The Global Data Center Physical Security market is expected to grow from USD 1.67 Billion in 2019 to USD 4.82 billion by 2027, at a CAGR of 14.17% during the forecast period 2020-2027.

Data centers are a kind of physical or virtual framework utilized by enterprises for lodging different PCs, servers, and network systems along with components for storing and processing high volumes of data and then client is served in a client-to-server architecture. These data center contains of large groups of interconnected computers and servers that are accountable for remote storage and/or processing of data. Data center serves as principal repositories of IT equipment that include servers, networking switches, storage subsystems, routers, and firewalls. The data center require the extensive backup power supply systems or cooling systems together with redundant networking connections for policy-based security systems, in order to run the core applications of an enterprise. The data center management helps in keeping of reliable connections between the data center and companies containing critical information stored in these center. This management involves placing of application workloads on the maximum cost-effective resource available. Security Risks raised in the IT Industry by Byod Policies and increasing risk of data leakage are the driving factors for the market. Cyber threat is driving the need for holistic security at the hardware level, cloud and IoT technologies will help simplify PACS deployment and management are some of the opportunities that going to drive this market in the forecasting period. Cyber threats will become more consistent and targeted towards access control systems, which will need a more holistic approach including hardware, software and end-user due diligence in detecting threats–to establish the strongest line of defense. However, the need for persistent policies is the risk for this market.

The market has been segmented on the basis of type, application, and region. The type segment includes access control solutions, video surveillance and monitoring solutions. Access control solutions further segmented into biometric, card-based readers, multi-technology readers, electronic locks and RFID tags. The video surveillance segment held the largest market share of 52.49% and valued at USD 878.03 million in 2019. Due to access use of video surveillance tools in security systems to analyse any potential threats arising out such as inventory losses, terrorist attacks, or damage of records. The application segment includes IT & telecom, BFSI, government, healthcare, energy, and others. BFSI segment held the largest market share of 29.04% and valued at USD 485.81 million in 2019. As BFSI uses video surveillance, monitoring solutions, and access control solutions to detect threats in real time, quickly respond to alarms, and improve operational efficiency. The market has been divided into North America, Europe, APAC, MEA and South America. North America has the largest market share in 2019. United States held the largest market share of 34.84% and valued at USD 582.80million in 2019. owing to heavy investments in building new and improve existing infrastructure.

Key players operating in the global data center physical security market include Honeywell International Inc, Robert Bosch GmbH, Assa Abloy, Morpho(Safran)/ IDEMIA, Hangzhou Hikvision Digital Technology Co., Ltd, Tyco, Siemens AG, Schneider Electric, Dahua Technology Co. LTD and Axis Communication among others. To enhance their market position in the global Data Center Physical Security market, the key players are now focusing on adopting strategies such as recent developments, joint venture, product innovations, mergers & acquisitions, collaborations, and partnership.

This study forecasts revenue growth at global, regional, and country levels from 2012 to 2027. Fior Markets has segmented on the basis of below-mentioned segments:

Chapter 1 Introduction

1.1 Research Methodology

1.2 FMR desk research

1.2.1 FMR data synthesis

1.2.2 Data validation and market feedback

1.2.3 FMR data sources

Chapter 2 Global Data Center Physical Security Market Overview

2.1 Product Overview and Scope of Data Center Physical Security

2.2 Market Status and Outlook

2.2.1 Global Data Center Physical Security Market Size and Analysis by Regions (2012-2019)

2.2.2 United States Data Center Physical Security Market Status and Outlook

2.2.3 Europe Data Center Physical Security Market Status and Outlook

2.2.4 Japan Data Center Physical Security Market Status and Outlook

2.2.5 China Data Center Physical Security Market Status and Outlook

2.2.6 India Data Center Physical Security Market Status and Outlook

2.2.7 Southeast Asia Data Center Physical Security Market Status and Outlook

2.3 Classification of Data Center Physical Security by Product

2.3.1 Global Data Center Physical Security Revenue (Million USD) and Growth (%) Comparison by Product (2012-2022)

2.3.2 Global Data Center Physical Security Revenue (Million USD) Market Share (%) by Product in 2016

2.3.3 Video Surveillance

2.3.4 Monitoring Solutions

2.3.5 Access Control Solutions

2.3.5.1 Card-Based Readers

2.3.5.2 Biometric Readers

2.3.5.3 Others (RFID tags, cards, keypads, door sets, and servers multi-technology readers, electronic locks, controllers)

2.4 Data Center Physical Security Market by End Users/Application

2.4.1 IT and Telecom

2.4.2 BFSI

2.4.3 Government

2.4.4 Healthcare

2.4.5 Energy

2.4.6 Others

Chapter 3 Global Data Center Physical Security Market Competition by Manufacturers

3.1 Global Data Center Physical Security Market Size (Million USD) by Players (2012-2019)

3.2 Market Future Trends

3.2.1 Smartphone integration means increased convenience

3.2.2 Biometric access control techniques for heightened security

3.2.3 Manage multiple devices or systems from a single platform

3.3 Mergers, Acquisition and Expansion

3.4 Key Market Insight

Chapter 4 Company (Top Players) Profiles and Key Data

4.1 Honeywell International Inc.

4.1.1 Company Profile

4.1.2 Business Overview

4.1.3 Representative Data Center Physical Security Market for Access Control Industry Product

4.1.4 Data Center Physical Security Market for Access Control Industry Sales, Revenue, Price and Gross Margin of Honeywell International Inc.

