Market Overview

The global Deepwater Hydrocarbons Exploration market size is expected to gain market growth in the forecast period of 2020 to 2025, with a CAGR of xx% in the forecast period of 2020 to 2025 and will expected to reach USD xx million by 2025, from USD xx million in 2019.

The Deepwater Hydrocarbons Exploration market report provides a detailed analysis of global market size, regional and country-level market size, segmentation market growth, market share, competitive Landscape, sales analysis, impact of domestic and global market players, value chain optimization, trade regulations, recent developments, opportunities analysis, strategic market growth analysis, product launches, area marketplace expanding, and technological innovations.

Market segmentation

Deepwater Hydrocarbons Exploration market is split by Type and by Application. For the period 2015-2025, the growth among segments provide accurate calculations and forecasts for sales by Type and by Application in terms of volume and value. This analysis can help you expand your business by targeting qualified niche markets.

By Type, Deepwater Hydrocarbons Exploration market has been segmented into:

Subsea Systems

Fixed Platform Rig

Jack-Up Rig

Spar Platforms

Compliant Tower Rigs

By Application, Deepwater Hydrocarbons Exploration has been segmented into:

Deep Water

Ultra Deep Water

Regions and Countries Level Analysis

Regional analysis is another highly comprehensive part of the research and analysis study of the global Deepwater Hydrocarbons Exploration market presented in the report. This section sheds light on the sales growth of different regional and country-level Deepwater Hydrocarbons Exploration markets. For the historical and forecast period 2015 to 2025, it provides detailed and accurate country-wise volume analysis and region-wise market size analysis of the global Deepwater Hydrocarbons Exploration market.

The report offers in-depth assessment of the growth and other aspects of the Deepwater Hydrocarbons Exploration market in important countries (regions), including:

North America (United States, Canada and Mexico)

Europe (Germany, France, UK, Russia and Italy)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia and Australia)

South America (Brazil, Argentina, Colombia)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Competitive Landscape and Deepwater Hydrocarbons Exploration Market Share Analysis

Deepwater Hydrocarbons Exploration competitive landscape provides details by vendors, including company overview, company total revenue (financials), market potential, global presence, Deepwater Hydrocarbons Exploration sales and revenue generated, market share, price, production sites and facilities, SWOT analysis, product launch. For the period 2015-2020, this study provides the Deepwater Hydrocarbons Exploration sales, revenue and market share for each player covered in this report.

The major players covered in Deepwater Hydrocarbons Exploration are:

Halliburton

Brazilian Petroleum Corporation

Geoservices

Diamond Offshore

PetroBras

TransOcean

Oceaneering International

Schlumberger

Trico Marine Services

Table of Contents

1 Deepwater Hydrocarbons Exploration Market Overview

1.1 Product Overview and Scope of Deepwater Hydrocarbons Exploration

1.2 Classification of Deepwater Hydrocarbons Exploration by Type

1.2.1 Global Deepwater Hydrocarbons Exploration Revenue by Type: 2015 VS 2019 VS 2025

1.2.2 Global Deepwater Hydrocarbons Exploration Revenue Market Share by Type in 2019

1.2.3 Subsea Systems

1.2.4 Fixed Platform Rig

1.2.5 Jack-Up Rig

1.2.6 Spar Platforms

1.2.7 Compliant Tower Rigs

1.3 Global Deepwater Hydrocarbons Exploration Market by Application

1.3.1 Overview: Global Deepwater Hydrocarbons Exploration Revenue by Application: 2015 VS 2019 VS 2025

1.3.2 Deep Water

1.3.3 Ultra Deep Water

1.4 Global Deepwater Hydrocarbons Exploration Market by Regions

1.4.1 Global Deepwater Hydrocarbons Exploration Market Size by Regions: 2015 VS 2019 VS 2025

1.4.2 Global Market Size of Deepwater Hydrocarbons Exploration (2015-2025)

1.4.3 North America (USA, Canada and Mexico) Deepwater Hydrocarbons Exploration Status and Prospect (2015-2025)

1.4.4 Europe (Germany, France, UK, Russia and Italy) Deepwater Hydrocarbons Exploration Status and Prospect (2015-2025)

1.4.5 Asia-Pacific (China, Japan, Korea, India and Southeast Asia) Deepwater Hydrocarbons Exploration Status and Prospect (2015-2025)

