base and Competitors

Table Archer Daniels Midland Index-based Agricultural Insurance Type and Applications

Table Archer Daniels Midland Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table CGB Diversified Services Basic Information, Manufacturing Base and Competitors

Table CGB Diversified Services Index-based Agricultural Insurance Type and Applications

Table CGB Diversified Services Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table Agriculture Insurance Company of India Basic Information, Manufacturing Base and Competitors

Table Agriculture Insurance Company of India Index-based Agricultural Insurance Type and Applications

Table Agriculture Insurance Company of India Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table New India Assurance Basic Information, Manufacturing Base and Competitors

Table New India Assurance Index-based Agricultural Insurance Type and Applications

Table New India Assurance Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table Tokio Marine Basic Information, Manufacturing Base and Competitors

Table Tokio Marine Index-based Agricultural Insurance Type and Applications

Table Tokio Marine Index-based Agricultural Insurance Revenue, Gross Margin and Market Share (2017-2018)

Table Global Index-based Agricultural Insurance Revenue (Million USD) by Players (2014-2019)

Table Global Index-based Agricultural Insurance Revenue Share by Players (2014-2019)

Figure Global Index-based Agricultural Insurance Revenue Share by Players in 2017

Figure Global Index-based Agricultural Insurance Revenue Share by Players in 2018

Figure Global Top 5 Players Index-based Agricultural Insurance Revenue Market Share in 2018

Figure Global Top 10 Players Index-based Agricultural Insurance Revenue Market Share in 2018

Figure Global Index-based Agricultural Insurance Revenue (Million USD) and Growth Rate (%) (2014-2019)

Table Global Index-based Agricultural Insurance Revenue (Million USD) by Regions (2014-2019)

Table Global Index-based Agricultural Insurance Revenue Market Share by Regions (2014-2019)

Figure Global Index-based Agricultural Insurance Revenue Market Share by Regions (2014-2019)

Figure Global Index-based Agricultural Insurance Revenue Market Share by Regions in 2018

Figure North America Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure Europe Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure Asia-Pacific Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure South America Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure Middle East and Africa Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Table North America Index-based Agricultural Insurance Revenue by Countries (2014-2019)

Table North America Index-based Agricultural Insurance Revenue Market Share by Countries (2014-2019)

Figure North America Index-based Agricultural Insurance Revenue Market Share by Countries (2014-2019)

Figure North America Index-based Agricultural Insurance Revenue Market Share by Countries in 2018

Figure USA Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure Canada Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure Mexico Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Table Europe Index-based Agricultural Insurance Revenue (Million USD) by Countries (2014-2019)

Figure Europe Index-based Agricultural Insurance Revenue Market Share by Countries (2014-2019)

Figure Europe Index-based Agricultural Insurance Revenue Market Share by Countries in 2018

Figure Germany Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure UK Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure France Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure Russia Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure Italy Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Table Asia-Pacific Index-based Agricultural Insurance Revenue (Million USD) by Countries (2014-2019)

Figure Asia-Pacific Index-based Agricultural Insurance Revenue Market Share by Countries (2014-2019)

Figure Asia-Pacific Index-based Agricultural Insurance Revenue Market Share by Countries in 2018

Figure China Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure Japan Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure Korea Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure India Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure Southeast Asia Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Table South America Index-based Agricultural Insurance Revenue by Countries (2014-2019)

Table South America Index-based Agricultural Insurance Revenue Market Share by Countries (2014-2019)

Figure South America Index-based Agricultural Insurance Revenue Market Share by Countries (2014-2019)

Figure South America Index-based Agricultural Insurance Revenue Market Share by Countries in 2018

Figure Brazil Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure Argentina Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure Colombia Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Table Middle East and Africa Index-based Agricultural Insurance Revenue (Million USD) by Countries (2014-2019)

Table Middle East and Africa Index-based Agricultural Insurance Revenue Market Share by Countries (2014-2019)

Figure Middle East and Africa Index-based Agricultural Insurance Revenue Market Share by Countries (2014-2019)

Figure Middle East and Africa Index-based Agricultural Insurance Revenue Market Share by Countries in 2018

Figure Saudi Arabia Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure UAE Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure Egypt Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure Nigeria Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Figure South Africa Index-based Agricultural Insurance Revenue and Growth Rate (2014-2019)

Table Global Index-based Agricultural Insurance Revenue (Million USD) by Type (2014-2019)

Table Global Index-based Agricultural Insurance Revenue Share by Type (2014-2019)

Figure Global Index-based Agricultural Insurance Revenue Share by Type (2014-2019)

Figure Global Index-based Agricultural Insurance Revenue Share by Type in 2018

Table Global Index-based Agricultural Insurance Revenue Forecast by Type (2019-2024)

Figure Global Index-based Agricultural Insurance Market Share Forecast by Type (2019-2024)

