The global dry cooler market is expected to grow from USD 1.04 billion in 2019 to USD 1.72 billion by 2027, at a CAGR of 6.46% during the forecast period from 2020-2027.

A dry cooler utilizes a liquid solution, such as water, or combination of water and other liquids such as ethylene glycol/water, to transfer the heat of refrigerant and compressors. The increasing use of dry cooler in data centers and in processing liquids in refrigeration applications, driving the growth of the market. In addition to this, the growing use of dry coolers in various industries such as plastic, food & beverage, chemical & pharmaceutical, and other industries is creating substantial market opportunities for the manufacturers of the dry coolers. However, high maintenance costs due to frequent cleaning of its cooling systems could hamper the market growth.

The dry cooler market has been segmented based on type, application, and region. The type segment includes vertical dry coolers and horizontal dry coolers. The horizontal dry coolers segment held the largest market share and valued at USD 600.37 million in 2019. The dry coolers in the horizontal version are specifically designed for the horizontal airflow and to operate outside-in spacious areas. Thus increasing demand for horizontal dry coolers for the large cooling places, boosting the need for the market. The application segment includes the plastic industry, food & beverage industry, chemical & pharmaceutical industry, and others. The food & beverage industry segment held the largest market share of 38.52% in 2019, as food and beverage processing requires a large number of dry coolers for the cooling process. Typically the food industry produces products that need to be cooled or frozen before transport, consumption, and utilization. The dry cooler market classified into North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. North America region dominated the dry cooler market and held the largest market share of 35.61% in 2019.

Key players in the dry cooler market are Thermofin, Motivair, MTA, Modine Manufacturing Company, Airedale, Colmac Coil, Sierra, Alfa Laval, Piovan Group (Aquatech), FRITERM A.S., Althermo, Stefani, Kelvion, Carrier, EVAPCO, Refra, REFTECO, ThermoKey, Kref Group, CIAT, Tecnicas Evaporativas, SL (Teva), Uniflair, Guentner, Frigo System, and Intersam among others. Developing and developed countries are offering more significant opportunities, and major players are continuously focused on new developments, strategic partnerships, acquisitions, and venture capital investments to obtain high growth in the market. In January 2017, Modine Manufacturing Company announced the launch of a new division– Commercial Industrial Solutions, which includes CO2 gas coolers, CO2 unit coolers, dry coolers, heat exchangers, industrial heat exchangers, and ammonia unit coolers product portfolio.

This study forecasts revenue growth at global, regional, and country levels from 2014 to 2027. Fior Markets has segmented the on the basis of below-mentioned segments:

Chapter 1 Introduction 24

1.1 Research Methodology 24

1.2 FMR desk research 25

1.2.1 FMR data synthesis 26

1.2.2 Data validation and market feedback 26

1.2.3 FMR data sources 27

Chapter 2 Executive Summary 29

2.1 World Market Overview 29

2.1.1 Global Dry Coolers Consumption 2014-2027 31

2.1.2 Dry Coolers Consumption CAGR by Region 33

2.2 Dry Coolers Segment by Type 35

2.2.1 Vertical Dry Coolers 35

2.2.2 Horizontal Dry Coolers 36

2.3 Dry Coolers Consumption by Type 37

2.3.1 Global Dry Coolers Consumption Market Share by Type (2014-2019) 37

2.3.2 Global Dry Coolers Revenue Market Share by Type (2014-2019) 39

2.3.3 Global Dry Coolers Price by Type (2014-2019) 41

2.4 Dry Coolers Segment by Application 42

2.4.1 Plastic Industry 42

2.4.2 Food & Beverage Industry 43

2.4.3 Chemical & Pharmaceutical Industry 44

2.4.4 Others 45

2.5 Dry Coolers Consumption by Application 46

2.5.1 Global Dry Coolers Consumption Market Share by Application (2014-2019) 46

2.5.2 Global Dry Coolers Revenue Market Share by Application (2014-2019) 49

Chapter 3 Global Dry Coolers by Company 52

3.1 Global Dry Coolers Consumption Market Share by Company 52

3.1.1 Global Dry Coolers Consumption by Company (2017-2019) 52

3.1.2 Dry Coolers Consumption Market Share by Manufacturers 53

3.2 Global Dry Coolers Revenue Market Share by Company 55

3.2.1 Global Dry Coolers Revenue by Manufacturers 55

3.2.2 Dry Coolers Revenue Market Share by Manufacturers 56

3.3 Global Dry Coolers Price by Manufacturers 58

3.4 Dry Coolers Manufacturers Manufacturing Base Distribution, Headquarters 59

3.4.1 Key Manufacturers Dry Coolers Product Location Distribution 59

3.5 Manufacturers Mergers & Acquisitions, Expansion Plans 60

Chapter 4 Dry Coolers by Region 62

4.1 Dry Coolers Consumption by Region 62

4.1.1 Global Dry Coolers Consumption Market Share by Region (2014-2019) 62

4.1.2 Global Dry Coolers Revenue Market Share by Region (2014-2019) 64

4.2 North Americas Dry Coolers Consumption Growth 66

4.3 APAC Dry Coolers Consumption Growth 68

4.4 Europe Dry Coolers Consumption Growth 70

4.5 Central & South America Dry Coolers Consumption Growth 72

4.6 Middle East & Africa Dry Coolers Consumption Growth 74

Chapter 5 North America 76

5.1 North America Dry Coolers Consumption by Countries 76

5.1.1 North America Dry Coolers Consumption by Countries 76

5.1.2 North America Dry Coolers Revenue by Countries 78

5.2 North America Dry Coolers Consumption by Type 80

5.2.1 North America Dry Coolers Consumption by Type 80

5.3 North America Dry Coolers Consumption by Application 82

5.3.1 North America Dry Coolers Consumption by Application 82

5.4 United States 84

5.5 Canada 86

5.6 Mexico 88

Chapter 6 Central & South America 90

6.1 South America Dry Coolers Consumption by Countries 90

6.1.1 South America Dry Coolers Consumption by Countries 90

6.1.2 South America Dry Coolers Revenue by Countries 92

6.2 South America Dry Coolers Consumption by Type 94

6.2.1 South America Dry Coolers Consumption by Type 94

6.3 South America Dry Coolers Consumption by Application 96

6.3.1 South America Dry Coolers Consumption by Application 96

6.4 Brazil 99

6.5 Rest of SA 101

Chapter 7 APAC 103