1.4.6 South America (Brazil, Argentina, Colombia) Deepwater Hydrocarbons Exploration Status and Prospect (2015-2025)

1.4.7 Middle East & Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa) Deepwater Hydrocarbons Exploration Status and Prospect (2015-2025)

2 Company Profiles

2.1 Halliburton

2.1.1 Halliburton Details

2.1.2 Halliburton Major Business and Total Revenue (Financial Highlights) Analysis

2.1.3 Halliburton SWOT Analysis

2.1.4 Halliburton Product and Services

2.1.5 Halliburton Deepwater Hydrocarbons Exploration Revenue, Gross Margin and Market Share (2018-2019)

2.2 Brazilian Petroleum Corporation

2.2.1 Brazilian Petroleum Corporation Details

2.2.2 Brazilian Petroleum Corporation Major Business and Total Revenue (Financial Highlights) Analysis

2.2.3 Brazilian Petroleum Corporation SWOT Analysis

2.2.4 Brazilian Petroleum Corporation Product and Services

2.2.5 Brazilian Petroleum Corporation Deepwater Hydrocarbons Exploration Revenue, Gross Margin and Market Share (2018-2019)

2.3 Geoservices

2.3.1 Geoservices Details

2.3.2 Geoservices Major Business and Total Revenue (Financial Highlights) Analysis

2.3.3 Geoservices SWOT Analysis

2.3.4 Geoservices Product and Services

2.3.5 Geoservices Deepwater Hydrocarbons Exploration Revenue, Gross Margin and Market Share (2018-2019)

2.4 Diamond Offshore

2.4.1 Diamond Offshore Details

2.4.2 Diamond Offshore Major Business and Total Revenue (Financial Highlights) Analysis

2.4.3 Diamond Offshore SWOT Analysis

2.4.4 Diamond Offshore Product and Services

2.4.5 Diamond Offshore Deepwater Hydrocarbons Exploration Revenue, Gross Margin and Market Share (2018-2019)

2.5 PetroBras

2.5.1 PetroBras Details

2.5.2 PetroBras Major Business and Total Revenue (Financial Highlights) Analysis

2.5.3 PetroBras SWOT Analysis

2.5.4 PetroBras Product and Services

2.5.5 PetroBras Deepwater Hydrocarbons Exploration Revenue, Gross Margin and Market Share (2018-2019)

2.6 TransOcean

2.6.1 TransOcean Details

2.6.2 TransOcean Major Business and Total Revenue (Financial Highlights) Analysis

2.6.3 TransOcean SWOT Analysis

2.6.4 TransOcean Product and Services

2.6.5 TransOcean Deepwater Hydrocarbons Exploration Revenue, Gross Margin and Market Share (2018-2019)

2.7 Oceaneering International

2.7.1 Oceaneering International Details

2.7.2 Oceaneering International Major Business and Total Revenue (Financial Highlights) Analysis

2.7.3 Oceaneering International SWOT Analysis

2.7.4 Oceaneering International Product and Services

2.7.5 Oceaneering International Deepwater Hydrocarbons Exploration Revenue, Gross Margin and Market Share (2018-2019)

2.8 Schlumberger

2.8.1 Schlumberger Details

2.8.2 Schlumberger Major Business and Total Revenue (Financial Highlights) Analysis

2.8.3 Schlumberger SWOT Analysis

2.8.4 Schlumberger Product and Services

2.8.5 Schlumberger Deepwater Hydrocarbons Exploration Revenue, Gross Margin and Market Share (2018-2019)

2.9 Trico Marine Services

2.9.1 Trico Marine Services Details

2.9.2 Trico Marine Services Major Business and Total Revenue (Financial Highlights) Analysis

2.9.3 Trico Marine Services SWOT Analysis

2.9.4 Trico Marine Services Product and Services

2.9.5 Trico Marine Services Deepwater Hydrocarbons Exploration Revenue, Gross Margin and Market Share (2018-2019)

3 Market Competition, by Players

3.1 Global Deepwater Hydrocarbons Exploration Revenue and Share by Players (2015-2020)

3.2 Market Concentration Rate

3.2.1 Top 5 Deepwater Hydrocarbons Exploration Players Market Share

3.2.2 Top 10 Deepwater Hydrocarbons Exploration Players Market Share

3.3 Market Competition Trend

4 Market Size by Regions

4.1 Global Deepwater Hydrocarbons Exploration Revenue and Market Share by Regions

4.2 North America Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

4.3 Europe Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

4.4 Asia-Pacific Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

4.5 South America Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

