The Electric School Bus market is expected to grow from USD 22.48 billion in 2022 to USD 87.91 billion by 2032, at a CAGR of 14.61% during the forecast period 2023-2032.

Electric school buses are equipped with electric drivetrains and battery packs, which replace traditional internal combustion engines and fuel systems found in conventional school buses. These environmentally-friendly vehicles offer numerous advantages over their fossil fuel-powered counterparts. Electric school buses produce zero tailpipe emissions, reducing air pollution and improving local air quality. They contribute to mitigating greenhouse gas emissions, as the electricity used to charge their batteries can be generated from renewable sources. Additionally, electric school buses operate quietly, minimizing noise pollution in residential areas and providing a more comfortable ride for students.

Many governments worldwide are implementing initiatives and offering incentives to promote the adoption of electric vehicles, including school buses, which is driving the market's growth. In addition, advancements in battery technology, including higher energy densities and improved charging capabilities, are enhancing the range and performance of electric school buses. As technology evolves, electric buses become more practical and reliable for daily school transportation. As a result, this factor is expected to create new growth opportunities over the forecast period. However, the upfront costs of electric school buses, including the purchase of vehicles and the installation of charging infrastructure, can be a significant barrier for some school districts and fleet operators. Limited budgets and financial constraints may hinder the widespread adoption of electric buses.

This study comprehensively analyses the type, seating capacity, and region. The type segment includes battery electric vehicle, fuel cell electric vehicle and plug-in hybrid electric vehicle. The battery electric vehicle segment held the highest market share in 2022. Many governments worldwide have set ambitious targets to reduce greenhouse gas emissions and promote sustainable transportation. As a result, they are implementing stricter emission standards and offering incentives and subsidies specifically for battery electric vehicles, including electric school buses. These government policies and regulations create a favourable environment for the dominance of battery electric school buses in the market. The seating capacity segment is divided into below 40 seats, 40-70 seats and above 70 seats. The below 40 seats segment registered the largest market share in 2022. The availability and accessibility of charging infrastructure play a significant role in the dominance of the below 40 seats segment. Smaller electric school buses typically require lower charging capacities, making installing charging stations in school facilities or depots easier and more cost-effective. This factor reduces the dependency on extensive charging infrastructure development, making it more feasible for schools to adopt electric buses.

The market has been divided into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. The Asia-Pacific region held the highest market revenue in 2022. The Asia-Pacific region has witnessed significant government support and favourable policies promoting the adoption of electric vehicles, including electric school buses. Many countries in the region have set ambitious goals to reduce greenhouse gas emissions and improve air quality. Governments provide incentives such as subsidies, tax credits, and grants, explicitly targeting the adoption of electric vehicles in the public transportation sector.

Some of the notable players in the market are BYD, Yutong, CAF, VDL Groep, AB Volvo, Dailmer AG, NFI Group, Ankai, King Long, Nissan Motor Corporation, Toyota Motor Corporation, SCANIA AB, General Motors, Volvo, Ford and Tata among others.

Report Description:

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

1.5. Key Target Audience

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces Analysis

4.2. Value Chain Analysis

4.3. Top Investment Pockets

4.3.1. Market Attractiveness Analysis By Type

4.3.2. Market Attractiveness Analysis By Seating Capacity

4.3.3. Market Attractiveness Analysis By Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.2.1. Government initiatives and incentives