4.1.5 Recent Development

4.2 Robert Bosch GmbH

4.2.1 Company Profile

4.2.2 Business Overview

4.2.3 Representative Data Center Physical Security Market for Access Control Industry Product

4.2.4 Data Center Physical Security Market for Access Control Industry Sales, Revenue, Price and Gross Margin of Robert Bosch GmbH

4.2.5 Recent Development

4.3 Assa Abloy

4.3.1 Company Profile

4.3.2 Business Overview

4.3.3 Representative Data Center Physical Security Market for Access Control Industry Product

4.3.4 Data Center Physical Security Market for Access Control Industry Sales, Revenue, Price and Gross Margin of Assa Abloy

4.3.5 Recent Development

4.4 Morpho(Safran)/ IDEMIA

4.4.1 Company Profile

4.4.2 Business Overview

4.4.3 Representative Data Center Physical Security Market for Access Control Industry Product

4.4.4 Recent Development

4.5 Hangzhou Hikvision Digital Technology Co.,Ltd

4.5.1 Company Profile

4.5.2 Business Overview

4.5.3 Representative Data Center Physical Security Market for Access Control Industry Product

4.5.4 Recent Development

4.6 Tyco

4.6.1 Company Profile

4.6.2 Business Overview

4.6.3 Representative Data Center Physical Security Market for Access Control Industry Product

4.6.4 Data Center Physical Security Market for Access Control Industry Sales, Revenue, Price and Gross Margin of Tyco

4.6.5 Recent Development

4.7 Siemens AG

4.7.1 Company Profile

4.7.2 Business Overview

4.7.3 Representative Data Center Physical Security Market for Access Control Industry Product

4.7.4 Data Center Physical Security Market for Access Control Industry Sales, Revenue, Price and Gross Margin of Siemens AG

4.7.5 Recent Development

4.8 Schneider Electric

4.8.1 Company Profile

4.8.2 Business Overview

4.8.3 Representative Data Center Physical Security Market for Access Control Industry Product

4.8.4 Data Center Physical Security Market for Access Control Industry Sales, Revenue, Price and Gross Margin of Schneider Electric

4.8.5 Recent Development

4.9 Dahua Technology Co. LTD

4.9.1 Company Profile

4.9.2 Business Overview

4.9.3 Representative Data Center Physical Security Market for Access Control Industry Product

4.9.4 Recent Development

4.10 Axis Communication

4.10.1 Company Profile

4.10.2 Business Overview

4.10.3 Representative Data Center Physical Security Market for Access Control Industry Product

4.10.4 Recent Development

Chapter 5 Global Data Center Physical Security Market Size by Product and Application (2012-2019)

5.1 Global Data Center Physical Security Market Size by Product (2012-2019)

5.1.1 Global Data Center Physical Security Market for Access Control (2012-2019)

5.2 Global Data Center Physical Security Market Size by Application (2012-2019)

5.3 Potential Application of Data Center Physical Security for Access Control in Future

5.4 Top Consumer / End Users of Data Center Physical Security for Access Contro

5.5 Top Consumer / End Users of Data Center Physical Security for Access Control

Chapter 6 North America Data Center Physical Security Development Status and Outlook

6.1 United States Data Center Physical Security Market Size (2012-2019)

6.2 United States Data Center Physical Security Market Size and Market Share by Players (2012-2019)

6.3 United States Data Center Physical Security Market Size by Application (2012-2019)

Chapter 7 Europe Data Center Physical Security Development Status and Outlook

7.1 Europe Data Center Physical Security Market Size (2012-2019)

7.2 Europe Data Center Physical Security Market Size and Market Share by Players (2012-2019)

7.3 Europe Data Center Physical Security Market Size by Application (2012-2019)

Chapter 8 MEA Data Center Physical Security Development Status and Outlook

8.1 Japan Data Center Physical Security Market Size (2012-2019)

8.2 Japan Data Center Physical Security Market Size by Application (2012-2019)

Chapter 9 APAC Data Center Physical Security Development Status and Outlook

9.1 China Data Center Physical Security Market Size (2012-2019)

9.2 China Data Center Physical Security Market Size by Application (2012-2019)

Chapter 11 South America Data Center Physical Security Development Status and Outlook

11.1 Southeast Asia Data Center Physical Security Market Size (2012-2019)

11.2 Southeast Asia Data Center Physical Security Market Size by Application (2012-2019)

Chapter 12 APAC Data Center Physical Security Development Status and Outlook

12.1 APAC Data Center Physical Security Market Size and Market Share by Players (2012-2019)

Chapter 13 Market Forecast by Regions, Product and Application (2020-2027)