4.6 Middle East & Africa Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

5 North America Deepwater Hydrocarbons Exploration Revenue by Countries

5.1 North America Deepwater Hydrocarbons Exploration Revenue by Countries (2015-2020)

5.2 USA Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

5.3 Canada Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

5.4 Mexico Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

6 Europe Deepwater Hydrocarbons Exploration Revenue by Countries

6.1 Europe Deepwater Hydrocarbons Exploration Revenue by Countries (2015-2020)

6.2 Germany Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

6.3 UK Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

6.4 France Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

6.5 Russia Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

6.6 Italy Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

7 Asia-Pacific Deepwater Hydrocarbons Exploration Revenue by Countries

7.1 Asia-Pacific Deepwater Hydrocarbons Exploration Revenue by Countries (2015-2020)

7.2 China Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

7.3 Japan Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

7.4 Korea Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

7.5 India Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

7.6 Southeast Asia Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

8 South America Deepwater Hydrocarbons Exploration Revenue by Countries

8.1 South America Deepwater Hydrocarbons Exploration Revenue by Countries (2015-2020)

8.2 Brazil Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

8.3 Argentina Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

9 Middle East & Africa Revenue Deepwater Hydrocarbons Exploration by Countries

9.1 Middle East & Africa Deepwater Hydrocarbons Exploration Revenue by Countries (2015-2020)

9.2 Saudi Arabia Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

9.3 UAE Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

9.4 Egypt Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

9.5 South Africa Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

10 Market Size Segment by Type

10.1 Global Deepwater Hydrocarbons Exploration Revenue and Market Share by Type (2015-2020)

10.2 Global Deepwater Hydrocarbons Exploration Market Forecast by Type (2019-2024)

10.3 Subsea Systems Revenue Growth Rate (2015-2025)

10.4 Fixed Platform Rig Revenue Growth Rate (2015-2025)

10.5 Jack-Up Rig Revenue Growth Rate (2015-2025)

10.6 Spar Platforms Revenue Growth Rate (2015-2025)

10.7 Compliant Tower Rigs Revenue Growth Rate (2015-2025)

11 Global Deepwater Hydrocarbons Exploration Market Segment by Application

11.1 Global Deepwater Hydrocarbons Exploration Revenue Market Share by Application (2015-2020)

11.2 Deepwater Hydrocarbons Exploration Market Forecast by Application (2019-2024)

11.3 Deep Water Revenue Growth (2015-2020)

11.4 Ultra Deep Water Revenue Growth (2015-2020)

12 Global Deepwater Hydrocarbons Exploration Market Size Forecast (2021-2025)

12.1 Global Deepwater Hydrocarbons Exploration Market Size Forecast (2021-2025)

12.2 Global Deepwater Hydrocarbons Exploration Market Forecast by Regions (2021-2025)

12.3 North America Deepwater Hydrocarbons Exploration Revenue Market Forecast (2021-2025)

12.4 Europe Deepwater Hydrocarbons Exploration Revenue Market Forecast (2021-2025)

12.5 Asia-Pacific Deepwater Hydrocarbons Exploration Revenue Market Forecast (2021-2025)

12.6 South America Deepwater Hydrocarbons Exploration Revenue Market Forecast (2021-2025)

12.7 Middle East & Africa Deepwater Hydrocarbons Exploration Revenue Market Forecast (2021-2025)

13 Research Findings and Conclusion

14 Appendix

14.1 Methodology

14.2 Data Source

14.3 Disclaimer

14.4 About US

List of Tables

Table 1. Global Deepwater Hydrocarbons Exploration Revenue (USD Million) by Type: 2015 VS 2019 VS 2025

Table 2. Breakdown of Deepwater Hydrocarbons Exploration by Company Type (Tier 1, Tier 2 and Tier 3)