5.3. Restraints

5.3.1. High initial costs

5.4. Opportunities

5.4.1. Technological advancements

5.5. Challenges

5.5.1. Limited battery technology

6. Global Electric School Bus Market Analysis and Forecast, By Type

6.1. Segment Overview

6.2. Battery Electric Vehicle

6.3. Fuel Cell Electric Vehicle

6.4. Plug-in Hybrid Electric Vehicle

7. Global Electric School Bus Market Analysis and Forecast, By Seating Capacity

7.1. Segment Overview

7.2. Below 40 Seats

7.3. 40-70 Seats

7.4. Above 70 Seats

8. Global Electric School Bus Market Analysis and Forecast, By Regional Analysis

8.1. Segment Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.2.3. Mexico

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.4. Asia-Pacific

8.4.1. Japan

8.4.2. China

8.4.3. India

8.5. South America

8.5.1. Brazil

8.6. Middle East and Africa

8.6.1. UAE

8.6.2. South Africa

9. Global Electric School Bus Market-Competitive Landscape

9.1. Overview

9.2. Market Share of Key Players in Global Electric School Bus Market

9.2.1. Global Company Market Share

9.2.2. North America Company Market Share

9.2.3. Europe Company Market Share

9.2.4. APAC Company Market Share

9.3. Competitive Situations and Trends

9.3.1. Product Launches and Developments

9.3.2. Partnerships, Collaborations, and Agreements

9.3.3. Mergers & Acquisitions

9.3.4. Expansions

10. Company Profiles

10.1. BYD

10.1.1. Business Overview

10.1.2. Company Snapshot

10.1.3. Company Market Share Analysis

10.1.4. Company Product Portfolio

10.1.5. Recent Developments

10.1.6. SWOT Analysis

10.2. Yutong

10.2.1. Business Overview

10.2.2. Company Snapshot

10.2.3. Company Market Share Analysis

10.2.4. Company Product Portfolio

10.2.5. Recent Developments

10.2.6. SWOT Analysis

10.3. CAF

10.3.1. Business Overview

10.3.2. Company Snapshot

10.3.3. Company Market Share Analysis

10.3.4. Company Product Portfolio

10.3.5. Recent Developments

10.3.6. SWOT Analysis

10.4. VDL Groep

10.4.1. Business Overview

10.4.2. Company Snapshot

10.4.3. Company Market Share Analysis

10.4.4. Company Product Portfolio

10.4.5. Recent Developments

10.4.6. SWOT Analysis

10.5. AB Volvo

10.5.1. Business Overview

10.5.2. Company Snapshot

10.5.3. Company Market Share Analysis

10.5.4. Company Product Portfolio

10.5.5. Recent Developments

10.5.6. SWOT Analysis

10.6. Dailmer AG

10.6.1. Business Overview

10.6.2. Company Snapshot

10.6.3. Company Market Share Analysis

10.6.4. Company Product Portfolio

10.6.5. Recent Developments

10.6.6. SWOT Analysis

10.7. NFI Group

10.7.1. Business Overview

10.7.2. Company Snapshot

10.7.3. Company Market Share Analysis

10.7.4. Company Product Portfolio

10.7.5. Recent Developments

10.7.6. SWOT Analysis

10.8. Ankai

10.8.1. Business Overview

10.8.2. Company Snapshot

10.8.3. Company Market Share Analysis

10.8.4. Company Product Portfolio

10.8.5. Recent Developments

10.8.6. SWOT Analysis

10.9. King Long

10.9.1. Business Overview

10.9.2. Company Snapshot

10.9.3. Company Market Share Analysis

10.9.4. Company Product Portfolio

10.9.5. Recent Developments

10.9.6. SWOT Analysis

10.10. Nissan Motor Corporation

10.10.1. Business Overview

