The global engineering services outsourcing market is expected to grow from USD 316 Billion in 2019 to USD 2,450 Billion by 2027, at a CAGR of 29.2% during the forecast period 2020-2027.

Engineering services outsourcing market is the integration of information technology with various other industries. It is a very high growth potential industry. It now emphasizes on offering services to the end-customers with integrated digital technologies, such as analytics, cloud, internet of things (IoT) and automation. This industry has now done advancements in services, including robotics, smart manufacturing, automation and artificial intelligence (AI). These are positively impacting the market. The automotive and manufacturing sector, incorporating digital transformational services emerged as the essential buyers of the engineering services outsourcing market globally. However, security threats and Intellectual Property (IP) confidentiality are critical factors restraining the growth of this market. The end-use industry participants transfer large volumes of data, compromising data monitoring, and load management, quality assurance between OEMs, service providers, and consumers.

The global engineering services outsourcing market is segmented by services into designing, system integration, prototyping, testing, and others. The testing segment accounts for the highest revenue. The OEMs outsource software testing component from ESPs with IT professionals to have an efficient and bug-free software in their systems coupled with the increasing demand for procuring software solutions to reduce manual intervention and time significantly is driving the testing segments growing demand. Also, the designing segment is anticipated to witness rapid growth. The increasing popularity of graphic design, visual design, architectural design, and industrial design has led to the deployment of design tools, such as CAE, CAD, and CAM. Location outlook wise the onshore segment dominates over offshore services segment. Onshore services refer to the services offered to the OEMs by the ESO operating in the country. OEMs prefer outsourcing from onshore services due to the lower costs incurred, and concerns regarding the information security and privacy of their data involved in the procurement. The onshore ESO activities are gaining popularity in the similar time zones. Application wise segments are aerospace, automotive, telecom, consumer electronics, construction, pharmaceuticals, and semiconductors. The automotive sector hold the highest share owing to the increasing demand of innovative features in vehicles. The construction sector is expected to grow at a fast pace because of the proliferation of digital transformation technologies for the smart city projects worldwide. Also, the upsurge of intelligent buildings powered by AI, which can carry self-optimized operations and building management systems are anticipated to fuel the growth of this segment.

The global engineering services outsourcing market has been divided into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. Asia-Pacific holds the largest market share and is expected to be on the top during the forecast period. This is because countries such as India, and China emerged as low-cost destinations offering technologically upgraded services, and with the help availability of highly skilled professionals. These countries are hubs of manufacturing, construction and automotive OEMs industries. These factors will help Asia-Pacific to hold the largest market share. North America is expected to show substantial growth over the forecast period. This is primarily because the U.S. is a major automotive, construction and aerospace hub for OEMs.

The key players in the global engineering services outsourcing market are M Group, Deaton Engineering, Aricent Group, Fareva, GlobalLogic, EPAM Systems, Cyient, and Pactera Technology International Ltd, HCL Technologies Limited, Infosys, IAV GmbH, Tata Consulting Services, P+Z Engineering GmbH, Wipro, ASAP Holdings GmbH, EDAG Engineering GmbH, FEV Group, Cybage software, Kistler Instruments AG, and others.

The leading and emerging players are focusing on introducing advanced services in to strengthen their position and expand their customer base. Companies are infusing vast amounts in R&D to concentrate on providing customized services to their customers. The companies are using tie-ups and collaborations with key OEMs from different verticals as the strategy to grow and grab the market share and to offer the best solutions within the client budget.

For instance, In December 2018, Wirepas and Altran collaborated for the expansion of their range of localization solutions, to help Wirepas to reduce the inventory wastage and money, along with increased security and safety of workers by leveraging Wirepas’s location-based service solutions.