Table 3. Global Deepwater Hydrocarbons Exploration Revenue (USD Million) by Application: 2015 VS 2019 VS 2025

Table 4. Global Market Deepwater Hydrocarbons Exploration Revenue (Million USD) Comparison by Regions 2015-2025

Table 5. Halliburton Corporate Information, Location and Competitors

Table 6. Halliburton Deepwater Hydrocarbons Exploration Major Business

Table 7. Halliburton Deepwater Hydrocarbons Exploration Total Revenue (USD Million) (2017-2018)

Table 8. Halliburton SWOT Analysis

Table 9. Halliburton Deepwater Hydrocarbons Exploration Product and Solutions

Table 10. Halliburton Deepwater Hydrocarbons Exploration Revenue (USD Million), Gross Margin and Market Share (2018-2019)

Table 11. Brazilian Petroleum Corporation Corporate Information, Location and Competitors

Table 12. Brazilian Petroleum Corporation Deepwater Hydrocarbons Exploration Major Business

Table 13. Brazilian Petroleum Corporation Deepwater Hydrocarbons Exploration Total Revenue (USD Million) (2018-2019)

Table 14. Brazilian Petroleum Corporation SWOT Analysis

Table 15. Brazilian Petroleum Corporation Deepwater Hydrocarbons Exploration Product and Solutions

Table 16. Brazilian Petroleum Corporation Deepwater Hydrocarbons Exploration Revenue (USD Million), Gross Margin and Market Share (2018-2019)

Table 17. Geoservices Corporate Information, Location and Competitors

Table 18. Geoservices Deepwater Hydrocarbons Exploration Major Business

Table 19. Geoservices Deepwater Hydrocarbons Exploration Total Revenue (USD Million) (2017-2018)

Table 20. Geoservices SWOT Analysis

Table 21. Geoservices Deepwater Hydrocarbons Exploration Product and Solutions

Table 22. Geoservices Deepwater Hydrocarbons Exploration Revenue (USD Million), Gross Margin and Market Share (2018-2019)

Table 23. Diamond Offshore Corporate Information, Location and Competitors

Table 24. Diamond Offshore Deepwater Hydrocarbons Exploration Major Business

Table 25. Diamond Offshore Deepwater Hydrocarbons Exploration Total Revenue (USD Million) (2017-2018)

Table 26. Diamond Offshore SWOT Analysis

Table 27. Diamond Offshore Deepwater Hydrocarbons Exploration Product and Solutions

Table 28. Diamond Offshore Deepwater Hydrocarbons Exploration Revenue (USD Million), Gross Margin and Market Share (2018-2019)

Table 29. PetroBras Corporate Information, Location and Competitors

Table 30. PetroBras Deepwater Hydrocarbons Exploration Major Business

Table 31. PetroBras Deepwater Hydrocarbons Exploration Total Revenue (USD Million) (2017-2018)

Table 32. PetroBras SWOT Analysis

Table 33. PetroBras Deepwater Hydrocarbons Exploration Product and Solutions

Table 34. PetroBras Deepwater Hydrocarbons Exploration Revenue (USD Million), Gross Margin and Market Share (2018-2019)

Table 35. TransOcean Corporate Information, Location and Competitors

Table 36. TransOcean Deepwater Hydrocarbons Exploration Major Business

Table 37. TransOcean Deepwater Hydrocarbons Exploration Total Revenue (USD Million) (2017-2018)

Table 38. TransOcean SWOT Analysis

Table 39. TransOcean Deepwater Hydrocarbons Exploration Product and Solutions

Table 40. TransOcean Deepwater Hydrocarbons Exploration Revenue (USD Million), Gross Margin and Market Share (2018-2019)

Table 41. Oceaneering International Corporate Information, Location and Competitors

Table 42. Oceaneering International Deepwater Hydrocarbons Exploration Major Business

Table 43. Oceaneering International Deepwater Hydrocarbons Exploration Total Revenue (USD Million) (2017-2018)

Table 44. Oceaneering International SWOT Analysis

Table 45. Oceaneering International Deepwater Hydrocarbons Exploration Product and Solutions