10.10.2. Company Snapshot

10.10.3. Company Market Share Analysis

10.10.4. Company Product Portfolio

10.10.5. Recent Developments

10.10.6. SWOT Analysis

10.11. Toyota Motor Corporation

10.11.1. Business Overview

10.11.2. Company Snapshot

10.11.3. Company Market Share Analysis

10.11.4. Company Product Portfolio

10.11.5. Recent Developments

10.11.6. SWOT Analysis

10.12. SCANIA AB

10.12.1. Business Overview

10.12.2. Company Snapshot

10.12.3. Company Market Share Analysis

10.12.4. Company Product Portfolio

10.12.5. Recent Developments

10.12.6. SWOT Analysis

10.13. General Motors

10.13.1. Business Overview

10.13.2. Company Snapshot

10.13.3. Company Market Share Analysis

10.13.4. Company Product Portfolio

10.13.5. Recent Developments

10.13.6. SWOT Analysis

10.14. Volvo

10.14.1. Business Overview

10.14.2. Company Snapshot

10.14.3. Company Market Share Analysis

10.14.4. Company Product Portfolio

10.14.5. Recent Developments

10.14.6. SWOT Analysis

10.15. Ford

10.15.1. Business Overview

10.15.2. Company Snapshot

10.15.3. Company Market Share Analysis

10.15.4. Company Product Portfolio

10.15.5. Recent Developments

10.15.6. SWOT Analysis

10.16. Tata

10.16.1. Business Overview

10.16.2. Company Snapshot

10.16.3. Company Market Share Analysis

10.16.4. Company Product Portfolio

10.16.5. Recent Developments

10.16.6. SWOT Analysis

List of Table

1. Global Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

2. Global Battery Electric Vehicle, Electric School Bus Market, By Region, 2019-2032 (USD Billion) (Units)

3. Global Fuel Cell Electric Vehicle, Electric School Bus Market, By Region, 2019-2032 (USD Billion) (Units)

4. Global Plug-in Hybrid Electric Vehicle, Electric School Bus Market, By Region, 2019-2032 (USD Billion) (Units)

5. Global Electric School Bus Market, By Seating Capacity, 2019-2032 (USD Billion) (Units)

6. Global Below 40 Seats, Electric School Bus Market, By Region, 2019-2032 (USD Billion) (Units)

7. Global 40-70 Seats, Electric School Bus Market, By Region, 2019-2032 (USD Billion) (Units)

8. Global Above 70 Seats, Electric School Bus Market, By Region, 2019-2032 (USD Billion) (Units)

9. Global Electric School Bus Market, By Region, 2019-2032 (USD Billion) (Units)

10. North America Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

11. North America Electric School Bus Market, By Seating Capacity, 2019-2032 (USD Billion) (Units)

12. U.S. Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

13. U.S. Electric School Bus Market, By Seating Capacity, 2019-2032 (USD Billion) (Units)

14. Canada Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

15. Canada Electric School Bus Market, By Seating Capacity, 2019-2032 (USD Billion) (Units)

16. Mexico Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

17. Mexico Electric School Bus Market, By Seating Capacity, 2019-2032 (USD Billion) (Units)

18. Europe Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

19. Europe Electric School Bus Market, By Seating Capacity, 2019-2032 (USD Billion) (Units)

20. Germany Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

21. Germany Electric School Bus Market, By Seating Capacity, 2019-2032 (USD Billion) (Units)