This study predicts revenue growth at global, national, and country levels from 2020 to 2027. This report has segmented the global engineering services outsourcing market based on below-mentioned segments:

Based on Services:

Based on Location Outlook:

Based on Applications:

Based on Regions:

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

1.5. Key Target Audience

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces Analysis

4.2. Value Chain Analysis

4.3. Top Investment Pockets

4.3.1. Market Attractiveness Analysis By Services

4.3.2. Market Attractiveness Analysis By Location Outlook

4.3.3. Market Attractiveness Analysis By Applications

4.3.4. Market Attractiveness Analysis By Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.3. Restraints

5.4. Opportunities

5.5. Challenges

6. Global Engineering Services Outsourcing Market Analysis and Forecast, By Services

6.1. Segment Overview

6.2. Designing

6.3. System Integration

6.4. Prototyping

6.5. Testing

6.6. Others

7. Global Engineering Services Outsourcing Market Analysis and Forecast, By Location Outlook

7.1. Segment Overview

7.2. Onshore

7.3. Offshore

8. Global Engineering Services Outsourcing Market Analysis and Forecast, By Applications

8.1. Segment Overview

8.2. Aerospace

8.3. Automotive

8.4. Telecom

8.5. Consumer Electronics

8.6. Construction

8.7. Pharmaceuticals

8.8. Semiconductors

8.9. Others

9. Global Engineering Services Outsourcing Market Analysis and Forecast, By Regional Analysis

9.1. Segment Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.2.3. Mexico

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Italy

9.3.5. Spain

9.4. Asia-Pacific

9.4.1. Japan

9.4.2. China

9.4.3. India

9.5. South America

9.5.1. Brazil

9.6. Middle East and Africa

9.6.1. UAE

9.6.2. South Africa

10. Global Engineering Services Outsourcing Market-Competitive Landscape

10.1. Overview

10.2. Market Share of Key Players in Global Engineering Services Outsourcing Market

10.2.1. Global Company Market Share

10.2.2. North America Company Market Share

10.2.3. Europe Company Market Share

10.2.4. APAC Company Market Share

10.3. Competitive Situations and Trends

10.3.1. Product Launches and Developments

10.3.2. Partnerships, Collaborations, and Agreements

10.3.3. Mergers & Acquisitions

10.3.4. Expansions

11. Company Profiles

11.1. M Group

11.1.1. Business Overview

11.1.2. Company Snapshot

11.1.3. Company Market Share Analysis

11.1.4. Company Product Portfolio

11.1.5. Recent Developments

11.1.6. SWOT Analysis

11.2. Deaton Engineering

11.2.1. Business Overview

11.2.2. Company Snapshot

11.2.3. Company Market Share Analysis

11.2.4. Company Product Portfolio

11.2.5. Recent Developments

11.2.6. SWOT Analysis

11.3. Aricent Group

11.3.1. Business Overview

11.3.2. Company Snapshot

11.3.3. Company Market Share Analysis

11.3.4. Company Product Portfolio

11.3.5. Recent Developments

11.3.6. SWOT Analysis

11.4. Aricent Group

11.5. GlobalLogic

11.5.1. Business Overview

11.5.2. Company Snapshot

11.5.3. Company Market Share Analysis

11.5.4. Company Product Portfolio

11.5.5. Recent Developments

11.5.6. SWOT Analysis

11.6. EPAM Systems

11.6.1. Business Overview

11.6.2. Company Snapshot

11.6.3. Company Market Share Analysis

11.6.4. Company Product Portfolio

11.6.5. Recent Developments

11.6.6. SWOT Analysis

11.7. Cyient

11.7.1. Business Overview

11.7.2. Company Snapshot

11.7.3. Company Market Share Analysis

11.7.4. Company Product Portfolio

11.7.5. Recent Developments

11.7.6. SWOT Analysis

11.8. Pactera Technology International Ltd

11.8.1. Business Overview

11.8.2. Company Snapshot

11.8.3. Company Market Share Analysis

11.8.4. Company Product Portfolio

11.8.5. Recent Developments

11.8.6. SWOT Analysis

