The Global Alcopop Market is expected to grow from USD 123.64 Billion in 2019 to USD 202.48 Billion by 2027, at a CAGR of 6.36% during the forecast period 2020-2027.

The word alcopop (a combination of the words alcohol and pop) is frequently used in the United Kingdom to define these drinks and in some countries by neoprohibitionists. Other terms comprise FMB (flavored malt beverage), FAB (flavored alcoholic beverage), PPS (pre-packaged spirit or premium packaged spirits), and RTD (ready-to-drink – Australia and New Zealand).

Growing necessity of rums in cocktails, flavored rum deliver exclusive tastes to cocktails, rum cakes, and many other, also, spiced rum being usually consumed with cola and the easiness of preparation are some of the key factors boosting the alcopop market. The growing younger population is anticipated to make demand for flavored whiskey over the forecast period. Also, an increase in female drinking population is projected which a different taste needs profile to target that is why flavored spirits are expected to witness high CAGR growth in the developing regions, globally.

The introduction of a competitive segment in mature spirit market is anticipated to boost the demand for the flavored whiskey over the forecast period due to the introduction of attractive drinks against old ones. However, Regulations are single-handedly the biggest challenge for any wine, beer, or spirits company who chooses to trade within the United States. There aren't just federal laws, but there are also state laws must comply with to produce and sell product. In addition to meeting with both state and federal legislation, there is also the concern about taxation. This again differs from state-to-state further adding to the complexities of trying to distribute product.

The market has been segmented on the basic of type, application and region. The type segment includes Beer, Whiskey, Rum, Scotch-Whiskey, Vodka and Others. Beer segment held largest market share of 45.24% and valued at USD 55.94 billion in 2019. The Flavored Beer category has some potential overlap with Specialty Beer, and the determination of category is the brewery’s decision. Entries in this category are beers flavored with either conventional (fruit, honey, chocolate) or sometimes unconventional ingredients (chilies, peanut butter).

The application segment includes store based and non-store based. Store based segment held the largest market share of 68.36% and valued at USD 84.52 billion in 2019. A liquor store is a retail shop that predominantly sells pre-packaged alcoholic beverages typically in bottles intended to be consumed off the store's premises. Depending on region and local idiom (social issue), they may also be called bottle store, off licence, bottle shop, bottle-o, package store (in New England, called a packie) party store (in Michigan), ABC store, state store, or other similar terms. Many states and jurisdictions have an alcohol monopoly.

The market has been divided into North America, Europe, Asia-Pacific, Central & South America, and Middle East and Africa. Asia-Pacific held the largest market share of 39.53% and valued at USD 48.88 billion in 2019.

The companies for Alcopop market are, Diageo, Brown-Forman, Bacardi, Bass Brewery, Miller Brewing Company, Anheuser-Busch and Beam Suntory. Anheuser-Busch held the largest market share of 17.92% in 2019.

This study forecasts revenue growth at global, regional, and country levels from 2013 to 2027. Fior Markets has segmented the on the basis of below mentioned segments:

Chapter 1 Introduction

1.1 Research Methodology

1.2 FMR Desk Research

1.2.1 FMR Data Synthesis

1.2.2 Data Validation And Market Feedback

1.2.3 FMR Data Sources

Chapter 2 Global Alcopop Market Overview

2.1 Alcopop Market Overview

2.1.1 Alcopop Type Scope

2.1.2 Market Status and Outlook

2.2 Global Alcopop Market Size and Analysis by Regions (2013-2019)

2.2.1 North America Alcopop Market Status and Outlook

2.2.2 Europe Alcopop Market Status and Outlook

2.2.3 Asia-Pacific Alcopop Market Status and Outlook

2.2.4 Central & South America Alcopop Market Status and Outlook

2.2.5 Middle East & Africa Alcopop Market Status and Outlook

2.2.6 North America Alcopop Market Status and Outlook

2.2.7 Europe Alcopop Market Status and Outlook

2.2.8 Asia Pacific Alcopop Market Status and Outlook

2.2.9 Central & South America Alcopop Market Status and Outlook

2.2.10 Middle East and Africa Alcopop Market Status and Outlook

2.3 Classification of Alcopop by Type

2.3.1 Global Alcopop Sales (Mn Units) and Growth (%) Comparison by Type (2013-2027)

2.3.2 Global Alcopop Sales (Mn Units) Market Share (%) by Type in 2017

2.3.3 Global Alcopop Revenue (USD Billion) and Growth (%) Comparison by Type (2013-2027)

2.3.4 Global Alcopop Revenue Share and Growth (%) Comparison by Type (2013-2027)

2.3.5 Global Alcopop Revenue (USD Billion) Market Share (%) by Type in 2017

2.3.6 Beer

2.3.7 Whiskey

2.3.8 Rum

2.3.9 Scotch-Whiskey

2.3.10 Vodka

2.3.11 Others

2.4 Global Alcopop Market by End Users/Application

2.4.1 Store Based

2.4.2 Non-Store Based

Chapter 3 Global Alcopop Competition Analysis by Players

3.1.1 Global Alcopop Market Size (Billion USD) by Players (2013-2019)

3.2 Competitive Status

3.2.1 Global Alcopop Market Size (Mn Units) by Players (2013-2019)

3.3 Manufacturers Mergers & Acquisitions, Expansion Plans

Chapter 4 Manufacturers Profiles

4.1 Diageo plc

4.1.1 Company Profile

4.1.2 Business Overview

4.1.3 Products, Services and Solutions

4.1.4 Diageo plc Alcopop Sales (Billion USD) (2013-2019)

4.1.5 Recent Developments

4.2 Brown-Forman Corporation

4.2.1 Company Profile

4.2.2 Business Overview

4.2.3 Products, Services and Solutions

4.2.4 Recent Developments

4.3 Bacardi Limited

4.3.1 Company Profile

4.3.2 Business Overview

4.3.3 Products, Services and Solutions

4.3.4 Bacardi Limited Alcopop Sales (Billion USD) (2013-2019)

4.3.5 Recent Developments

4.4 Anheuser-Busch InBev SA/NA

4.4.1 Company Profile

4.4.2 Business Overview

4.4.3 Products, Services and Solutions

4.4.4 Anheuser-Busch InBev SA/NA Alcopop Sales (Billion USD) (2013-2019)

4.4.5 Recent Developments

4.5 MillerCoors LLC

4.5.1 Company Profile

4.5.2 Business Overview

4.5.3 Products, Services and Solutions

4.5.4 Miller Brewing Company Alcopop Sales (Billion USD) (2013-2019)

4.5.5 Recent Developments

4.6 Beam Suntory Inc.

4.6.1 Company Profile

4.6.2 Business Overview

4.6.3 Products, Services and Solutions

4.6.4 Beam Suntory Inc. Alcopop Sales (Billion USD) (2013-2019)

4.6.5 Recent Developments

4.7 Bundaberg Brewed Drinks Pty Ltd

4.7.1 Company Profile

4.7.2 Business Overview

4.7.3 Products, Services and Solutions

4.7.4 Recent Developments

Chapter 5 North America Alcopop Development Status and Outlook

5.1 North America Alcopop Market Size (2013-2019)

5.2 North America Alcopop Sales by Countries (2013-2019)

5.3 North America Alcopop Revenue by Countries (2013-2019)

5.4 North America Alcopop Market Sales by Type (2013-2019)

5.5 North America Alcopop Market Sales by Type (2013-2019)

5.6 North America Alcopop Market Sales by Application (2013-2019)

Chapter 6 Europe Alcopop Development Status and Outlook

6.1 Europe Alcopop Market Size (2013-2019)

6.2 Europe Alcopop Sales by Countries (2013-2019)