Table 46. Oceaneering International Deepwater Hydrocarbons Exploration Revenue (USD Million), Gross Margin and Market Share (2018-2019)

Table 47. Schlumberger Corporate Information, Location and Competitors

Table 48. Schlumberger Deepwater Hydrocarbons Exploration Major Business

Table 49. Schlumberger Deepwater Hydrocarbons Exploration Total Revenue (USD Million) (2017-2018)

Table 50. Schlumberger SWOT Analysis

Table 51. Schlumberger Deepwater Hydrocarbons Exploration Product and Solutions

Table 52. Schlumberger Deepwater Hydrocarbons Exploration Revenue (USD Million), Gross Margin and Market Share (2018-2019)

Table 53. Trico Marine Services Corporate Information, Location and Competitors

Table 54. Trico Marine Services Deepwater Hydrocarbons Exploration Major Business

Table 55. Trico Marine Services Deepwater Hydrocarbons Exploration Total Revenue (USD Million) (2017-2018)

Table 56. Trico Marine Services SWOT Analysis

Table 57. Trico Marine Services Deepwater Hydrocarbons Exploration Product and Solutions

Table 58. Trico Marine Services Deepwater Hydrocarbons Exploration Revenue (USD Million), Gross Margin and Market Share (2018-2019)

Table 59. Global Deepwater Hydrocarbons Exploration Revenue (Million USD) by Players (2015-2020)

Table 60. Global Deepwater Hydrocarbons Exploration Revenue Share by Players (2015-2020)

Table 61. Global Deepwater Hydrocarbons Exploration Revenue (Million USD) by Regions (2015-2020)

Table 62. Global Deepwater Hydrocarbons Exploration Revenue Market Share by Regions (2015-2020)

Table 63. North America Deepwater Hydrocarbons Exploration Revenue by Countries (2015-2020)

Table 64. North America Deepwater Hydrocarbons Exploration Revenue Market Share by Countries (2015-2020)

Table 65. Europe Deepwater Hydrocarbons Exploration Revenue (Million USD) by Countries (2015-2020)

Table 66. Asia-Pacific Deepwater Hydrocarbons Exploration Revenue (Million USD) by Countries (2015-2020)

Table 67. South America Deepwater Hydrocarbons Exploration Revenue by Countries (2015-2020)

Table 68. South America Deepwater Hydrocarbons Exploration Revenue Market Share by Countries (2015-2020)

Table 69. Middle East and Africa Deepwater Hydrocarbons Exploration Revenue (Million USD) by Countries (2015-2020)

Table 70. Middle East and Africa Deepwater Hydrocarbons Exploration Revenue Market Share by Countries (2015-2020)

Table 71. Global Deepwater Hydrocarbons Exploration Revenue (Million USD) by Type (2015-2020)

Table 72. Global Deepwater Hydrocarbons Exploration Revenue Share by Type (2015-2020)

Table 73. Global Deepwater Hydrocarbons Exploration Revenue Forecast by Type (2021-2025)

Table 74. Global Deepwater Hydrocarbons Exploration Revenue by Application (2015-2020)

Table 75. Global Deepwater Hydrocarbons Exploration Revenue Share by Application (2015-2020)

Table 76. Global Deepwater Hydrocarbons Exploration Revenue Forecast by Application (2021-2025)

Table 77. Global Deepwater Hydrocarbons Exploration Revenue (Million USD) Forecast by Regions (2021-2025)

List of Figures

Figure 1. Deepwater Hydrocarbons Exploration Picture

Figure 2. Global Deepwater Hydrocarbons Exploration Revenue Market Share by Type in 2019

Figure 3. Subsea Systems Picture

Figure 4. Fixed Platform Rig Picture

Figure 5. Jack-Up Rig Picture

Figure 6. Spar Platforms Picture

Figure 7. Compliant Tower Rigs Picture

Figure 8. Deepwater Hydrocarbons Exploration Revenue Market Share by Application in 2019

Figure 9. Deep Water Picture

Figure 10. Ultra Deep Water Picture

Figure 11. Global Deepwater Hydrocarbons Exploration Revenue (USD Million) and Growth Rate (2015-2025)