11.9. HCL Technologies Limited

11.9.1. Business Overview

11.9.2. Company Snapshot

11.9.3. Company Market Share Analysis

11.9.4. Company Product Portfolio

11.9.5. Recent Developments

11.9.6. SWOT Analysis

11.10. Infosys

11.10.1. Business Overview

11.10.2. Company Snapshot

11.10.3. Company Market Share Analysis

11.10.4. Company Product Portfolio

11.10.5. Recent Developments

11.10.6. SWOT Analysis

List of Table

1. Global Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

2. Global Designing In Engineering Services Outsourcing Market, By Region, 2017–2027(USD Billion)

3. Global System Integration In Engineering Services Outsourcing Market, By Region, 2017–2027(USD Billion)

4. Global Prototyping In Engineering Services Outsourcing Market, By Region, 2017–2027(USD Billion)

5. Global Testing Engineering Services Outsourcing Market, By Region, 2017–2027(USD Billion)

6. Global Others Engineering Services Outsourcing Market, By Region, 2017–2027(USD Billion)

7. Global Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

8. Global Onshore, Engineering Services Outsourcing Market, By Region, 2017–2027(USD Billion)

9. Global Offshore, Engineering Services Outsourcing Market, By Region, 2017–2027(USD Billion)

10. Global Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

11. Global Aerospace, Engineering Services Outsourcing Market, By Region, 2017–2027(USD Billion)

12. Global Automotive, Engineering Services Outsourcing Market, By Region, 2017–2027 (USD Billion)

13. Global Telecom, Engineering Services Outsourcing Market, By Region, 2017–2027 (USD Billion)

14. Global Consumer Electronics, Engineering Services Outsourcing Market, By Region, 2017–2027 (USD Billion)

15. Global Construction, Engineering Services Outsourcing Market, By Region, 2017–2027 (USD Billion)

16. Global Pharmaceuticals, Engineering Services Outsourcing Market, By Region, 2017–2027 (USD Billion)

17. Global Semiconductors, Engineering Services Outsourcing Market, By Region, 2017–2027 (USD Billion)

18. Global Others, Engineering Services Outsourcing Market, By Region, 2017–2027 (USD Billion)

19. Global Engineering Services Outsourcing Market, By Region, 2017–2027(USD Billion)

20. Global Engineering Services Outsourcing Market, By North America, 2017–2027(USD Billion)

21. North America Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

22. North America Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

23. North America Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

24. U.S. Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

25. U.S. Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

26. U.S. Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

27. Canada Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

28. Canada Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

29. Canada Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

30. Mexico Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

31. Mexico Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

32. Mexico Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

33. Europe Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

34. Europe Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

35. Europe Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

36. Germany Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

37. Germany Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

38. Germany Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

39. France Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

40. France Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

41. France Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

42. U.K. Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

43. U.K. Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