6.3 Europe Alcopop Revenue by Countries (2013-2019)

6.4 Europe Alcopop Market Sales by Type (2013-2019)

6.5 Europe Alcopop Market Share by Type (2013-2019)

6.6 Europe Alcopop Market Sales by Application (2013-2019)

Chapter 7 Asia-Pacific Alcopop Development Status and Outlook

7.1 Asia Pacific Alcopop Market Size (2013-2019)

7.2 Asia Pacific Alcopop Sales by Countries (2013-2019)

7.3 Asia Pacific Alcopop Revenue by Countries (2013-2019)

7.4 Asia Pacific Alcopop Market Sales by Type (2013-2019)

7.5 Asia Pacific Alcopop Market Sales by Type (2013-2019)

7.6 Asia Pacific Alcopop Market Sales by Application (2013-2019)

Chapter 8 Central & South America Alcopop Development Status and Outlook

8.1 Central & South America Alcopop Market Size (2013-2019)

8.2 Central & South America Alcopop Sales by Countries (2013-2019)

8.3 Central & South America Alcopop Revenue by Countries (2013-2019)

8.4 Central & South America Alcopop Market Sales by Type (2013-2019)

8.5 Central & South America Alcopop Market Sales by Type (2013-2019)

8.6 Central & South America Alcopop Market Sales by Application (2013-2019)

Chapter 9 Middle East & Africa Alcopop Development Status and Outlook

9.1 Middle East and Africa Alcopop Market Size (2013-2019)

9.2 Middle East and Africa Alcopop Sales by Countries (2013-2019)

9.3 Middle East and Africa Alcopop Revenue by Countries (2013-2019)

9.4 Middle East and Africa Alcopop Market Sales by Type (2013-2019)

9.5 Middle East and Africa Alcopop Market Sales by Type (2013-2019)

9.6 Middle East and Africa Alcopop Market Sales by Application (2013-2019)

Chapter 10 Alcopop Market Dynamics

10.1 Alcopop Market Opportunities

10.2 Alcopop Market Challenge

10.2.1 Developing an Online Presence

10.2.2 Consumers Want Ethical Brands

10.2.3 Alcoholic Drinks Have More Competition

10.3 Alcopop Market Risk

10.3.1 Working Within Regulations

10.4 Alcopop Market Driving Force

10.4.1 Increasing demand of rums in cocktails

10.4.2 Increasing younger population

Chapter 11 Industrial Chain, Sourcing Strategy and Downstream Buyers

11.1 Alcopop Industrial Chain Analysis

11.1.1 Typical Suppliers of Key Alcopop Raw Material

11.1.2 Downstream Buyers

11.2 Sales Channel Analysis

11.2.1 Marketing Channel

11.2.2 Direct Marketing

11.2.3 Indirect Marketing

11.3 Market Positioning

11.3.1 Marketing Channel Future Trend

11.3.2 Distributors/Traders List

Chapter 12 Market Forecast by Regions (2020-2027)

12.1 Global Alcopop Market Size (Billion USD) by Regions (2020-2027)

12.2 North America Alcopop Market Sales (Mn Units) by Countries (2020-2027)

12.3 North America Alcopop Market Size (Billion USD) by Regions (2020-2027)

12.4 North America Alcopop Market Sales (Mn Units) by Regions (2020-2027)

12.5 Europe Alcopop Market Size (Billion USD) by Regions (2020-2027)

12.6 Europe Alcopop Market Sales (Mn Units) by Regions (2020-2027)

12.7 Asia Pacific Alcopop Market Size (Billion USD) by Regions (2020-2027)

12.8 Asia Pacific Alcopop Market Sales (Mn Units) by Regions (2020-2027)

12.9 South America Alcopop Market Size (Billion USD) by Regions (2020-2027)

12.10 South America Alcopop Market Sales (Mn Units) by Regions (2020-2027)

12.11 Middle East and Africa Alcopop Market Size (Billion USD) by Regions (2020-2027)

12.12 Middle East and Africa Alcopop Market Sales (Mn Units) by Regions (2020-2027)

Chapter 13 Research Finding /Conclusion

1

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

Our market research process involves with the four specific stages.

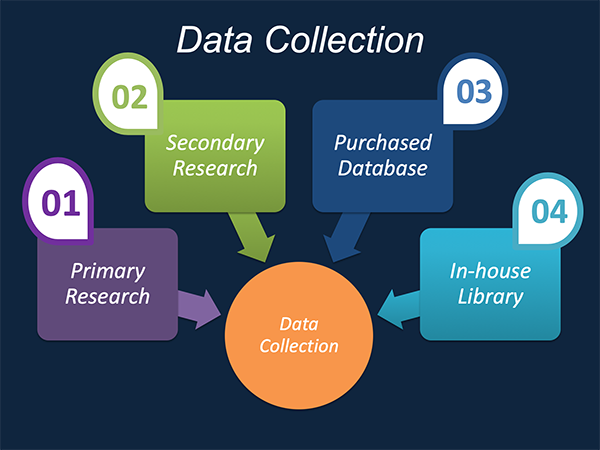

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

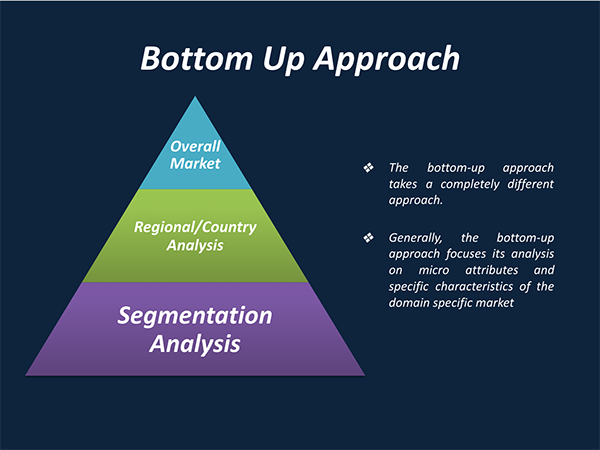

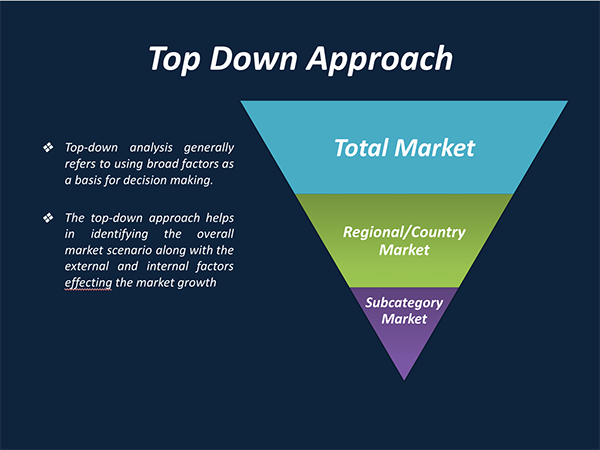

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.