7.1 APAC Dry Coolers Consumption by Countries 103

7.1.1 APAC Dry Coolers Consumption by Countries 103

7.1.2 APAC Dry Coolers Revenue by Countries 106

7.2 APAC Dry Coolers Consumption by Type 108

7.2.1 APAC Dry Coolers Consumption by Type 108

7.3 APAC Dry Coolers Consumption by Application 110

7.3.1 APAC Dry Coolers Consumption by Application 110

7.4 China 112

7.5 Japan 114

7.6 Korea 116

7.7 Southeast Asia 118

7.8 India 120

7.9 Australia 122

Chapter 8 Europe 124

8.1 Europe Dry Coolers Consumption by Countries 124

8.1.1 Europe Dry Coolers Consumption by Countries 124

8.1.2 Europe Dry Coolers Revenue by Countries 126

8.2 Europe Dry Coolers Consumption by Type 128

8.2.1 Europe Dry Coolers Consumption by Type 128

8.3 Europe Dry Coolers Consumption by Application 130

8.3.1 Europe Dry Coolers Consumption by Application 130

8.4 Germany 132

8.5 France 134

8.6 UK 136

8.7 Italy 138

8.8 Russia 140

Chapter 9 Middle East & Africa 142

9.1 Middle East & Africa Dry Coolers Consumption by Countries 142

9.1.1 Middle East & Africa Dry Coolers Consumption by Countries 142

9.1.2 Middle East & Africa Dry Coolers Revenue by Countries 145

9.2 Middle East & Africa Dry Coolers Consumption by Type 147

9.2.1 Middle East & Africa Dry Coolers Consumption by Type 147

9.3 Middle East & Africa Dry Coolers Consumption by Application 149

9.3.1 Middle East & Africa Dry Coolers Consumption by Application 149

9.4 Egypt 152

9.5 South Africa 154

9.6 Israel 156

9.7 GCC Countries 158

Chapter 10 Market Drivers, Challenges and Trends 160

10.1 Market Drivers and Impact 160

10.1.1 Growing Demand from Key Regions 160

10.1.2 Growing Demand from Key Applications and Potential Industries 160

10.2 Market Challenges and Impact 161

10.3 Market Trends 161

Chapter 11 Marketing, Distributors and Customer 162

11.1 Marketing Channel 162

11.1.1 Direct Marketing 163

11.1.2 Indirect Marketing 165

11.1 Market Positioning 165

11.1.1 Marketing Channel Future Trend 166

11.1.2 Pricing Strategy 167

11.1.3 Brand Strategy 169

11.2 Distributors/Traders List 171

Chapter 12 Global Dry Coolers Market Forecast 172

12.1 Global Dry Coolers Consumption Forecast (2019-2027) 172

12.2 Global Dry Coolers Forecast by Region 174

12.2.1 Global Dry Coolers Consumption Forecast Market Share by Region (2019-2027) 174

12.2.2 Global Dry Coolers Revenue Forecast Market Share by Region (2019-2027) 175

12.2.3 North Americas Consumption Forecast 176

12.2.4 APAC Consumption Forecast 178

12.2.5 Europe Consumption Forecast 180

12.2.6 Central & South America Consumption Forecast 182

12.2.7 Middle East & Africa Consumption Forecast 184

12.3 Americas Forecast by Country 186

12.3.1 United States Market Forecast 186

12.3.2 Canada Market Forecast 188

12.3.3 Mexico Market Forecast 190

12.4 Central & South America 192

12.4.1 Brazil Market Forecast 192

12.4.2 Rest of SA Market Forecast 194

12.5 APAC Forecast by Country 196

12.5.1 China Market Forecast 196

12.5.2 Japan Market Forecast 198

12.5.3 Korea Market Forecast 200

12.5.4 Southeast Asia Market Forecast 202

12.5.5 India Market Forecast 204

12.5.6 Australia Market Forecast 206

12.6 Europe Forecast by Country 208

12.6.1 Germany Market Forecast 208