44. U.K. Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

45. Italy Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

46. Italy Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

47. Italy Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

48. Spain Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

49. Spain Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

50. Spain Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

51. Asia Pacific Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

52. Asia Pacific Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

53. Asia Pacific Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

54. Japan Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

55. Japan Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

56. Japan Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

57. China Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

58. China Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

59. China Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

60. India Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

61. India Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

62. India Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

63. South America Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

64. South America Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

65. South America Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

66. Brazil Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

67. Brazil Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

68. Brazil Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

69. Middle East and Africa Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

70. Middle East and Africa Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

71. Middle East Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

72. UAE Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

73. UAE Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

74. UAE Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

75. South Africa Engineering Services Outsourcing Market, By Services, 2017–2027(USD Billion)

76. South Africa Engineering Services Outsourcing Market, By Location Outlook, 2017–2027(USD Billion)

77. South Africa Engineering Services Outsourcing Market, By Applications, 2017–2027(USD Billion)

List of Figures

1. Global Engineering Services Outsourcing Market Segmentation

2. Engineering Services Outsourcing Market: Research Methodology

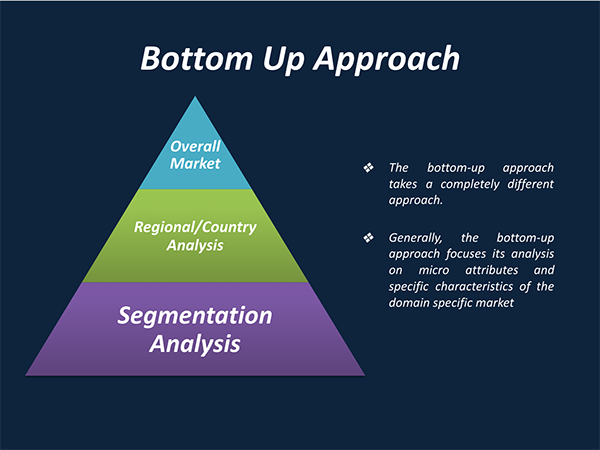

3. Market Size Estimation Methodology: Bottom-Up Approach

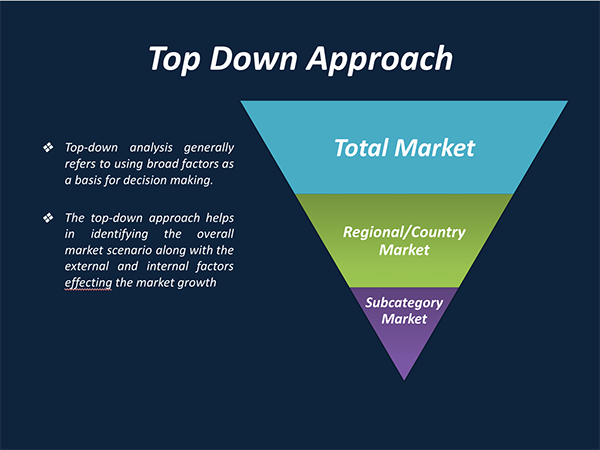

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Engineering Services Outsourcing Market Attractiveness Analysis By Services

9. Global Engineering Services Outsourcing Market Attractiveness Analysis By Location Outlook

10. Global Engineering Services Outsourcing Market Attractiveness Analysis By Applications

11. Global Engineering Services Outsourcing Market Attractiveness Analysis By Region

12. Global Engineering Services Outsourcing Market: Dynamics

13. Global Engineering Services Outsourcing Market Share By Services (2019 & 2027)

14. Global Engineering Services Outsourcing Market Share By Location Outlook (2019 & 2027)

15. Global Engineering Services Outsourcing Market Share By Applications (2019 & 2027)

16. Global Engineering Services Outsourcing Market Share by Regions (2019 & 2027)

17. Global Engineering Services Outsourcing Market Share by Company (2019)

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

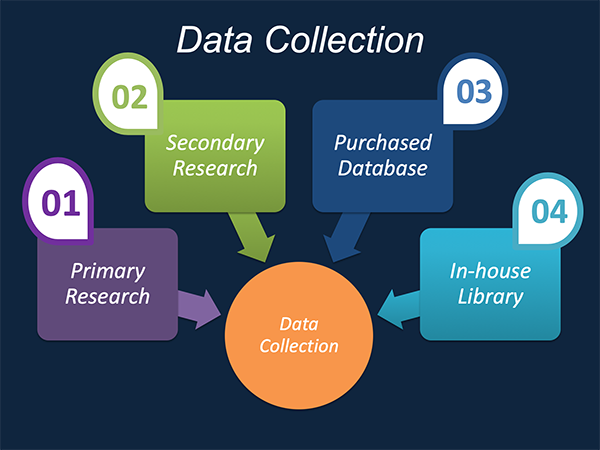

Our market research process involves with the four specific stages.

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.