Figure 12. North America Deepwater Hydrocarbons Exploration Revenue (Million USD) and Growth Rate (2015-2025)

Figure 13. Europe Deepwater Hydrocarbons Exploration Revenue (Million USD) and Growth Rate (2015-2025)

Figure 14. Asia-Pacific Deepwater Hydrocarbons Exploration Revenue (Million USD) and Growth Rate (2015-2025)

Figure 15. South America Deepwater Hydrocarbons Exploration Revenue (Million USD) and Growth Rate (2015-2025)

Figure 16. Middle East and Africa Deepwater Hydrocarbons Exploration Revenue (Million USD) and Growth Rate (2015-2025)

Figure 17. Global Deepwater Hydrocarbons Exploration Revenue (Million USD) and Growth Rate (2015-2025)

Figure 18. Global Deepwater Hydrocarbons Exploration Revenue Share by Players in 2019

Figure 19. Global Top 5 Players Deepwater Hydrocarbons Exploration Revenue Market Share in 2019

Figure 20. Global Top 10 Players Deepwater Hydrocarbons Exploration Revenue Market Share in 2019

Figure 21. Key Players Market Share Trend

Figure 22. Global Deepwater Hydrocarbons Exploration Revenue (Million USD) and Growth Rate (%) (2015-2020)

Figure 23. Global Deepwater Hydrocarbons Exploration Revenue Market Share by Regions (2015-2020)

Figure 24. Global Deepwater Hydrocarbons Exploration Revenue Market Share by Regions in 2018

Figure 25. North America Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 26. Europe Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 27. Asia-Pacific Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 28. South America Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 29. Middle East and Africa Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 30. North America Deepwater Hydrocarbons Exploration Revenue Market Share by Countries (2015-2020)

Figure 31. North America Deepwater Hydrocarbons Exploration Revenue Market Share by Countries in 2019

Figure 32. USA Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 33. Canada Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 34. Mexico Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 35. Europe Deepwater Hydrocarbons Exploration Revenue Market Share by Countries (2015-2020)

Figure 36. Europe Deepwater Hydrocarbons Exploration Revenue Market Share by Countries in 2019

Figure 37. Germany Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 38. UK Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 39. France Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 40. Russia Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 41. Italy Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 42. Asia-Pacific Deepwater Hydrocarbons Exploration Revenue Market Share by Countries (2015-2020)

Figure 43. Asia-Pacific Deepwater Hydrocarbons Exploration Revenue Market Share by Countries in 2019

Figure 44. China Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 45. Japan Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 46. Korea Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 47. India Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 48. Southeast Asia Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 49. South America Deepwater Hydrocarbons Exploration Revenue Market Share by Countries (2015-2020)

Figure 50. South America Deepwater Hydrocarbons Exploration Revenue Market Share by Countries in 2019

Figure 51. Brazil Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 52. Argentina Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 53. Middle East and Africa Deepwater Hydrocarbons Exploration Revenue Market Share by Countries (2015-2020)

Figure 54. Middle East and Africa Deepwater Hydrocarbons Exploration Revenue Market Share by Countries in 2019

Figure 55. Saudi Arabia Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 56. UAE Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 57. Egypt Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 58. South Africa Deepwater Hydrocarbons Exploration Revenue and Growth Rate (2015-2020)

Figure 59. Global Deepwater Hydrocarbons Exploration Revenue Share by Type (2015-2020)

Figure 60. Global Deepwater Hydrocarbons Exploration Revenue Share by Type in 2019

Figure 61. Global Deepwater Hydrocarbons Exploration Market Share Forecast by Type (2021-2025)

Figure 62. Global Subsea Systems Revenue Growth Rate (2015-2020)

Figure 63. Global Fixed Platform Rig Revenue Growth Rate (2015-2020)

Figure 64. Global Jack-Up Rig Revenue Growth Rate (2015-2020)

Figure 65. Global Spar Platforms Revenue Growth Rate (2015-2020)

Figure 66. Global Compliant Tower Rigs Revenue Growth Rate (2015-2020)

Figure 67. Global Deepwater Hydrocarbons Exploration Revenue Share by Application (2015-2020)

Figure 68. Global Deepwater Hydrocarbons Exploration Revenue Share by Application in 2019