Figure Global Weather Index Revenue Growth Rate (2014-2019)

Figure Global Yield Index Revenue Growth Rate (2014-2019)

Figure Global Others Revenue Growth Rate (2014-2019)

Table Global Index-based Agricultural Insurance Revenue by Application (2014-2019)

Table Global Index-based Agricultural Insurance Revenue Share by Application (2014-2019)

Figure Global Index-based Agricultural Insurance Revenue Share by Application (2014-2019)

Figure Global Index-based Agricultural Insurance Revenue Share by Application in 2018

Table Global Index-based Agricultural Insurance Revenue Forecast by Application (2019-2024)

Figure Global Index-based Agricultural Insurance Market Share Forecast by Application (2019-2024)

Figure Global Corn Revenue Growth Rate (2014-2019)

Figure Global Soybeans Revenue Growth Rate (2014-2019)

Figure Global Wheat Revenue Growth Rate (2014-2019)

Figure Global Cotton Revenue Growth Rate (2014-2019)

Figure Global Others Revenue Growth Rate (2014-2019)

Figure Global Index-based Agricultural Insurance Revenue (Million USD) and Growth Rate Forecast (2019-2024)

Table Global Index-based Agricultural Insurance Revenue (Million USD) Forecast by Regions (2019-2024)

Figure Global Index-based Agricultural Insurance Revenue Market Share Forecast by Regions (2019-2024)

Figure North America Index-based Agricultural Insurance Revenue Market Forecast (2019-2024)

Figure Europe Index-based Agricultural Insurance Revenue Market Forecast (2019-2024)

Figure Asia-Pacific Index-based Agricultural Insurance Revenue Market Forecast (2019-2024)

Figure South America Index-based Agricultural Insurance Revenue Market Forecast (2019-2024)

Figure Middle East and Africa Index-based Agricultural Insurance Revenue Market Forecast (2019-2024)

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

Our market research process involves with the four specific stages.

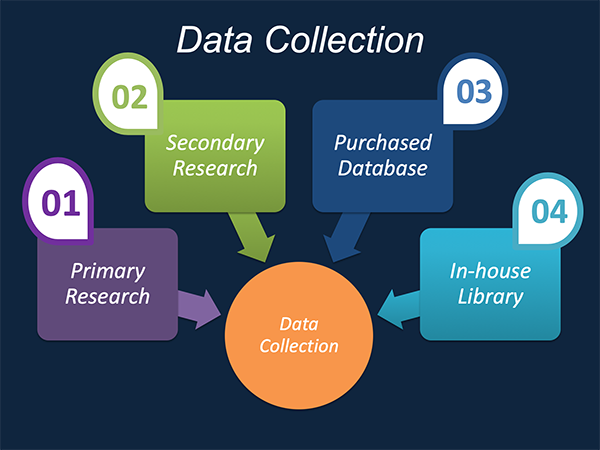

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

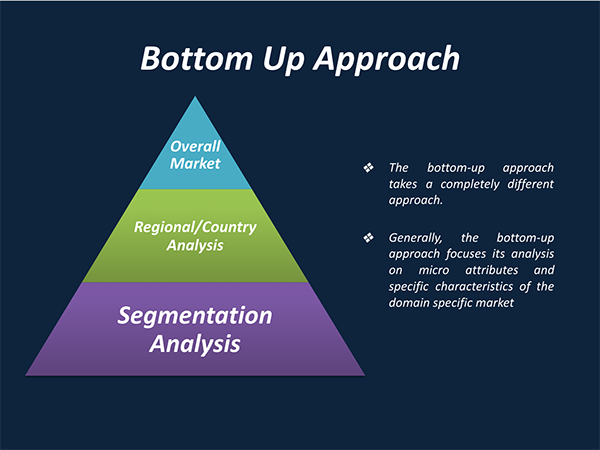

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

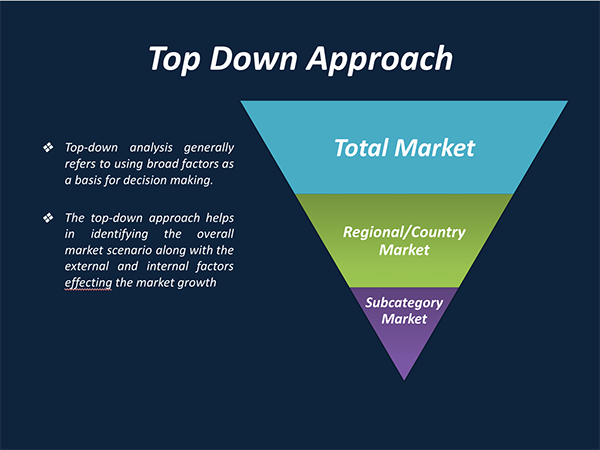

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.