12.6.2 France Market Forecast 210

12.6.3 UK Market Forecast 212

12.6.4 Italy Market Forecast 214

12.6.5 Russia Market Forecast 216

12.7 Middle East & Africa Forecast by Country 218

12.7.1 Egypt Market Forecast 218

12.7.2 South Africa Market Forecast 220

12.7.3 Israel Market Forecast 222

12.7.4 GCC Countries Market Forecast 224

12.8 Global Dry Coolers Forecast by Type 226

12.8.1 Global Dry Coolers Consumption Forecast Market Share by Type (2019-2027) 226

12.8.2 Global Dry Coolers Revenue Forecast Market Share by Type (2019-2027) 227

12.9 Global Dry Coolers Forecast by Application 228

12.9.1 Global Dry Coolers Consumption Forecast Market Share by Application (2019-2027) 228

12.9.2 Global Dry Coolers Revenue Forecast Market Share by Application (2019-2027) 230

Chapter 13 Key Players Analysis 231

13.1 Thermofin GmbH 231

13.1.1 Company Profile 231

13.1.2 Dry Coolers Product Category, End Uses and Specification of Thermofin GmbH 232

13.1.3 Thermofin GmbH Track Inspection Revenue (2017-2019) 232

13.1.4 Business Overview 233

13.1.5 News 233

13.2 Motivair Corporation 234

13.2.1 Company Profile 234

13.2.2 Dry Coolers Product Category, End Uses and Specification of Motivair Corporation 235

13.2.3 Motivair Corporation Track Inspection Revenue (2017-2019) 235

13.2.4 Business Overview 236

13.2.5 News 236

13.3 MTA Spa 237

13.3.1 Company Profile 237

13.3.2 Dry Coolers Product Category, End Uses and Specification of MTA Spa 238

13.3.3 MTA Spa Track Inspection Revenue (2017-2019) 238

13.3.4 Business Overview 239

13.3.5 News 239

13.4 Modine Manufacturing Company 240

13.4.1 Company Profile 240

13.4.2 Dry Coolers Product Category, End Uses and Specification of Modine Manufacturing Company 241

13.4.3 Modine Manufacturing Company Track Inspection Revenue (2017-2019) 242

13.4.4 Business Overview 242

13.4.5 News 243

13.5 Airedale Air Conditioning 244

13.5.1 Company Profile 244

13.5.2 Dry Coolers Product Category, End Uses and Specification of Airedale Air Conditioning 245

13.5.3 Business Overview 246

13.5.4 News 246

13.6 Colmac Coil Fluid Coolers 247

13.6.1 Company Profile 247

13.6.2 Dry Coolers Product Category, End Uses and Specification of Colmac Coil Fluid Coolers 248

13.6.3 Business Overview 250

13.6.4 News 250

13.7 Sierra S.p.A 251

13.7.1 Company Profile 251

13.7.2 Dry Coolers Product Category, End Uses and Specification of Sierra S.p.A 252

13.7.3 Business Overview 253

13.7.4 News 253

13.8 Alfa Laval 254

13.8.1 Company Profile 254

13.8.2 Dry Coolers Product Category, End Uses and Specification of Alfa Laval 255

13.8.3 Business Overview 255

13.8.4 News 256

13.9 Aquatech S.r.l 257

13.9.1 Company Profile 257

13.9.2 Dry Coolers Product Category, End Uses and Specification of Aquatech S.r.l 258

13.9.3 Business Overview 259

13.9.4 News 259

13.10 Friterm A.S 260

13.10.1 Company Profile 260

13.10.2 Dry Coolers Product Category, End Uses and Specification of Friterm A.S 261

13.10.3 Business Overview 262

13.10.4 News 262

13.11 Althermo 263

13.11.1 Company Profile 263

13.11.2 Dry Coolers Product Category, End Uses and Specification of Althermo 264

13.11.3 Business Overview 265

13.11.4 News 265