22. France Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

23. France Electric School Bus Market, By Seating Capacity 2019-2032 (USD Billion) (Units)

24. U.K. Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

25. U.K. Electric School Bus Market, By Seating Capacity 2019-2032 (USD Billion) (Units)

26. Italy Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

27. Italy Electric School Bus Market, By Seating Capacity 2019-2032 (USD Billion) (Units)

28. Spain Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

29. Spain Electric School Bus Market, By Seating Capacity 2019-2032 (USD Billion) (Units)

30. Asia Pacific Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

31. Asia Pacific Electric School Bus Market, By Seating Capacity 2019-2032 (USD Billion) (Units)

32. Japan Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

33. Japan Electric School Bus Market, By Seating Capacity 2019-2032 (USD Billion) (Units)

34. China Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

35. China Electric School Bus Market, By Seating Capacity 2019-2032 (USD Billion) (Units)

36. India Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

37. India Electric School Bus Market, By Seating Capacity 2019-2032 (USD Billion) (Units)

38. South America Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

39. South America Electric School Bus Market, By Seating Capacity 2019-2032 (USD Billion) (Units)

40. Brazil Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

41. Brazil Electric School Bus Market, By Seating Capacity 2019-2032 (USD Billion) (Units)

42. Middle East and Africa Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

43. Middle East and Africa Electric School Bus Market, By Seating Capacity 2019-2032 (USD Billion) (Units)

44. UAE Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

45. UAE Electric School Bus Market, By Seating Capacity 2019-2032 (USD Billion) (Units)

46. South Africa Electric School Bus Market, By Type, 2019-2032 (USD Billion) (Units)

47. South Africa Electric School Bus Market, By Seating Capacity 2019-2032 (USD Billion) (Units)

List of Figures

1. Global Electric School Bus Market Segmentation

2. Global Electric School Bus Market: Research Methodology

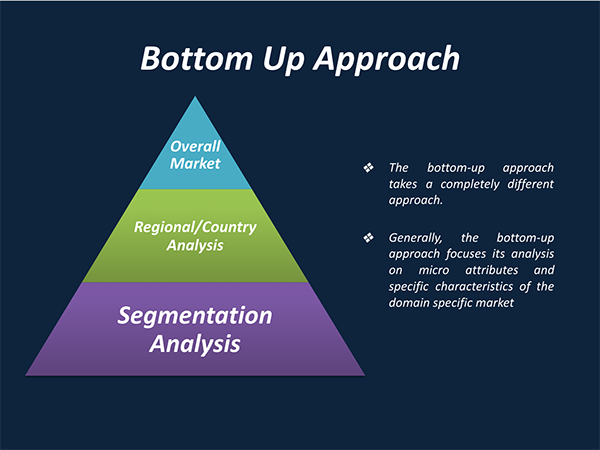

3. Market Size Estimation Methodology: Bottom-Up Approach

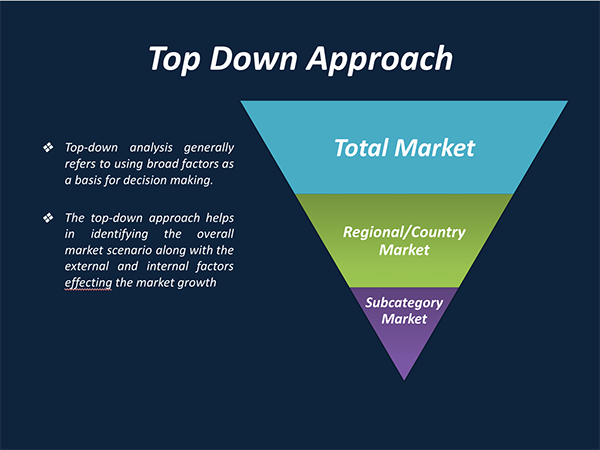

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Electric School Bus Market Attractiveness Analysis By Type

9. Global Electric School Bus Market Attractiveness Analysis By Seating Capacity

10. Global Electric School Bus Market Attractiveness Analysis By Region

11. Global Electric School Bus Market: Dynamics

12. Global Electric School Bus Market Share By Type (2023 & 2032)

13. Global Electric School Bus Market Share By Seating Capacity (2023 & 2032)

14. Global Electric School Bus Market Share By Regions (2023 & 2032)

15. Global Electric School Bus Market Share By Company (2022)

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

Our market research process involves with the four specific stages.

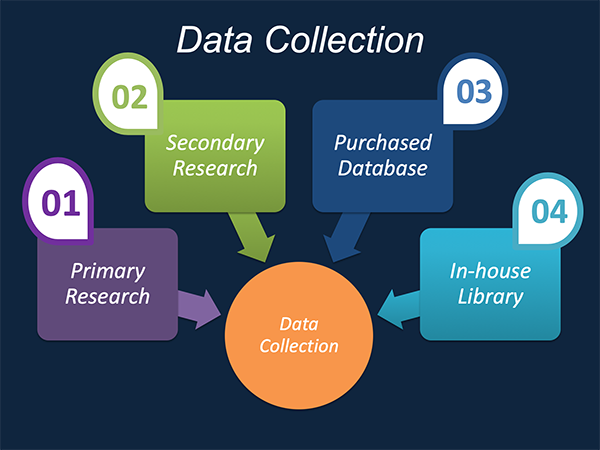

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.