13.1 Global Data Center Physical Security Market Size(Million USD) by Regions (2020-2027

13.2 North America Data Center Physical Security Revenue and Growth Rate (2020-2027)

13.3 Europe Data Center Physical Security Revenue and Growth Rate (2020-2027)

13.4 MEA Data Center Physical Security Revenue and Growth Rate (2020-2027)

13.5 APAC Data Center Physical Security Revenue and Growth Rate (2020-2027)

13.7 South America Data Center Physical Security Revenue and Growth Rate (2020-2027)

13.8 Global Data Center Physical Security Market Size by Application (2020-2027)

13.9 Global Data Center Physical Security Market Size by Product (2020-2027)

13.9.1 Global Data Center Physical Security Market Size by Access Control Solutions (2020-2027)

Chapter 14 Data Center Physical Security Market Dynamics

14.1 Data Center Physical Security Market Opportunities

14.1.1 Rise in demand for interconnected systems and streamlined management

14.1.2 Cyber threat driving the need for holistic security at the hardware level

14.1.3 Cloud and IoT technologies will help simplify PACS deployment and management

14.2 Data Center Physical Security Challenge and Risk

14.2.1 The need for persistent policies

14.2.2 Deciding upon the most appropriate control model

14.3 Data Center Physical Security Market Driving Force

14.3.1 Security Risks are Raised in It Industry By Byod Policies

14.3.2 Increasing risk of data leakage

14.4 Data Center Physical Security Market Threads

14.4.1 Security Risks are Raised in It Industry By Byod Policies

14.5 Technology Progress

14.5.1 CCTV Integration

14.5.2 Two Door Interlock / Mantrap

14.6 Consumer Trends

14.6.1 Personalized Mobile Facility Access Control

14.6.2 More Focus on User Experience

14.6.3 Advancements in Secure Connected Identities

Chapter 15 Research Findings and Conclusion

1

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

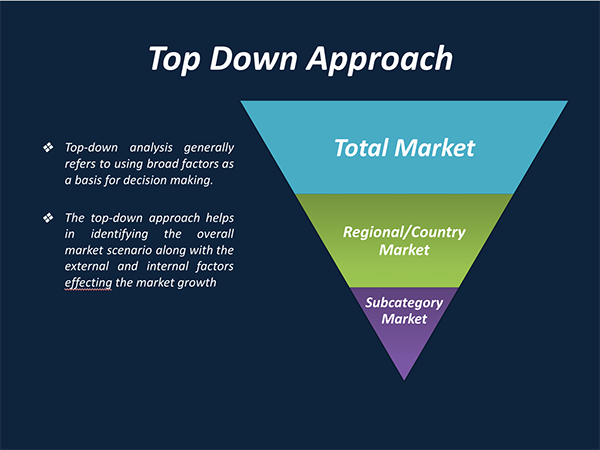

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

Our market research process involves with the four specific stages.

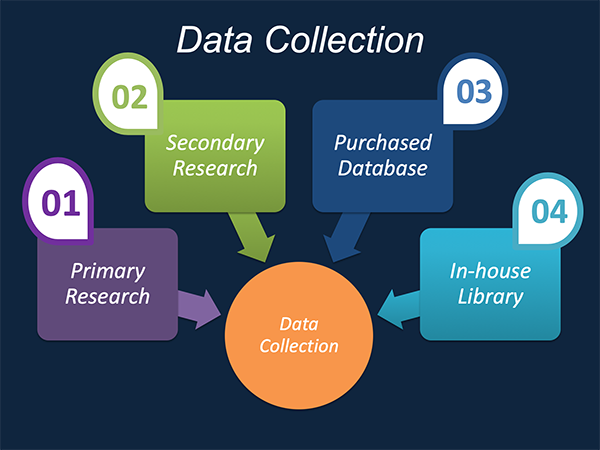

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

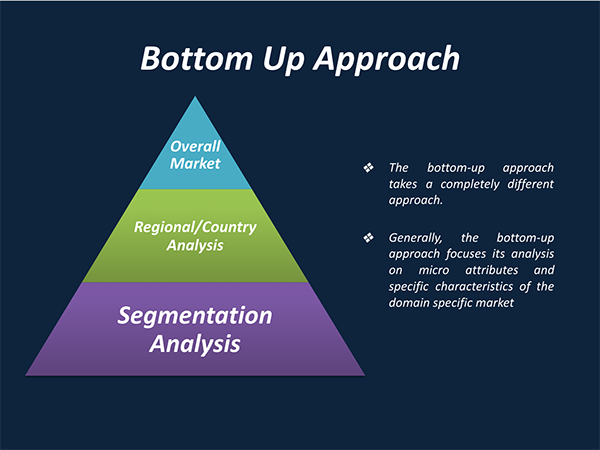

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.