13.12 Stefani 266

13.12.1 Company Profile 266

13.12.2 Dry Coolers Product Category, End Uses and Specification of Stefani 267

13.12.3 Business Overview 268

13.12.4 News 268

13.13 Kelvion Holding GmbH 269

13.13.1 Company Profile 269

13.13.2 Dry Coolers Product Category, End Uses and Specification of Kelvion Holding GmbH 270

13.13.3 Business Overview 270

13.13.4 News 270

13.14 Carrier Corporation 271

13.14.1 Company Profile 271

13.14.2 Dry Coolers Product Category, End Uses and Specification of Carrier Corporation 272

13.14.3 Carrier Corporation Track Inspection Revenue (2017-2019) 273

13.14.4 Business Overview 273

13.14.5 News 274

13.15 Evapco, Inc 275

13.15.1 Company Profile 275

13.15.2 Dry Coolers Product Category, End Uses and Specification of Evapco, Inc 276

13.15.3 Evapco, Inc Track Inspection Revenue (2017-2019) 276

13.15.4 Business Overview 277

13.15.5 News 277

13.16 Refra 278

13.16.1 Company Profile 278

13.16.2 Dry Coolers Product Category, End Uses and Specification of Refra 279

13.16.3 Business Overview 279

13.17 Refteco Srl 280

13.17.1 Company Profile 280

13.17.2 Dry Coolers Product Category, End Uses and Specification of Refteco Srl 281

13.17.3 Business Overview 282

13.17.4 News 283

13.18 ThermoKey 284

13.18.1 Company Profile 284

13.18.2 Dry Coolers Product Category, End Uses and Specification of ThermoKey 285

13.18.3 Business Overview 286

13.18.4 News 286

13.19 Koxka 287

13.19.1 Company Profile 287

13.19.2 Dry Coolers Product Category, End Uses and Specification of Koxka 288

13.19.3 Business Overview 289

13.19.4 News 289

13.20 CIAT 290

13.20.1 Company Profile 290

13.20.2 Dry Coolers Product Category, End Uses and Specification of CIAT 291

13.20.3 Business Overview 292

13.21 TEVA - Técnicas Evaporativas, S.L. 293

13.21.1 Company Profile 293

13.21.2 Dry Coolers Product Category, End Uses and Specification of TEVA - Técnicas Evaporativas, S.L. 294

13.21.3 Business Overview 295

13.21.4 News 295

13.22 Uniflair S.p.A. 296

13.22.1 Company Profile 296

13.22.2 Dry Coolers Product Category, End Uses and Specification of Uniflair S.p.A. 297

13.22.3 Business Overview 297

13.22.4 News 298

13.23 Güntner Group 299

13.23.1 Company Profile 299

13.23.2 Dry Coolers Product Category, End Uses and Specification of Güntner Group 300

13.23.3 Business Overview 301

13.23.4 News 301

13.24 Frigosystem-Corema 302

13.24.1 Company Profile 302

13.24.2 Dry Coolers Product Category, End Uses and Specification of Frigosystem-Corema 303

13.24.3 Business Overview 304

13.24.4 News 304

13.25 Intersam 305

13.25.1 Company Profile 305

13.25.2 Dry Coolers Product Category, End Uses and Specification of Intersam 306

13.25.3 Business Overview 307

13.25.4 News 307

Chapter 14 Research Findings and Conclusion 308

1

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

Our market research process involves with the four specific stages.

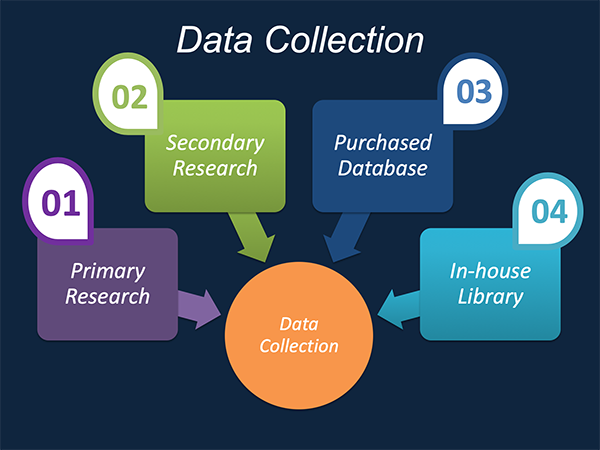

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

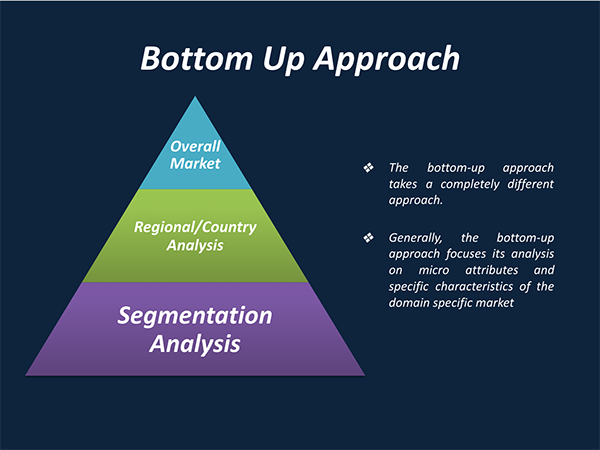

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

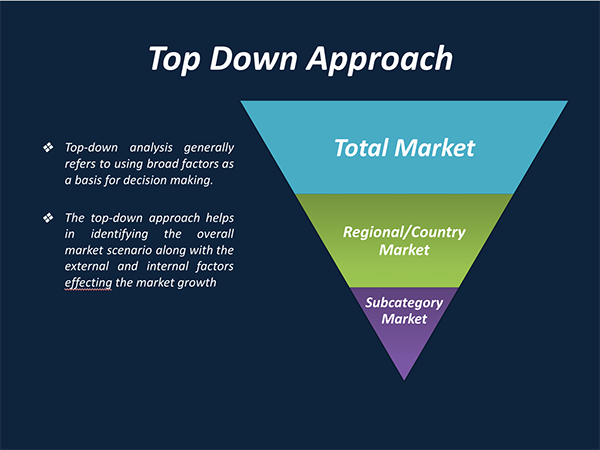

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.