Figure 69. Global Deepwater Hydrocarbons Exploration Market Share Forecast by Application (2021-2025)

Figure 70. Global Deep Water Revenue Growth Rate (2015-2020)

Figure 71. Global Ultra Deep Water Revenue Growth Rate (2015-2020)

Figure 72. Global Deepwater Hydrocarbons Exploration Revenue (Million USD) and Growth Rate Forecast (2021-2025)

Figure 73. Global Deepwater Hydrocarbons Exploration Revenue (Million USD) Forecast by Regions (2021-2025)

Figure 74. Global Deepwater Hydrocarbons Exploration Revenue Market Share Forecast by Regions (2021-2025)

Figure 75. North America Deepwater Hydrocarbons Exploration Revenue Market Forecast (2021-2025)

Figure 76. Europe Deepwater Hydrocarbons Exploration Revenue Market Forecast (2021-2025)

Figure 77. Asia-Pacific Deepwater Hydrocarbons Exploration Revenue Market Forecast (2021-2025)

Figure 78. South America Deepwater Hydrocarbons Exploration Revenue Market Forecast (2021-2025)

Figure 79. Middle East and Africa Deepwater Hydrocarbons Exploration Revenue Market Forecast (2021-2025)

Figure 80. Sales Channel: Direct Channel vs Indirect Channel

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

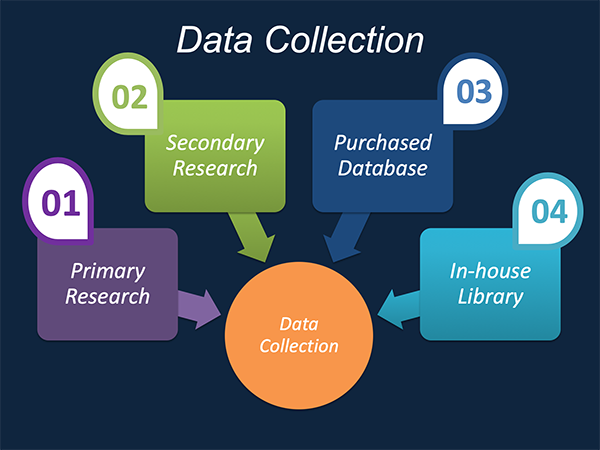

Our market research process involves with the four specific stages.

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

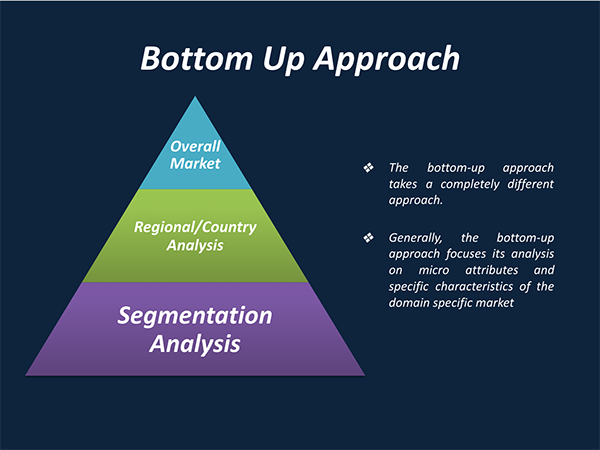

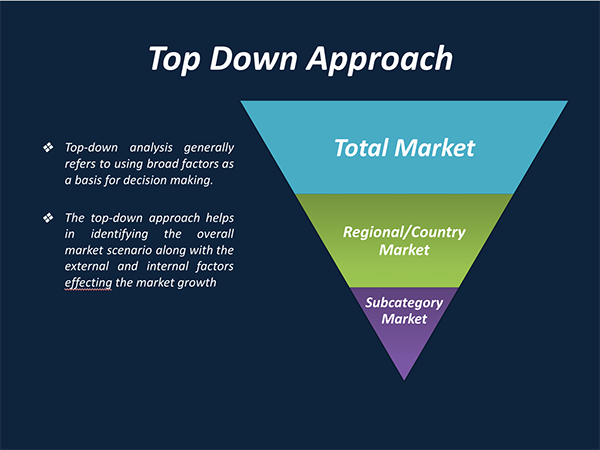

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.